For all the financial pain real estate and gold have inflicted in recent years, Americans can’t seem to put an end to their long-standing love affair with those investments.

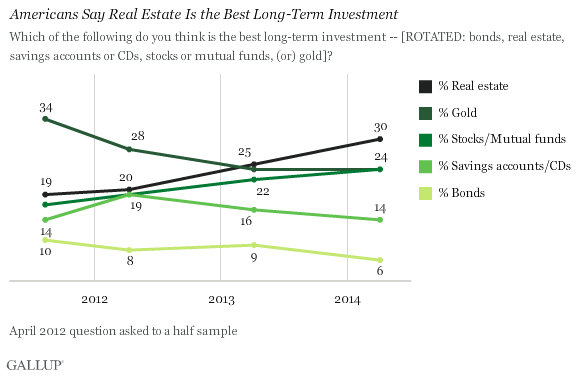

The two asset classes finished first and second in a Gallup poll this month that asked Americans what they see as the “best long-term investment.” Real estate was the top choice, picked by 30 percent of respondents (up from 19 percent in 2011). Another 24 percent opted for gold (down from 34 percent in 2011). Stocks and mutual funds, in spite of the big market rally that has pundits fretting about the S&P 500 being overvalued, just tied with gold at 24 percent.

It’s easy enough to understand why investors might be wary about owning stocks. After all, the period from March 1999 to March 2009 was a “lost decade” for those who entrusted their financial wellbeing to equities. In comparison, real estate and gold are things you can literally touch and hang on to: They are less ephemeral, even if their value can fluctuate — as recent events have demonstrated — just as dramatically as that of a portfolio stuffed full of stocks and bonds.

Related: Top 10 Fastest-Selling Housing Markets This Spring

The problem is that picking real estate and gold as your favorite investments simply doesn’t make sense. Let’s start with the numbers. Over the last 25 years – a period running from the end of 1988 to the end of 2013 and including bear and bull markets for gold, real estate and stocks – the annualized return for gold has been 1.6 percent. For real estate, it was 3.43 percent, as measured by the S&P Case Schiller 10-city composite index. For stocks, as measured by the S&P 500 index, that return was 7.9 percent.

Of course, a simple historical return doesn’t tell the full story.

Let’s tackle the pesky question of gold first, since the argument against keeping more than a sliver of your portfolio in the precious metal is fairly well established. So is the purported case in favor of gold: It’s an ever-present source of help in times of inflation; a place of refuge in times of crisis; a shelter from a storm that may result from overwhelming debt/deficit crises or a loss of confidence in the dollar. Gold does sometimes perform as expected. During the financial crisis, when stocks plunged 22 percent in the fourth quarter of 2008, gold fell only about 1 percent, acting as a hedge. Alas, it turned out that Treasury bonds were a much better hedge, gaining 14.8 percent in the same period.

For gold investors, sometimes it all works out perfectly…until it doesn’t. And it didn’t last year: The price of gold bullion plunged 28 percent. Even in a good year, if you’re a gold investor, your profits come only from other people’s interest in buying, i.e. capital gains. On the other side, you have to weigh the cost of maintaining your position, or rolling over your futures positions (if you’re a bullion investor).

As Barry Ritholtz noted, it’s particularly worrying to find that the Gallup poll results showed that the less affluent the household, the more likely they were to make gold their investment of choice. Perhaps it’s because they feel the financial system is rigged against them? Perhaps it’s simply that they don’t feel they have the skills to figure out which stock fund to choose? Perhaps they are more susceptible to the kind of fear-mongering that tends to accompany the promotion of gold as an investment?

Right now, gold could hit the headlines again as the standoff between Ukraine and Russia heats up once more. But we’ve seen these periods come and go before – and even flare up into long-lasting regional wars – without gold being transformed gold into the best long-term investment from a performance standpoint.

Related: Americans Say We 'Enjoy' Saving Money, Even Though We Don't

Real estate is a trickier matter. I’d be the first person to agree that the actual return on investment is only part of the value of real estate to its owner – at least, when it comes to home ownership, which is what the vast majority of the Gallup poll respondents probably mean. When you own your own home, you’re not only capturing whatever upside in value you can over the life of that investment, you’re saving whatever the difference is between your cost of ownership and the rent that you’d otherwise be paying. Then there are those tax benefits – and the less quantifiable peace of mind that owning your own home offers.

All that would be well and good if what most Americans did was buy their own home with a reasonable down-payment and a sensible mortgage that they then paid off over the years. In other words, as if we respected the fact that these are fairly illiquid assets that make up the vast majority of our personal net worth. Instead, over the last 10 or 15 years, we have begun to treat our homes as if they were any other asset.

Buying and selling when we move is unavoidable, of course, and moving when our family size changes or our needs do is understandable. But “trading up” simply because we can, taking out home equity loans to renovate in ways that won’t necessarily add value, buying homes with low or no down-payments so we’re at greater risk of being trapped in a negative equity position — all became mainstream in the run-up to the real estate crash of 2007-2008.

Those choices should at least they linger in the memory of many home buyers who still view the market crunch with indignation rather than as a reminder that a home isn’t the same as an ATM.

Which brings us back to stocks. Yes, stocks are risky. That’s why their returns, over the last 25 years, have been more than double those of real estate and more than four times those of gold. But they also offer investors a greater degree of liquidity than most other asset classes, and the ability to choose from a vast array of investment options — some more conservative, others more aggressive.

The ups and downs of the stock market may make owning shares feel less secure than owning an actual home. But mountains of data and study after study show that stocks have been the best long-term investment. They’re likely to continue to be.

The Gallup results show it’s time Americans got real about real estate and smarter about their money.

Top Reads from The Fiscal Times:

- The Growing Perils of the Cashless Future

- Bond Markets Put the Squeeze on Putin

- How Income Inequality Can Hurt the Economy