Business investment has risen since the GOP tax cuts were signed into law by President Trump in 2017, but it’s not clear how much a contribution the tax cuts made to the relatively modest investment boom. A survey by the National Association of Business Economics earlier this year showed that the tax cuts had little effect on businesses’ capital investment or hiring plans, and a recent study by economists at the International Monetary Fund found that expectations of stronger demand have driven the recent increases in capital expenditures, with the tax cuts having little or no effect.

This week, the authors of that IMF paper reviewed their analysis, emphasizing their theory that the U.S. economy has changed over the last 30 years in ways that mute the effects of corporate tax cuts. The authors argue that large companies that dominate their markets have a much weaker response to tax cuts than companies that operate in more competitive environments.

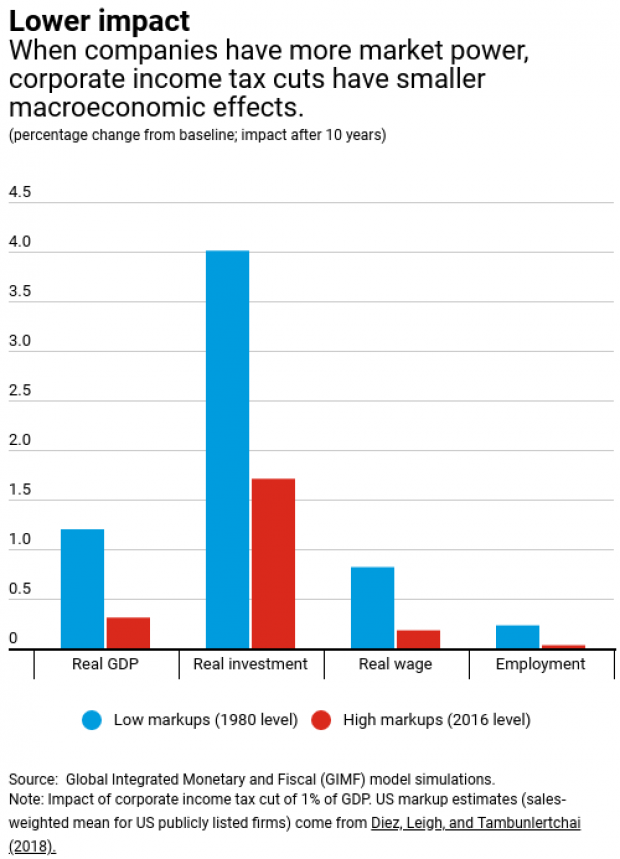

The chart below compares the growth effects associated with corporate income tax cuts in two kinds of economies: one in which companies have low market power and another in which they have a lot. The effects on real investment are particularly notable. In a “low markup” economy, corporate tax cuts worth 1% of GDP can be expected to produce a 4% increase in real investment. But in “high markup” economies, in which corporations have extensive market power, that same tax cut will produce less than half of the level of increased investment, according to the author's calculations.

“The bottom line is this,” the economists write, “strong demand since the passage of the Tax Cuts and Jobs Act has been the principal driver behind corporate investment decisions—not the reduction in the cost of capital coming from the corporate tax cuts themselves. Moreover, the rise in corporate market power in recent decades appears to have muted the effectiveness of corporate tax cuts as a means for boosting business investment.”