Nearly two months after Obamacare’s first open enrollment closed, we finally have a clearer picture of what people are paying for the policies they bought on the federal health insurance exchange.

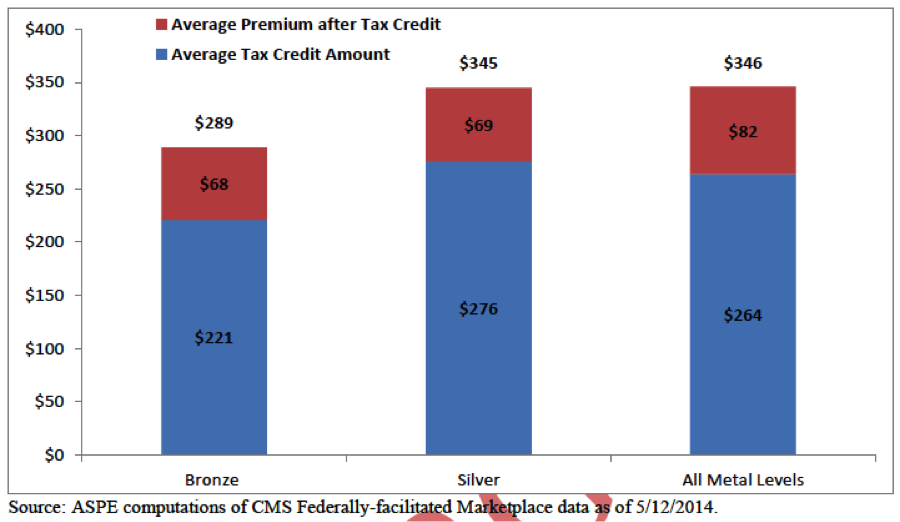

Monthly premiums for silver plans – the standard insurance policy sold on the exchanges – cost an average of $345 a month this year for people who did not qualify for subsidies, a new analysis from the administration shows.

Related: A Million Americans Can Get Wrong Subsidies

However, for the overwhelming majority of Obamacare enrollees (87 percent) who did qualify for financial assistance, the average monthly premium on the silver plan costs about $69.

That’s an average tax credit of about $276 a month, or $3,312 a year.

The administration’s report broke down the average monthly premium for each of the four plans offered on the federal marketplace – before and after tax credits. It also detailed the percentage of enrollees selecting each plan, with or without tax credits. Data was not available for the state exchanges, which make up about one third of the total 8 million enrollees.

The report said 69 percent of individuals who qualified for subsidies are paying an average monthly premium of $100 or less. Premiums, of course, vary widely from region to region depending on the share of competition in each market.

Average premiums in New Hampshire, where only one insurer controls the region, were $390 before subsidies, well above the national average.

“If more insurers come into the marketplace in future years, it seems likely not only that consumers will have a greater choice of plans, but also that the benchmark plan (second-lowest cost silver plan) will become even more affordable,” the report said.

Related: Obamacare Subsidy Overpayments: How to Recoup?

So far, in every state where data is available, more insurers will be participating in the exchanges next year, which will likely stabilize the price of premiums.

Under the law, subsidies are available with incomes ranging from one to four times the federal poverty level – or $11,490 to $45,960 for an individual and $23,550 to $94,200 for a family of four. They are determined by an individual’s annual income as listed on their applications—otherwise known as an honor system.

So far this year the federal government has paid out $4.7 billion in subsidies. The Congressional Budget Office and the Joint Committee on Taxation currently estimate that the ACA’s insurance provisions will cost just under 41.1 trillion over 10 years.

It could likely climb higher, since a significant number of this year’s subsidies have apparently been incorrectly doled out to more than two million Americans. Earlier this week The New York Times reported that the administration is in the process of contacting hundreds of thousands of people to verify their eligibility for the tax credits they are currently using to subsidize their health coverage.

This could mean that a significant number of enrollees could lose their subsidies – or maybe even their coverage.

Top Reads from the Fiscal Times: