Last October, German officials seethed when a U.S. Treasury Department report took Berlin to task for running trade deficits that are exasperating the seemingly-never ending eurozone crisis. The German Economics Ministry responded to the report calling it "incomprehensible" and told the United States to “analyze its own economic situation.”

The trade deficit was “a sign of the competitiveness of the German economy and global demand for quality products from Germany,” the ministry said in the statement.

Related: “Mama” Merkel May Win Germany, But Not the Eurozone

Turns out, Treasury was on to something.

According to numbers released Friday, Germany’s trade surplus hit a new high in 2013. It now has a trade surplus of $271 billion, meaning that it exported $271 billion more than it imported.

German sensitivity over Treasury’s October report comes from an uncomfortable truth at the heart of the euro crisis: Germany has been able to get rich by exporting to eurozone partners. At the same time, it doesn’t buy products from those partners, creating a trade surplus internally while depressing other eurozone economies.

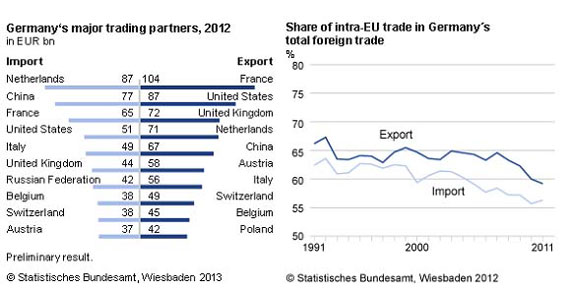

The two charts below illustrate the problem. They illustrate the primary reason behind the entire euro crisis.

Germany has recognized this problem in the past. In fact, as the second chart shows, Germany has been exporting less. But because the German economy grew just .04 percent last year, spendthrift Germans have been reluctant to buy products from elsewhere (quietly, many Germans make the argument that they don’t buy foreign products because German ones are superior, but that’s not a popular topic in Brussels these days).

Related: Germany's Tea Party: A Threat to European Unity

That isn’t the only problem for the EU that emerged Friday. Despite making progress by scaling back its deficit by $8.31 billion, France is still running a deficit of $83.4 billion.

France’s economy has been weighed down by structural deficits for years now, hampering economic progress. There was widespread hope that 2013 would be a turnaround year for France. Even French Trade Minister Nicole Bricq expressed disappointment at the figure, saying that France would make a comeback this year.

“After a difficult year in 2013, the economic lights are turning to green, particularly in the eurozone where we do 47 percent of our trade,” she said, calling 2014 a year of "recovery and rebound.”

Top Reads from the Fiscal Times: