The Amazingly Stupid Things Smartphone Users Do While Driving

If you’re reading this while driving, put your phone down right now. This article — as engrossing as it is — will still be here when you reach your destination.

We provide that friendly bit of advice because, as The New York Times reported this morning, a whole bunch of motorists are occupying themselves with their smartphones — and distracting themselves from the road — in ways that go way beyond talking and texting, according to a new survey conducted by Braun Research for AT&T.

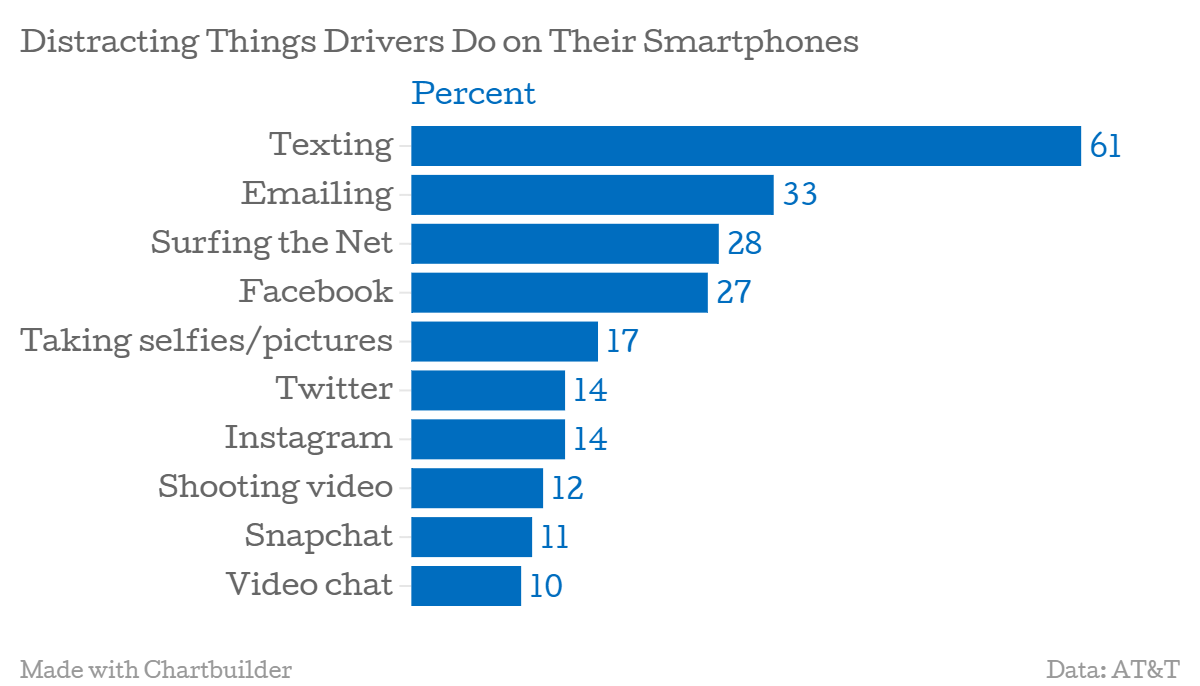

The pollsters surveyed 2,067 smartphone users who drive daily, and their findings should be frightening to anyone on the roads. More than six in 10 smartphone users surveyed say they text while driving. It gets scarier: Nearly 40 percent of smartphone users admit to checking in on social media while driving, with 27 percent admitting to using Facebook and another 14 percent saying they use Twitter and Instagram while behind the wheel. Of users who cop to posting on Twitter while driving, 30 percent say they do it “all the time.” Given those figures, it’s amazing that #TwitterAccident isn’t always trending.

Related: Here's How Much Likelier You Are to Be Killed in a Car Than on Amtrak

Some other troubling stats from the survey: 17 percent snap selfies or other pictures when in the driver’s seat and 12 percent shoot videos — with 27 percent of those videographers thinking they can do so safely. Astoundingly, 10 percent of drivers say they video chat while on the roads.

AT&T says it will expand its It Can Wait public service campaign about the dangers of distracted driving, which launched in 2010, to focus on hazards beyond just texting. But as Matt Richtel of the Times points out, the AT&T campaign and other efforts like it face a stiff challenge in trying to counter the social pressures and strongly ingrained habits that keep people constantly checking their phones.

Tough laws and widespread educational efforts have been effective at reducing drunk driving and encouraging use of seat belts. But we still have a way to go in getting drivers to understand that “mobile” doesn’t mean when you’re behind the wheel. Right now, 46 states and the District of Columbia have outlawed texting while driving. As you can see above, that hasn't helped much yet. Smartphone users still need to be convinced of the danger they pose — or face — if they use their devices while driving.

As Lori Lee, AT&T’s global marketing officer, put it: “For the sake of you and those around you, please keep your eyes on the road, not on your phone.”

How to Avoid the Worst Fees in America

Nothing gets under the skin of a savvy consumer like unwarranted and unwanted fees.

The Web site GoBankingRates.com has put together a list of the “31 Worst Fees in America,” listing some of the most egregious fees out there, as well as tips on two avoid them. The list includes 11 banking fees, 10 travel fees, and handful of fees from other categories such as health care and cell phones.

“At the bank, while traveling, or just when going about your daily business, fees are on the rise in seemingly all industries—and not just in quantity, but in price,” writes author Paul Sisolak. “Many times, they’re so well obscured that you end up paying fees without realizing it.”

The good news is that in most cases, there’s an easy fix for the fees: Avoid bank teller fees, for example, by using remote deposit and ATMs; and steer clear of ATM fees by using your bank’s app to find the nearest in-network machine.

Related: 10 Infuriating Consumer Fees to Stop Paying Now

While bank fees may be rising, the institutions are getting better about being transparent in disclosing them. More than 60 percent of the banks reviewed last week by The Pew Charitable Trusts have adopted a summary disclosure box of terms and fees that meets the organization’s standards, up from just 25 percent in 2013.

When it comes to avoiding fees while traveling, pack light to avoid overweight bag charges and call ahead of time to get a sense of Wi-Fi and other hotel/resort fees.

Obamacare’s Dirty Secret: 31 Million Still Can’t Afford Treatment

The president’s healthcare law sliced America’s uninsured rate down to historic lows by expanding coverage for tens of millions of Americans. At the same time, however, the number of insured people who still lack affordable, robust coverage is rising sharply as more people buy into high-deductible policies.

A new study from the Commonwealth Fund reveals that about 23 percent of Americans with coverage are considered underinsured—up from 12 percent in 2003. That means roughly 31 million Americans who bought health insurance still have trouble affording treatment under their policies.

The researchers at the Commonwealth Fund defined “underinsured” people as having out-of-pocket costs that total 10 percent or more of their annual income, or a deductible that is 5 percent or more of their income. The study concluded that high-deductible policies are likely the culprit behind this massive influx of underinsured people.

The findings are a huge problem for the Obama administration since the entire goal was to expand access to coverage to millions of Americans that they presumably would use instead of delaying treatment. But a handful of recent studies show that even people with health insurance are delaying treatment because they can’t afford it.

Related: High Deductible Plans Have More People Delaying Treatment

A December Gallup Poll showed at least 38 percent of insured, middle-income people, said they had delayed medical treatment because of the cost. “While many Americans have gained insurance, there has been no downturn in the percentage who say they have had to put off needed medical treatment because of cost,” Gallup’s Rebecca Riffkin wrote in a post on the pollster’s website.

The shift toward cost-sharing and high-deductible policies—defined by the Internal Revenue Service as those with annual deductibles of $1,300 or more for individuals and $2,600 for families--is widespread among exchange policies but also employer plans.

The Commonwealth Foundation’s study, unsurprisingly, reveals that low-income people with coverage are about twice as likely to be “underinsured” than people earning more than 200 percent of the poverty line.

Of course, it’s important to note that while affordability continues to be an issue, significantly more people do have health insurance because of the law.

Why That Annoying Fraud Alert Is Still a Good Thing

As credit card fraud has skyrocketed, issuers suspecting suspicious activity have become increasingly vigilant – sometime maybe too vigilant.

In many cases, fraud alerts are preventing consumers from making legitimate purchases. More than two-thirds of Americans who have received a fraudulent activity alert from their credit or debit card issuers have received at least one that’s inaccurate, according to a new study from CreditCards.com.

Still, card issuers have good reason to be cautious. This week, credit card scoring and analytics firm FICO said that the number of attacks on debit cards used at ATMs hit the highest level in 20 years during the first quarter of 2014

Related: How to Beat Credit and Debit Card ID Thieves

Americans remain extremely concerned about their personal data when shopping in stores, so many accept the inaccurate fraud alerts as a necessary hassle. “Most consumers we have spoken with seem to be okay with this trend,” CreditCards.com senior industry analyst Matt Schulz said in a statement.

You can avoid having your card blocked from legitimate purchases by calling your issuer or visiting their Web site to let them know you’ll be traveling, since purchases made from a new geographic area often send a red flag to card companies. Some issuers also offer text message alerts, so you can quickly and easily unblock a card for your transactions.

If you think you’ve been a victim of fraud (or if your cards have been physically lost or stolen), call your issuer immediately – most have 24/7 call centers dedicated to fraud.

Cancer Charities Exec Stole $187 Million for Personal Use

Donors who have given money to four of the largest cancer charities in the United States may have unknowingly been financing the lavish lifestyle of the C.E.O. who runs them—paying for luxury cruises, elite gym memberships instead of treatment for cancer patients.

That’s according to a suit filed Tuesday by the Federal Trade Commission as well as attorneys general in all 50 states, which alleges that James Reynolds deceived and defrauded donors out of more than $187 million between four of his charities—including the Cancer Fund of America, Cancer Support Services, Children’s Cancer Fund of America and the Breast Cancer Society.

Related: Medicare Recovers Nearly $28 Billion in Fraud Since 1997

The complaint says that the scheme started in the 1980’s. The charities told donors via telemarketing calls that their money would go toward medicine and transportation for cancer patients. However, most of the money actually went toward Reynolds’ personal indulges.

The complaint says that between 2008 and 2012, only three percent of donations actually went to cancer patients.

The FTC also accuses the organizations of cooking their books and reporting inflated revenues as well as “gifts in kind” that they said they distributed internationally.

The FTC said two of the charities—the Children’s Cancer Fund of America and the Breast Cancer Society plan to settle the charges out of court. The Associated Press reported that the Breast Cancer Society, posted a statement on its website Tuesday blaming increased government scrutiny for the charity's downfall.

"While the organization, its officers and directors have not been found guilty of any allegations of wrongdoing, and the government has not proven otherwise, our board of directors has decided that it does not help those who we seek to serve, and those who remain in need, for us to engage in a highly publicized, expensive, and distracting legal battle around our fundraising practices," the statement said.

Several executives who were also involved in the sccheme, including Reynolds’ son, have agreed to a settlement, which bans them from working in fundraising or charities. The two charities that settled, Breast Cancer Society and the Children’ Cancer Fund of America will be dissolved.

The settlement also orders a $65,664,360 judgment, which is the amount consumers donated between 2008 and 2012. Reynolds junior’s judgment will be for suspended once he pays $75,000. Meanwhile the legal proceedings for Reynolds’ senior and the two remaining charities are ongoing.

Former CBO Chief: Congress Never Meant to Limit Obamacare Subsidies

A Supreme Court ruling expected this summer will determine whether the federal government can subsidize the insurance costs of individuals in states that did not establish their own health care exchanges under the Affordable Care Act.

Douglas Elmendorf was the director of the Congressional Budget Office when Congress debated the bill, and on Tuesday he provided some ammunition to backers of the law who insist that that Congress did not intend to prevent payments of subsidies to consumers in states using the federal exchange.

Related: How Obamacare Could Be Squeezing Consumer Spending

In an interview with CNBC’s John Harwood at the Peter G. Peterson Foundation’s 2015 Fiscal Summit*, Elmendorf said that before the ACA passed, the CBO analyzed the bill for members of Congress, many of whom were powerfully opposed to it. At the time, he said, there was a common understanding on Capitol Hill that the subsidies would be available to states regardless of the status of their exchanges.

“That analysis was subject to a lot of very intense scrutiny and a lot of questions,” he said. “My colleagues and I can remember no occasion on which anybody asked why we were expecting subsidies to be paid in all states regardless of whether they established exchanges or not. And if people had not had this common understanding…then I’m sure we would have had a lot of questions about that.”

Pressed by Harwood, Elmendorf added, “My colleagues and I talked to a lot of people, with a lot of questions about nearly every aspect of the analysis that we did…and we could not remember anybody asking us any questions about what would happen in the federal exchange different from what would happen in the state exchanges.”

Even so, the language of the law states that the subsidies would apply to exchanges “established by the State” and the Supreme Court will decide how literally those words must be interpreted.

*Pete Peterson also funds The Fiscal Times.