Much has been made about wage stagnation that for decades has crippled the middle class and more recently has seemed largely immune to the effects of the economic recovery.

The U.S. median household income adjusted for inflation is still eight percent lower than it was before the Great Recession, nine percent lower than at its peak in 1999, and for all intense and purposes, unchanged since the end of the Reagan administration, Ben Casselman of FiveThirtyEightEconomics noted recently.

Related: Obama Can’t Get Away from Stagnant Wages

President Obama and the Democrats are certain to renew their call next year for an increase in the minimum wage, tax breaks and other measures for addressing this long-time crisis.

WHY THIS MATTERS

As policy makers continue to debate income disparity, new research suggests that stagnant wages are not the sole factor in measuring the economic plight of the middle class, and that cost-saving industrial innovation may be an important – but largely invisible – boon to middle-class Americans. For the same token, industries that fail to invest in innovation are hammering families by ever-rising prices.

Yet stagnant median wages are really just one side of the coin in the debate over income inequality. The other side has to do with the impact that consumer prices are having on household expenditures – or what middle-class families must spend to keep body and soul together.

This is particularly important because low and middle-income families must spend a much larger percentage of their gross income on consumption than wealthier people do.

As Scott Andes and Mark Muro of the Brookings Institution wrote in an insightful blog on Tuesday, for a change there is some very good news on this front. Citing recent data from the Consumer Price Index, the authors show that the prices of a number of products and services have actually declined in relation to the median income – in effect artificially boosting the buying power of the middle class.

For instance, while median income has grown annually by 2.8 percent since 1990, the average price of durable goods has declined by .01 percent a year.

Related: High Anxiety As Americans Grapple with Low Wages

They wrote, “Computers, information technology services, and appliances are all cheaper today than 25 years ago, while the price of automobiles has grown by less than a percentage point annually. Today it takes fewer hours of work for a middle-income wage earner to afford a car than at any time in history. These price declines constitute unequivocal wins for the American middle and working classes.”

For sure, this is not a complete picture. The prices of a number of goods and services have also skyrocketed over the years in relationship to median wages.

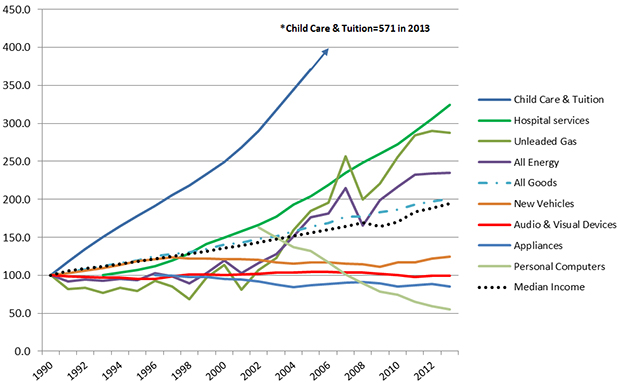

For example, the cost of hospital services and ambulatory care, childcare and tuition grew 200 percent faster on a compound annual basis than the median wage between 1990 and 2013, according to Bureau of Labor Statistics figures.

“Prices have outpaced income in housing rental, legal and professional services, and hotels and lodging as well,” according to Andes and Muro. “These large sectors and the high prices they charge are contributing heavily to the slipping economic position of American households.”

Here’s a chart that illustrates the conflicting long-term trends in critical consumer costs:

Source: The Brookings Institution

So what explains these striking disparities in the cost of consumer goods and services? While there are many factors that can explain it, the authors argue that the biggest difference is the impact of innovation. Many hospitals, universities, childcare centers and other enterprises differ from those in the technology sector because “they are neither investing heavily in innovation nor competing internationally,” the authors wrote.

Related: Why American Innovation Is Not Home Grown

For example, the automotive, Internet and computer software industries invested over nine percent of their sales in research and development last year, while the non-traded services like health care and education invested less than 0.7 percent of sales into research.

“The big picture is simply that it’s not always recognized that innovation – often in the form of technology development – is generating substantial price savings on many products,” Muro said in an interview. “You just know how much more TV you buy now when you buy a TV, and not only is the absolute price cheaper but the quality has gone way up on a whole bunch of consumer groups.”

He added, “Meanwhile, there are other areas that are not investing very much in innovation, and sure enough they’re the ones where we have soaring costs.”

But in making this argument, the Brookings study may have chosen some weak examples. Money-saving innovations in childcare services are hard to come by, just as the personal services of doctors, professors and teachers don’t always lend themselves to cost-saving breakthroughs.

At the same time, there are dozens of other industry innovations not mentioned in the report that do add up to substantial savings for middle-income Americans. Just a few examples:

- LegalZoom provides online assistance to people starting up or running a business, filing trademarks, changing their names, or even filing for bankruptcy or divorce – all at a fraction of the price of hiring a professional.

- Telemedicine, once used primarily for doctors and patients in isolated rural areas to communicate, now is integral to the operations of hospitals, private doctors’ offices and home health agencies. Patients communicating by email or smartphones save time, transportation costs and lost days at work, while hospitals and medical facilities rack up savings as well.

- SKYPE provides free international telecommunications for average Americans, while Amazon provides free delivery of virtually every classic book in the world.

Even with these oversights, the Brookings study offers a telling conclusion that rings true: “The reality is, in the moderate and long run, only by investing in novel techniques, machines, and production process can firms maintain global competiveness, keep jobs in the United States and lower prices.”

The Top Reads from The Fiscal Times