Last summer, House Ways and Means Committee Chairman Dave Camp (R-MI) was barnstorming across the country with his Senate counterpart, Max Baucus, trying to drum up public support for overhauling the nation’s tax code.

The mild-mannered Camp had made it a personal crusade to pass the first major reforms of the tax law since 1986 before stepping down as Chairman at the end of this year, and Baucus, the Democratic Senate Finance Committee Chairman, shared his passion.

Related: GOP Plan Cuts Top Rate, Adds Surcharge to Top Earners

“Since he became the senior Republican on Ways and Means in January of 2009, tax reform has been Dave Camp’s top priority,” said Jonathan Traub, former Ways and Means staff director under Camp and managing principal of the Tax Policy Group at Deloitte Tax LLP. “He has delved heavily – and successfully—into other issues, notably free trade. But he has always returned to tax reform as his goal as Chairman. He has done more to advance tax reform than anyone else in the last quarter-century.”

Yet Camp is likely to break his pick on tax reform, as did many of his predecessors on the committee.

With his Democratic ally Baucus having left Senate to take his new post as U.S. ambassador to China and time running out his tenure as Chairman due to the Republican conference’s term-limit rules, Camp plans to unveil a long-awaited overhaul and simplification of the tax code Wednesday afternoon at the Capitol.

The proposal would reduce the seven existing income tax brackets to two, while slashing the top income tax rate to 25 percent from 39.6 percent. It would impose a 10 percent surtax on some of the nation’s wealthiest households, according to The Washington Post. The surtax would hit many salaried professionals, such as doctors and lawyers, while avoiding farmers and manufacturers, as well as the super- rich whose income is often derived primarily from interest and investment.

Related: Corporate Tax Reform – The One Big Fix Congress Could Get Done this Year

For Camp and the House GOP leaders who are backing him, introducing a major tax bill with the mid-term election campaign looming constitutes a political roll of the dice. Many Republicans, eager to expand their majority in the House and possibly win back control of the Senate, are reluctant to take on a tax bill. Overhauling the tax code will inevitably create winners and losers, and making new enemies in an election year isn’t on any politician’s agenda.

“I’m for the concept of tax reform, but many of us have concerns about releasing a plan, considering the likelihood of enacting it this year,” Rep. Patrick McHenry (R-NC) , who heads candidate recruitment for the National Republican Congressional Committee, told Politico.

Douglas Holtz-Eakin, a Republican economic adviser and former director of the Congressional Budget Office, said on Monday, “I did some focus groups on tax reform, and for those who want this to get done, know that there are two words you cannot use when discussing tax reform with the public, and those words are “tax” and “reform.”

“They hear ‘tax reform’ and they hear ‘It’s a trick. You’re raising my taxes,’” Holtz-Eakin said. “I want to congratulate the Chairman for pushing forward with this effort. I think it’s not a 2014 issue. I don’t know if it’s a 2015, ’16 or ’17 issue, but it can’t wait forever.”

Related: Tax Breaks 2014 – A $63 Billion Boon to Business

University of Virginia political scientists Larry J. Sabato said, “Almost all observers will be surprised or even shocked if major tax reform passed this year. There are too many disincentives on both sides—from election year politics to fundamental disagreements to other legislative priorities. I don’t see how you get the House, Senate, and president to agree on a big tax package now.”

As Ways and Means chairman, Camp – a 23-year House veteran -- is among the most powerful men in Washington, with jurisdiction over taxes, Medicare, and Social Security. The hard-working, collegial Midwesterner is a far cry from some of the more abrasive and combative chairmen who came before him.

For years, he and Baucus pressed for proposals that would streamline the tax code, do away with costly or unfair loopholes and help small family businesses as well as large companies create jobs and compete. Repeatedly, however, Camp’s plans were thwarted by political concerns.

In 2012, as House Republicans strategized for the November elections, conservatives urged their leaders to unveil a detailed plan to overhaul the U.S. tax code. The GOP had vowed to lop 10 points off the top tax rate, and many House freshmen were eager to make that promise a centerpiece of their first reelection campaigns.

Related: Tax Reform Is Dead until a New President Is Elected

It fell to Camp to convince them that tax reform, like so many things in Washington, is more complicated than it might seem and would have to wait.

Last year, House Speaker John Boehner (R-Ohio) and other Republican leaders blocked Camp from moving ahead with a reform proposal. But in recent weeks, according to Politico, it became obvious that the leadership had allowed Camp to proceed. Last month, at a GOP retreat, many rank-and-file Republicans spoke out in favor of tax reform.

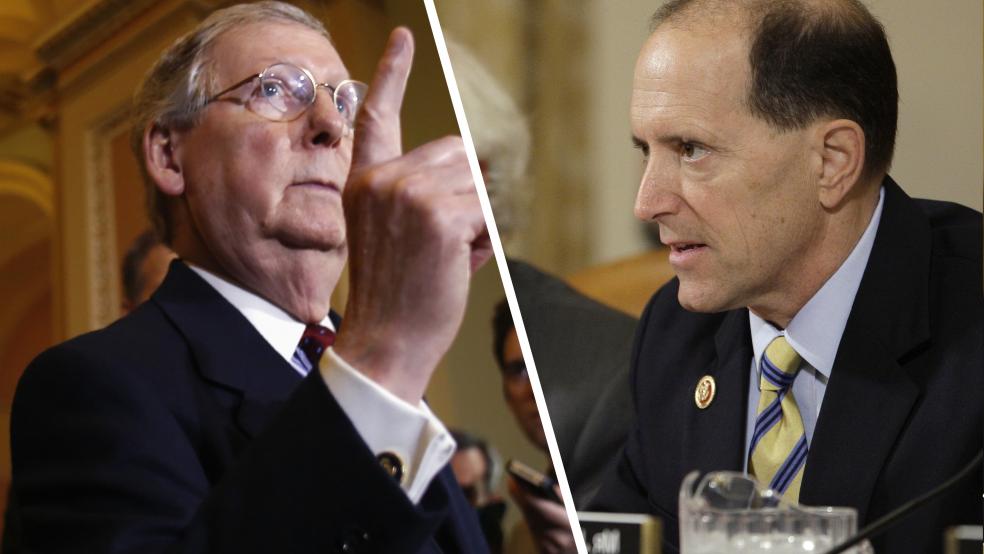

On Tuesday, though, the preliminary Republican reaction to his proposal was lukewarm at best and hostile at worst. In media reports, many GOP sources criticized the timing as politically awkward because of upcoming elections. Senate Minority Leader Mitch McConnell of Kentucky declared Camp’s proposal dead on arrival in an interview with the Associated Press.

Top Reads from The Fiscal Times: