Blockbuster. Darn good. A blow-out. Those aren’t the kinds of terms you’d expect mild-mannered economists to toss around lightly, but they’re just the kinds of descriptions they were using to describe the November job report released Friday morning. The better-than-expected numbers that led to such grand pronouncements included an increase of 321,000 in nonfarm payrolls, far stronger than the 230,000 economists had expected on average, and the best since January 2012. The gains for the previous two months were revised upward by 44,000. Another closely watched metric also delivered another positive surprise, as average hourly earnings rose by 0.4 percent, the best such gain in 16 months.

Economist Ian Shepherdson of Pantheon Macroeconomics summed it up like so: “Spectacular and, more to the point, believable.”

Related: What Economic Numbers Do and Don’t Say About the Economy

Beyond the healthy headline numbers, here are three reasons to cheer the November jobs data:

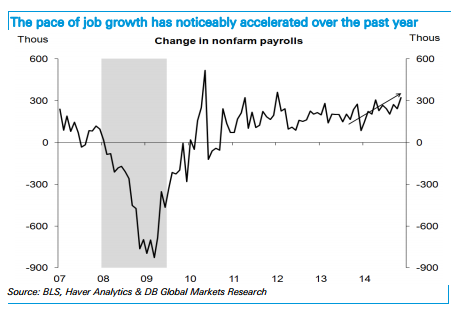

1. This wasn’t a fluke. The basic trend in payroll growth has been in place for quite some time: November is the tenth straight month with gains of 200,000 or more, and 2014 is on pace to be the best year for job gains since 1999. Payrolls have been growing by an average of 241,000 a month so far this year, up from 194,000 a month last year. With this report, the six-month average has climbed to 258,000, and the average gain for the last three months is 278,000. Recent trends suggest the final November number is likely to be revised even higher.

“It's hard to dismiss the solid beat as the product of fluky gains — the industrial breadth of job adds was the most since 1998,” J.P. Morgan economist Michael Feroli wrote to clients. Employment in the professional and business services category grew by 86,000 in November, and by 696,000 jobs for the year. Retailers added 50,000 jobs in November — suggesting they expect strong holiday sales — bringing the sector total for the year to 290,000. The health care sector added 29,000 jobs last month and 261,000 so far this year. The manufacturing sector gained 28,000 jobs and has added 171,000 over the past 12 months.

“The breadth of the job growth is noteworthy in two ways,” Deutsche Bank economist Joseph LaVorgna wrote Friday. “One, when most industries are hiring, the likelihood that these gains continue is quite high, because the job market is not relying on just a few industries to power growth. In other words, the scope of the job gains speaks to the durability of the current labor market expansion. Two, with employment growth so widespread, the jobs being created are not just in allegedly low-paying sectors or part-time employment.”

2. The economy is picking up the labor market slack. “While the inexorable decline in the unemployment rate stalled this month, there were other favorable signs that shadow slack continued to diminish,” Feroli wrote. For one thing, the number of people working part-time who would prefer to be at full-time jobs fell below 6.9 million — still historically high, but down from 7.7 million a year earlier. That helped a broader measure of the unemployment rate tick down to 11.4 percent, a six-year low and down from 12 percent in August and 13.1 percent in November 2013.

Related: How Immigrants Boost U.S. Economic Growth

On the downside, that broader measure of unemployment is still high compared to pre-recession levels. And while the long-term unemployment rate dropped a bit to 1.8 percent, some 2.8 million people — more than 30 percent of the unemployed — had still been out of work for more than six months as of November. Labor force participation remains near a three-decade low at 62.8 percent. So while the job market is clearly doing much better, it’s still got plenty of room for further improvement.

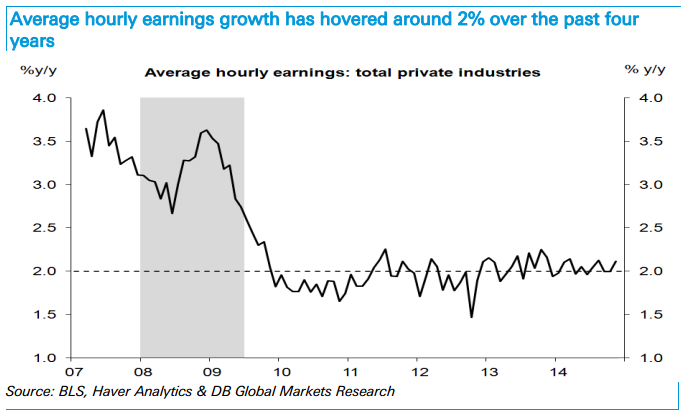

3. Wages may finally be picking up. Given the general trends in the job market, this is the number economists were watching. Average hourly earnings gained nine cents compared with October, the best gain since January 2011. That lifted the annual increase in wages in the private sector to 2.1 percent, up slightly from the 2 percent pace of recent months. Weekly earnings were also helped by a slightly longer average workweek, up to 34.6 hours in November from a revised 34.5 hours in October.

The question remains whether this is really the start of a long-awaited acceleration, especially since the wage growth for “production and non-supervisory workers” was a more tepid four cents an hour.

“A one-time, nine cent jump is insufficient to conclude that wage pressures are imminent,” IHS Chief U.S. Economist Doug Handler noted. “Several more months of growth at this rate will be needed to make a material difference in the average hourly earnings growth profile.” Other economists were slightly more optimistic. “We have been arguing that we are on the verge of better wage gains, but even we would be reluctant to say today's number is proof-positive of that argument,” Feroli wrote. “Even so, a journey of a thousand miles begins with a single step, and today’s number along with the recent [employment cost index] suggests the journey may have begun.”

Top Reads from The Fiscal Times: