House Democrats on Wednesday found themselves in the odd position of arguing against a tax credit that they generally support out of fear that its passage would endanger the success of other tax credit bills that they also favor.

House Republicans brought a bill to the floor that would expand a tax credit for companies engaged in research and development. The proposal would also make the credit permanent, without fiscal offsets, adding an estimated $156 billion to the federal deficit over the next decade.

Related: The 10 Worst States for Your Tax Dollar

The R&D credit (also known as the R&E credit, for Research and Experimentation) has for some years been one of several dozen measures referred to as “tax extenders.” These are temporary tax credits that Congress has more or less routinely extended. They are generally considered en masse rather than individually, and they contain not just business-related measures such as the R&D credit, but child credits, improvements to the Earned Income Tax Credit, and other provisions favored by Democrats.

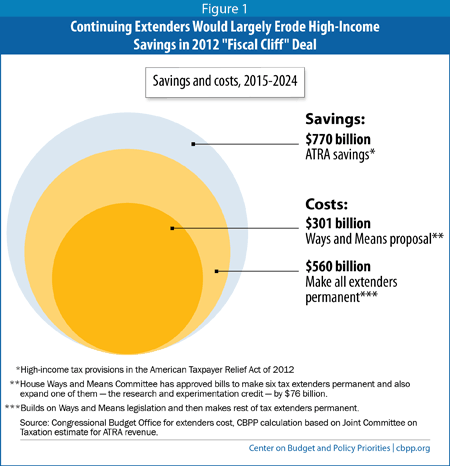

Last week, though, Rep. Dave Camp (R-MI), the chairman of the House Ways and Means Committee, had his panel consider six of the extenders – all favored by business groups – individually. They were fast-tracked to a vote on the House floor, with the R&D credit coming up first. In total, the six provisions would cost $310 billion over 10 years.

Republican leaders pointed out that the R&D credit has been in force since the early 1980s, and that making it permanent was more of a formality than anything else. “Enough of the silliness,” said House Speaker John Boehner (R-OH)

The tax extenders have not been paid for in the past, either, but building in expiration dates at least guaranteed that Congress would have to act affirmatively to keep them alive. Permanent tax cuts tend to be very hard to undo, particularly when they have the support of the business lobby.

The move angered Democrats, who saw the move not just as a sop to big business, but as endangering the other extenders chances of passage.

Related: The Woman Who Brought Down a Massive Tax Fraud Ring

In a detailed attack on the process, the Center on Budget and Policy Priorities claims the move “cherry picks several of the most heavily lobbied corporate tax extender provisions, while leaving behind expired provisions for hard-hit homeowners, teachers, and distressed communities, as well as alternative energy. Moreover, the push for permanence would mean that these corporate provisions would leap-frog over more important tax provisions that are scheduled to expire in coming years — notably key improvements to the Earned Income Tax Credit and Child Tax Credit for low-income working families and the American Opportunity Tax Credit for college students.”

Additionally, CBPP argues, approving the six extenders selected by Camp takes them off the table as measures that need to be offset in order to make any future tax reform deal meet the standard of “revenue neutrality.”

The group also blasted Republicans for agreeing to make the cuts permanent without paying for them while demanding that offsets be found for numerous programs favored by Democrats, including the extension of federal unemployment benefits to the long-term jobless.

During debate on the House floor, Rep. Alcee Hastings (D-FL) complained that Republicans, “have no problem increasing the deficit so long as it is a policy that is important to them and to big business.”

Related: The Tax Burden for Small Business Is Getting Worse

Rep Sander Levin (D-MI), the top Democrat on the Ways and Means Committee, called the move “Fiscally irresponsible, hypocritical, and programmatically dangerous.”

President Obama has already threatened to veto the bill, but it is highly unlikely to ever reach his desk in its current form. Sen. Ron Wyden (D-OR), chairman of the Senate Finance Committee, has his own bill pending in that chamber to deal with the tax extenders as a group.

In the end on Wednesday, the vote on the R&D credit didn’t take place. Republicans tried to approve the measure on a voice vote, but Democrats demanded a full roll-call vote, in which each of the members’ votes would be recorded. The House adjourned Wednesday night before getting to the R&D bill, but will likely hold the vote in the next few days.

Top Reads from The Fiscal Times