House Democrat Calls Congress ‘The Poster Child for Cowardice” on ISIS

Amid growing signs that the U.S. faces nothing but bad choices in its war against ISIS, Rep. Jim McGovern, a liberal Democrat from Massachusetts, today denounced Congress as “the poster child for cowardice” for refusing to debate a new war powers resolution to set parameters for the Obama administration’s efforts to “degrade and defeat” the jihadist terrorists in Iraq and Syria.

At the behest of Republican and Democratic leaders, Obama sent a proposed war powers resolution to Congress in February outlining his core objectives of systematically destroying the jihadist terror group through a sustained campaign of airstrikes, supporting and training allied forces on the ground and humanitarian assistance – but without committing a large number of U.S. combat troops to the effort.

Related: U.S. Shoots Itself in the Foot By Accidentally Arming ISIS

The administration proposal would give the military “flexibility” to confront unforeseen circumstances, potentially by deploying Special Forces in the region. But it would limit the mission to three years and would not authorize “enduring offensive ground combat operations.”

But rather than roll up their sleeves and debate and vote on the president’s request for new military authorization, Republican leaders have effectively shelved the issue and moved on to other things, such as rewriting the rules for NSA spying on Americans’ phone calls and providing Obama with fast track authority to negotiate a new trade pact with Asian countries.

With many conservative Republicans including Sens. John McCain of Arizona and Lindsey Graham of South Carolina complaining that the president’s strategy for defeating ISIS woefully inadequate and some Democrats worried that it goes too far in committing U.S. troops and resources to a no-win situation in the Middle East, Senate Foreign Relations Committee Chair Bob Corker (R-TN) said recently he had no incentive to take up the issue in his committee.

Related: Why Congress Should Simply Bag the War Powers Debate

Frankly speaking, this is unacceptable,” McGovern, a member of the House Rules Committee, said on the House floor today, adding that if the Congress “doesn’t have the stomach” to authorize the war it should vote to bring U.S. forces home, according to Politico. McGovern introduced a bipartisan resolution that would require full debate within 15 days on whether U.S. troops should withdraw from Iraq and Syria. His bipartisan resolution is co-sponsored by Reps. Walter Jones (R-NC) and Barbara Lee (D-CA).

“This House appears to have no problem sending our uniformed men and women into harm’s way,” McGovern said in prepared remarks. “It appears to have no problem spending billions of dollars for the arms, equipment and airpower to carry out these wars. But it just can’t bring itself to step up to the plate and take responsibility for these wars.”

Two-Thirds of Parents Are Making This Big Financial Mistake

More than a third of Americans with young children don’t have any life insurance, and another third have policies with payouts of less than $100,000, according to a new analysis by Bankrate.com

The survey found that 42 percent of all Americans haven’t purchased life insurance, and about half of those with insurance have policies worth $100,000 or less, including 25 percent of those with a household income over $75,000.

Of course not everyone needs life insurance, but people who have family members depending on them financially should have a policy. The amount you need varies, depending on your future financial obligations, outstanding debts, and current assets.

Related: How to Calculate Your Life Insurance in 3 Easy Steps

Part of the reason for inadequate coverage could be that people underestimate the benefits they’re receiving from work (which don’t roll over from job to job), or they’re failing to update their policy after major life changes like the birth of a child or the purchase of a home.

Another factor: They’re misinformed about the price of life insurance. Eight in 10 consumers have incorrect ideas about the price of life insurance, with millennials overestimating the cost by 213 percent and Gen Xers overestimating it by 119 percent, according insurer trade organization LIMRA.

In addition to your age and health, the price of life insurance could be impacted by your credit history, driving record, and lifestyle.

The LIMRA study found that 30 percent of Americans think they need more life insurance, but more than half said it was unlikely that they’d purchase a policy in the next year.

The Rapidly Rising Death Toll of the Heroin Epidemic

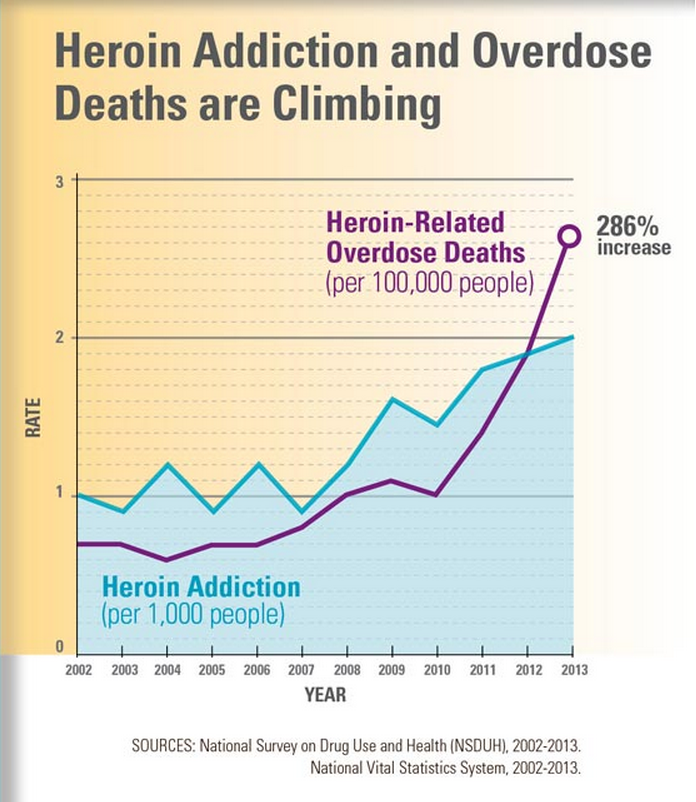

The death toll from the heroin epidemic has been climbing dramatically in recent years — and the annual rate of overdose deaths nearly doubled between 2011 and 2013, according to a new CDC study.

From 2002 through 2013, heroin use in the United States rose by 63 percent, and the rate of abuse or dependence climbed a staggering 90 percent. Deaths from heroin-related overdoses nearly quadrupled, with more than 8,200 people dying in 2013 alone.

The CDC report says that heroin use has increased across most demographic groups — men and women, most age groups, and across all income levels. Rates of heroin use are still highest among men, those ages 18 to 25, people with income less than $20,000 a year, people in urban areas, and those who do not have health insurance or are on Medicaid. But other groups are turning to the drug, too. “Some of the greatest increases occurred in demographic groups with historically low rates of heroin use: women, the privately insured and people with higher incomes,” the CDC says.

The heroin trend isn’t happening in isolation, the CDC study says. Almost all heroin users — 96 percent — also took at least one other drug, and 61 percent used at least three other drugs. Abuse or dependence on opioid painkillers is the strongest risk-factor for heroin use or addiction, the report says, with cocaine addiction also high on the list. People who are addicted to prescription opioid painkillers are 40 times more likely to use or be addicted to heroin, and 45 percent of people who used heroin were also addicted to painkillers.

Another key reason is that heroin is becoming cheaper and more widely available. According to the DEA, the increase in heroin seizures in the U.S. from 2010 and 2014 rose 81 percent, from 2,763 kilograms to 5,014 kilograms. More and more law enforcement agencies are identifying heroin as their primary drug threat, but the CDC report suggests that health care workers focus on reducing the abuse of painkillers by improving prescribing practices.

The study also recommends that states increase access to “medication-assisted treatment” programs that use methadone, buprenorphine and naltrexone along with behavioral counseling. And it says the rapid rise in heroin-related deaths highlights an “urgent need” to broaden access to naloxone, a drug that can reverse the effects of heroin and opioid overdose.

Here’s Why Economists Are Worried About A New Housing Bubble

After posting their 39th consecutive month of year-over-year price gains, home prices in 33 states and the District of Columbia are at or within 10 percent of record highs, according to a report issued today by CoreLogic.

Home prices increased 6.3 percent year-over-year in May, and 1.7 percent month-over-month. Relatively low mortgage rates have helped fuel the price gains. In cities like San Francisco, where there is limited supply and high demand, prices are growing at a double-digit clip.

Prices are so high in certain areas that some economists are starting to worry about localized bubbles. The number of homes on the market is increasing slightly. Total housing inventory at the end of may reached 2.29 million houses, 1.8 percent more than this time last year, according to the National Association of Realtors. That’s a 5.1-month supply, giving sellers a slight edge in today’s market. (A six-month supply is considered a healthy market.)

Related: Get ready for Another Real Estate Bubble

South Carolina saw the biggest price gains, with homes showing annual appreciation of 10.3 percent. Other states showing big gains were Colorado (9.8 percent) and Washington (8.8 percent), CoreLogic reports.

High prices have also spurred builders to start constructing new single-family homes, sales of which increased 23 percent year-over-year in May.

While most states have seen price gains, five states (Massachusetts, Connecticut, Maryland, Mississippi, and Louisiana) saw local home prices fall in May.

CoreLogic economists expect prices to increase 5.1 percent year-over-year in June and 0.8 percent month to month.

Looking for Likes? When to Post on Facebook for Maximum Attention

Trying to decide when to post photo updates to your “Summer 2015” album so the maximum number of people click through, comment on, and like your filtered selfies? Look no further. A new study conducted by the social media analytics firm Klout can tell you the best time and day of the week to post on Facebook and Twitter, depending where you are in the world.

The study found that posting in the late morning and early afternoons on Tuesdays and Wednesdays tends to generate the most engagement. Thursdays tend to be quiet, Fridays are quieter still, and the weekends are the quietest. On Mondays, the activity level begins to ramp up again as the work week begins and bored office workers take social media breaks.

Optimal times also depend on location. Tokyo peaks at the earliest time among cities studied, between 7 a.m. and 9 a.m. Paris has a high level of engagement once in the morning and once in the afternoon. In San Francisco, between 9 a.m. and 10 a.m. is ideal for posting. The most favorable time in New York is just before noon. London peaks the latest, with users becoming fully engaged on Twitter and Facebook only in the early afternoon.

Thinking about posting a picture of your cute new nephew at night? Don’t even bother if you want maximum engagement from your followers and friends. While one explanation is that fewer people are online at night, another is that most likes, shares, and comments occur within a short window of time after someone posts something. Researchers of the study found the majority of reactions were within the first two hours of posting time.

Using a sample set of half a million active users and more than 25 million messages over 56 days, the report boasts a reaction gain of up to 4 percent on Twitter and 17 percent on Facebook when the recommended posting times are used.

Why We All Buy Tide: The 10 Biggest Advertisers in the U.S.

The 200 top national advertisers spent a record $137.8 billion last year trying to get you to buy more of their goods and services, an increase of 2 percent over 2013, according to Ad Age’s latest annual spending review.

That total was slightly more than the GDP of Hungary last year, but the growth rate was the lowest since 2009, as advertisers looked to get the most for their money. Internet display advertising among those 200 marketing Goliaths dropped by 13.3 percent.

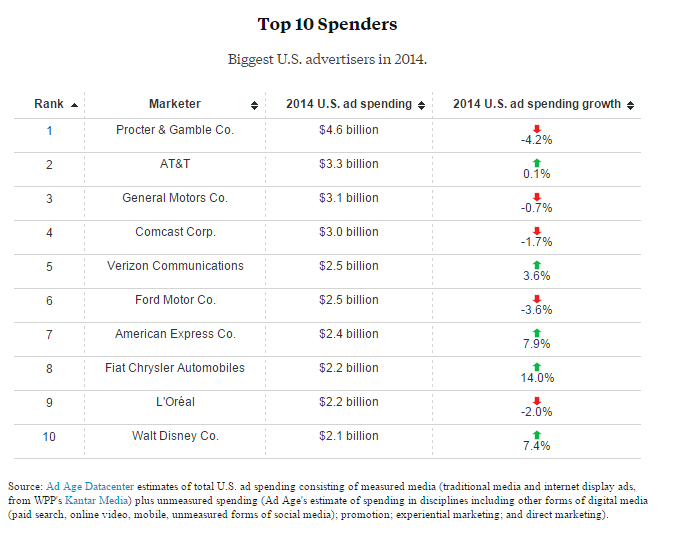

Overall, 38 marketers spent more than $1 billion on advertising last year. Procter & Gamble remains the country’s (and the world’s) largest advertiser. It shelled out $4.6 billion in the U.S. alone to promote brands such as Crest, Duracell, Pampers and Tide — or well over $1 billion more than the next biggest spender. P&G’s CFO recently revealed plans to cut ad spending by as much as $500 million, though.

Here’s Ad Age’s list of the 10 biggest advertisers in the U.S. last year: