How IBM Is Making Your Passwords Useless

For years, quantum computing has been hailed as a technology that could change the way the modern world works, but a long-standing technical issue has kept that potential from being realized. Now, in a paper published in the journal Nature last week, IBM scientists have taken a big step (see how I avoided the temptation to make a pun there?) toward solving that problem — and while it could represent progress toward making quatum computers real, it also could mean that current cybersecurity standards will soon be much easier to crack. In other words, your passwords could be obsolete soon.

The power of quantum computing has some obvious appeal: The increase in processing power could speed up research, especially in big data applications. Problems with large datasets, or those that need many millions (or billions, or more) of simulations to develop a working theory, would be able to be run at speeds unthinkable today. This could mean giant leaps forward in medical research, where enhanced simulations can be used to test cancer treatments or work on the development of new vaccines for ebola, HIV, malaria and the other diseases. High-level physics labs like CERN could use the extra power to increase our understanding of the way the universe at large works.

But the most immediate impact for the regular person would be in the way your private information is kept safe. Current encryption relies on massively large prime numbers to encode your sensitive information. Using combinations of large prime numbers means that anyone trying to crack such encryption needs to attempt to factor at least one of those numbers to get into encrypted data. When you buy something from, say, Amazon, the connection between your computer and Amazon is encrypted using that basic system (it's more complicated than that, but that's the rough summary). The time it would take a digital computer to calculate these factors is essentially past the heat death of the universe. (Still, this won't help you if your password is password, or monkey, or 123456. Please, people, use a password manager.)

Quantum computing, however, increases processing speed and the actual nature of the computation so significantly that it reduces that time to nearly nothing, making current encryption much less secure.

The IBM researcher that could make that happen is complicated, and it requires some background explanation. For starters, while a "traditional" computing bit can be either a 0 or a 1, a quantum computing bit can have three (or infinite, depending on how you want to interpret the concept) states. More specifically, a qubit can be 0, 1, or both.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Apparently — and you'll have to take this on faith a bit, as it hurts my head to think about it — the both state can switch back to either 0 or 1 at any given point, and sometimes incorrectly, based on the logic in the programming. Think about when your phone freezes up for a second or two while you're matching tiles. This is its processor handling vast amounts of information and filtering out the operations that fail for any number of reasons, from buggy code to malware to basic electrical noise. When there are only the two binary states, this is a process that usually happens behind the scenes and quickly.

The hold-up with quantum computing up until now is that the vastly greater potential for errors has stymied attempts to identify and nullify them. One additional wrinkle in this reading quantum states is familiar to anyone with basic science fiction knowledge, or perhaps just the ailurophobics. What if the action of reading the qubit actually causes it to collapse to 0 or 1?

The very smart people at IBM think they've solved this. The actual technical explanation is involved, and well beyond my ability to fully follow, but the gist is that instead of just having the qubits arrayed in a lattice on their own, they are arranged such that neighbors essentially check each other, producing the ability to check the common read problems.

That opens the door to further quantum computing developments, including ones that will make your password a thing of the past. So, does this mean that you need to start hoarding gold? No, not yet. And hopefully before quantum computing reaches commercial, or even simply industrial/governmental levels, a better cyber security method will be in place. Or the robots will have already taken over. I for one welcome them.

Millennials Like Saving Money, Want to Save More

Millennials have impressive financial habits when compared to baby boomers, according to a new Retirement Saving & Spending Study by T. Rower Price. Millennials like to save, with many taking advantage of 401(k) plans while still paying down debt. On average, millennials are saving nearly as much for retirement -- 8 percent of their incomes -- as baby boomers, who are saving an average of 9 percent. And in the past 12 months, millennials are saving a higher percentage of their incomes than baby boomers when it comes to 401(k) contributions.

The research is based on online interviews with 1,505 millennials and 514 baby boomers with 401(k)s, and includes both workers and retirees.

Overall, millennials in the study report they are in surprisingly good financial shape. Eighty-eight percent say they are living within their means and 74 percent are more comfortable saving and investing extra money than spending it. However, many millennials are pessimistic about Social Security: Sixty percent expect Social Security to go bankrupt before they retire.

Here’s what else the survey reveals:

Millennials like to save, and they’d save more if they could.

Saving for retirement and paying down debt are equally important to millennials, who rank both goals as a top priority. For those who say they are not saving enough, 23 percent cited student loans as a major contributing factor.

Related Link: ‘Irresponsible’ Millennials Saving More Than Almost Every Other Group

Millennials like auto-enrollment plans.

Seventy-nine percent of the millennials who were auto-enrolled in 401(k) plans were satisfied with auto-enrollment. When it comes to 401(k) matches, 59 percent of millennials set their 401(k) contribution rate to take full advantage of their employers’ matches.

They’re open to advice and more likely to ask for help if they need it.

If faced with a sudden financial emergency, 55 percent of millennials said they’d seek the help of family and friends, compared to 24 percent of baby boomers. Millennials were also much more likely to admit they could benefit from help with spending and debt management.

They find it hard to save when they make less money.

Non-savers made less money and carried more student debt. The median personal income of non-savers was $28,000, compared to $57,000 for savers. Thirty-nine percent of the non-savers have trouble meeting their monthly expenses.

Men save more.

Millennial women are less likely to save in 401(k)s, even if they are eligible, and when they do, they save less than men. The average 401(k) balance for women participating in their 401(k) is $38,000, compared to an average 401(k) balance of $74,000 for men. Of those who are already participating in 401(k)s, only 41 percent of the savers are women.

Related link: Here Are 7 Ways People Screw Up Their 401(k)s

It’s Not Just in Your Head, the Web Is Slowing Down

It’s not your imagination, and it’s not because AT&T — and possibly others — is purposefully cutting speeds to unlimited data plan users. The Internet is slowing down. The reason: Websites are growing in size, causing slower load times.

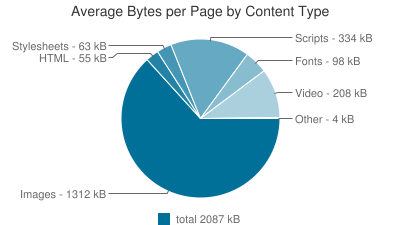

The average website is now 2.1 MB in size, compared to 1.5 MB two years ago, according to HTTP Archive, an Internet data measurement company. Multiple reasons can explain this increase in size.

Sites have been adding more content in an effort to drum up traffic, such as videos, engaging images, interactive plug-ins (comments and feeds) and other code and script-heavy features. Websites are becoming more and more technically advanced, and other sites have to keep adding features to stay competitive.

To keep up with the rapidly increasing number of users accessing sites on various platforms, developers are offering more versions of websites as well as apps to accommodate all devices, including smartphones, watches, tablets, and other gadgets. All of these versions require additional code, ultimately adding to the weight of a given website.

Then there are the advertisers who want to get the user’s attention by creating dramatic displays for their products that consume even more bandwidth.

Websites also want to know who is visiting their pages, both welcome and unwelcome visitors. New tools that track and analyze visitors have increased in popularity, as well as stronger encryption technology to add more security. These security measures and trackers require more code, again slowing load times.

Unfortunately for websites trying to keep up with the times, Google has just introduced a new ‘Slow to Load’ warning sign in mobile search results. Since mobile searches account for more than half of the total Google searches in 10 countries, Google wants to enhance user experience for those on their mobile platform.

Although the weight of a website isn’t all that contributes to slow loading, it’s a major factor. Other reasons include users overusing data, a poor connection, or a high level of traffic in the mobile network.

Google also changed its algorithm in April, so now ‘mobile friendly’ sites are ranked higher on search results, while those that fail to meet its criteria are ranked lower.

Although the internet is only slowing by a matter of seconds, it’s still slowing down. All the more reason for a user to become frustrated with a page that’s taking a couple extra seconds to load and go to a competitor’s site.

Taylor Swift Gets Apple Music to Pay Up

On Sunday morning, Taylor Swift took Apple to task for the royalty agreement on its news music streaming service. Her open letter on Tumblr, titled “To Apple, Love Taylor,” said, “I’m sure you are aware that Apple Music will be offering a free 3 month trial to anyone who signs up for the service. I’m not sure you know that Apple Music will not be paying writers, producers, or artists for those three months. I find it to be shocking, disappointing and completely unlike this historically progressive and generous company.”

Related Link: How the Video Game Industry Is Failing Its Fans

“Three months is a long time to go unpaid, and it is unfair to ask anyone to work for nothing,” the pop singer argued on the behalf of music-makers everywhere, many of whom had voiced their discontent with the royalty policy. She concluded her letter saying, “We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”

It was a sentiment shared by many independent music artists and producers. Just a few weeks earlier, the American Association for Independent Music had chimed in, “Since a sizable percentage of Apple’s most voracious music consumers are likely to initiate their free trials at launch, we are struggling to understand why rights holders would authorize their content on the service before October 1st.”

It took less than 24 hours for the “historically progressive and generous company” to respond via Twitter, and it didn’t wait until morning to make its announcement. Eddy Cue, Apple’s senior vice president of Internet Software and Services, personally called Swift to deliver the news before tweeting at 11:29 p.m., “#AppleMusic will pay artists for streaming, even during customers’ free trial period.”

Cue followed up with a feel-good response a minute later: “We hear you @taylorswift13 and indie artists. Love, Apple.” Later, Cue said that the company will pay artists on a per stream basis during the free trial period, although Cue declined to say what the rate would be. Once the free introductory period is over, Apple Music will pay music owners 71.5 percent of Apple Music’s overall subscription revenue in the United States.

Swift tweeted her response and addressed it to her fans and supporters: “I am elated and relieved. Thank you for your words of support today. They listened to us.”

Related Link: Apple Muscles Into Streaming Music Market

Swift’s crusade on social media showed the increasing weight that collective opinions on Twitter, Instagram and Facebook can have to force a change in corporate policy and direction. In a comic echo of that power, BuzzFeed promptly put together a list of 18 more issues Swift could fix through the power of social media, ranging from the battery life of iPhones to the size of Pringles cans.

Apple Music is launching on June 30, offering users a free, three-month subscription period. After that, the service will charge $9.99 a month for individuals and $14.99 a month for families with up to six members.

Most Americans Wouldn’t Vote for a Socialist President

Memo to Sen. Bernie Sanders:

Americans by overwhelming numbers say they would vote for a qualified presidential candidate nominated by their party who is Catholic, a woman, black, Hispanic or Jewish.

They say they would be somewhat less inclined to support a Mormon, a gay or lesbian, an evangelical Christian or Muslim for president, according to a new Gallup Poll released Monday. Yet more than half of those Americans surveyed said they would be accepting of anyone from this group who managed to garner their party’s presidential nomination. Even a qualified atheist would be acceptable to 58 percent of those questioned.

But only 47 percent said they could vote for a socialist for president. Fifty percent said they would absolutely not.

Related: Where Hillary Clinton, Bernie Sanders and Martin O’Malley Stand on the Issues

Sanders, 73, an independent who is challenging Hillary Clinton for the Democratic nomination, is the only Jewish candidate in the race. And while many wrote him off early on as a fringe candidate with limited appeal, Sanders has subsequently generated considerable buzz among liberals and progressives, and has made respectable showings in some of the early polling, including in New Hampshire.

With his ringing anti-Wall Street populist message, Sanders is tapping into the Democratic Party’s progressive wing – including some who had hoped at one time that Sen. Elizabeth Warren (D-MA) might change her mind and enter the race. However, the former University of Chicago student radical and self-described democratic socialist, supports proposals similar to those of mainstream social democratic governments in Europe, particularly those of Scandinavia.

Five of the declared candidates for president are Catholics – including Republicans Jeb Bush, George Pataki, Marco Rubio and Rick Santorum, and Democrat Martin O'Malley. Two are women -- Clinton and Republican Carly Fiorina. Republican Ben Carson is the only black candidate in the race, while two candidates are Hispanic -- Republicans Rubio and Ted Cruz.

Here are Gallup’s findings:

The Hidden Costs of Home Ownership: $6,000 a Year

Most new homeowners are prepared to pay their mortgages, but they may not be ready for other unavoidable costs that can amount to thousands of dollars every year.

The average homeowner shelled out $6,042 last year in homeowners insurance, property taxes, and utilities, according to a new report from Zillow. The average costs varied by location, with Boston homeowners spending the most ($9,413) and homeowners in Phoenix spending the least ($4,513).

“Home buyers too often fixate on the sticker price or monthly mortgage payment on a house, and don’t budget for the other expenses associated with ownership -- which can add up quickly,” Zillow spokeswoman Amy Bohutinsky said in a statement.

Related: How to Decide if You Should Rent or Buy a Home

The maintenance costs included in the report included things like lawn care and carpet cleaning.

The country’s homeownership rate fell to 63.7 percent in the first quarter, the lowest level since 1989. The rate peaked at 69.2 percent in the fourth quarter of 2004, right before the housing bubble burst.

As rents in many cities continue to skyrocket, however, homeownership may be becoming more appealing. However, in addition to hidden homeownership costs, new buyers should also consider the opportunity costs of potential earnings if buyers had invested their down payment. The New York Times has a handy calculator that incorporates these and other factors to help weigh whether it makes more sense to rent or buy.

Nearly two-thirds of consumers say that home ownership is a “dream come true” and an accomplishment to be proud of, according to a survey released last week by Wells Fargo.