Markets have been rattled over the past week, with small cap stocks suffering their worst run since 2011, as investors suddenly realize that the Federal Reserve is perhaps closer to raising interest rates than they expected — something that hasn't happened in eight years.

The bond market has been hit too, with junk bonds getting whacked as the iShares High Yield Corporate Bond Fund (HYG) tests lows not seen since late last year. And according to Barclays Capital, funds invested in corporate debt rated below investment grade suffered a 1.3 percent drop in July, the second worst monthly loss since November 2011.

The selling started on Wednesday in response to a more hawkish-than-expected Federal Reserve policy statement and continued on Friday as more hawkish Fed officials continued to rattle the widespread assumption that interest rates weren't going anywhere anytime soon.

Related: Fed Hawks Shake the Stock Markets on Interest Rates

The real risk, though, is that the rerating of interest rate expectations could unleash another wave of selling; selling that rattles a bond market that is more vulnerable than it appears on the surface, according to warnings from the Institute of International Finance (IIF), an association of global banks that was created in response to the Latin American debt crisis of the early 1980s.

In their most recent Capital Markets Monitor, the IFF warned of speculative froth in high-yield bonds and a buildup in corporate leverage worldwide (seen in high debt-to-equity ratios, as companies issue cheap debt for share buybacks). Those growing risk factors make bond prices more vulnerable to any fall in operating cash flow and profitability.

The IIF isn't alone in getting nervous.

The Bank for International Settlements recently noted a "puzzling disconnect between the markets' buoyancy and underlying economic developments globally."

Related: Market 'Black Swan' Fear at Record High

Even the International Monetary Fund, which has been more supportive of monetary stimulus and encouraged Europe to do more along these lines, is starting to feel apprehensive. Gian Maria Milesi-Ferretti, the fund's deputy director, warned that "Financial markets have been very optimistic in recent months" and that "Frankly, we're seeing some prices that are very high compared with what is happening in the real economy."

So the market was primed for more downside as the assumption the Fed will keep money cheap forever is picked apart by the improving economic data and the Fed's newly vocal policy hawks.

This dynamic is set to continue. And thus so should the selling.

Despite the relatively soft payroll report on Friday, there hawkish members of the Fed's Open Market Committee have plenty of data they can point to in making their case. That was underlined by a statement released Friday morning by Philly Fed President Charles Plosser explaining his dissenting vote against Wednesday's policy statement. In it, he laid into the doves — including Fed Chair Janet Yellen — for supporting what he believes is an inappropriate policy stance given the improvement in the economy, the job market and inflation over the last six months.

Given the Fed's own guidance at the beginning of the year, Plosser said he dissented because the FOMC's statement "does not appear to reflect what was once thought to be appropriate policy based on the behavior of unemployment and inflation."

Dallas Fed President Richard Fisher chimed in on CNBC later that day, saying that the debate within the FOMC was shifting toward the hawks (signified by the acknowledgement of rising inflation) and that the Fed could raise rates as soon as early 2015, should the economic data continue to improve.

That's news to the market, since current futures pricing puts the first rate hike in July 2015.

The IIF warns that "a key potential trigger for a correction in asset prices could be an acceleration in the expected path of [interest rates] currently priced in by futures markets — which is now much more relaxed than the median estimate of FOMC members."

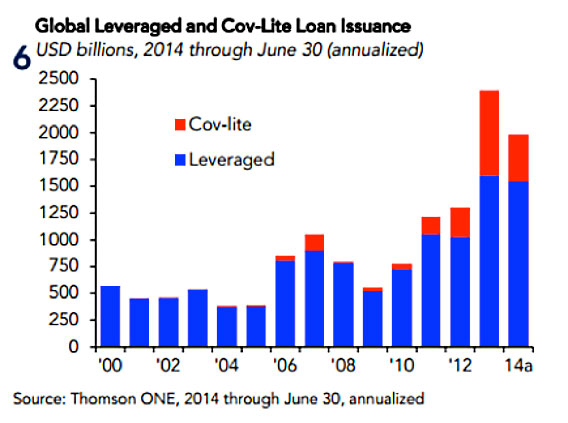

The problem is that that this correction could get ugly in high-yield bonds because of evidence of overzealousness and a lack of market liquidity as trading volumes have dried up. The chart below shows the surge of very speculative "cov-lite" and leveraged loan issuances since the beginning of 2013.

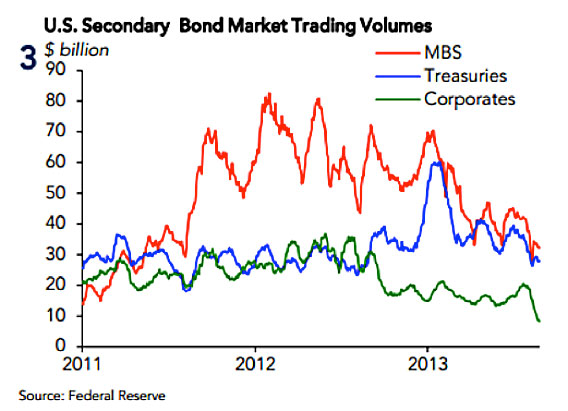

And the next chart shows how bond market trading volumes have dropped precipitously, with U.S. secondary bond trading volume falling $32 million per day in early 2012 to just $8.3 billion earlier this year.

Add it all up and you have a situation in which bonds are offering very little in the way of yield to compensate for rising interest rate and duration risk (because of Fed tightening), default risk (since yields haven't responded to the rise of corporate borrowing), and liquidity risk (as it will become harder and more expensive to exit positions).

That's a lot to worry about for a bond market that has, up until now, shown a remarkable resilience.

But should a rush for the exits develop later this year, in response to the end of QE3 in October and the approach of the first rate hike by the Fed, it could turn ugly fast. The lack of liquidity, according to the IIF, "may lead to an undesirable situation where the unwinding of the long bond trade runs into a one-way market, potentially creating disruptions, and disorderly adjustment."

More simply, we could be looking at a bond market rout in the very near future. Investors should prepare accordingly.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters, as well as Mirhaydari Capital Management, a registered investment advisory firm.

Top Reads from The Fiscal Times: