After the worst January ever for stocks, February isn’t turning out any better.

Investors got battered again Thursday, as recession worries rise and the reappearance of the Eurozone debt crisis adding to an already long list of worries.

This doesn't look like a typical bull market pullback. It has all the hallmarks of something much worse.

One catalyst this week has been the sudden appearance of stress in the Eurozone debt markets — specifically, the bonds of peripheral countries like Spain as well as European banks.

Related: Banks Drags Wall Street Lower as Growth Fears, Rate Outlook Weight

There are a few factors in play. Some political risk is popping back up (Spain basically has no government right now, Greece is having bailout issues again). That's hitting banks because of possible asset value impairment. And banks are being hit by worries that Deutsche Bank doesn't have enough capital to meet new regulatory requirements.

The kicker is that the recent move by the European Central Bank and the Bank of Japan to push policy rates into negative territory weakens banks by pushing net interest margins even lower (the gap between loan and deposit rates).

Investors are kind of freaking out about this, because it risks undermining the thesis that more monetary policy stimulus is always and everywhere a good thing. More negative rates now would only further weaken the banks. More asset purchases would further reduce the supply of high-quality collateral banks need for inter-bank lending.

Clearly, policymakers are likely to respond in some new creative form (money dropped from helicopters?) and that's why precious metals and the related mining stocks are going absolutely crazy. Since the Federal Reserve raised rates by 0.25 percent in December, the first tightening since 2006, gold has outperformed stocks by more than 20 percent — a loud vote of "no confidence" in the decision by traders.

Fed Chair Janet Yellen’s testimony this week in front of Congress hasn’t helped. She raised the risk that market volatility will lead to a tightening of financial conditions, further pushing back expectations of a rate hike into the second half of 2016. Yet the economic risks she highlighted have weighed on the markets more than the prospect of delayed rate hikes has helped.

As Yellen suggested, the list of concerns for 2016 is long: A strong dollar, weak oil prices, U.S. economic stalling, China's problems, geopolitical risks and falling corporate profitability.

Related: Why $1 a Gallon Gas Is Now on the Horizon

A downward spiral is developing. Reports are crossing that shale energy icon Chesapeake Energy (CHK) has hired bankruptcy lawyers. Fears of shale energy bond defaults has pushed the Barclays High Yield Bond ETF (JNK) to levels first reached in 2012. Bank stocks, as represented by the Financials Select SPDR (XLF), have been pummeled below their 200-day moving average for the first time since 2012.

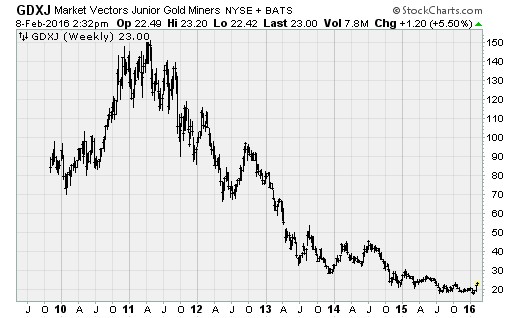

Safe havens are few and far between. Treasury bonds are rallying, but carry a negative real interest rate. The yield on the 10-year is down to 1.66 percent. Gold looks ready to emerge from its post-2011 downtrend. And precious metals stocks look best, at least for investors with the ability to tolerate the risk, since valuations have been bombed out, leaving buyers an opportunity to pick up shares of proven gold and silver reserves still in the ground at a discount.

The Market Vectors Gold Miners (GDX) is down 72 percent from its 2011 high. The Market Vectors Junior Gold Miners (GDXJ), focused on smaller outfits, is down a whopping 86 percent from its high. In a market where so much is overleveraged and overpriced, these stocks are some of the only bastions of value and protection left.