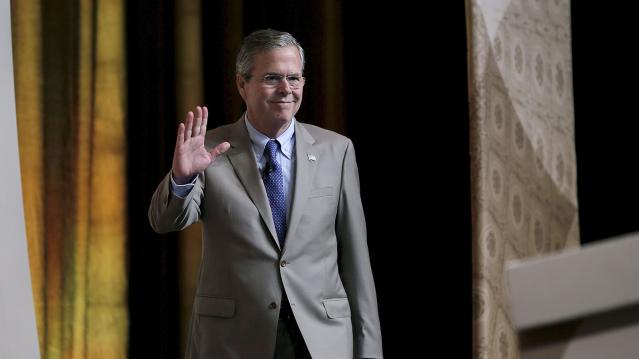

Jeb Bush Wasn’t Bashful About Trading on Family Name

While Jeb Bush frequently is touted as both a two-term governor and a successful businessman, his often dubious record as an entrepreneur and investor has been widely documented over the past three decades.

The 62-year-old scion of a powerful political family and now an announced candidate for the 2016 GOP presidential nomination was involved in a myriad business ventures dating back to the mid-1980s, The Washington Post noted on Monday in the latest media examination of Bush’s entrepreneurial exploits as he tried to amass his fortune.

Related: Jeb Bush Shows Some Fire in Campaign Launch

Bush brokered numerous real estate deals in Miami, helped to arrange bank loans in Venezuela, marketed shoes in Panama, sought out Mexican investors for a building-materials company, advised transnational financial services firms — you name it. He also made a boatload of money by sitting on a handful of corporate boards. And ever since he left the Florida governor’s office in 2007, Bush — like Democrat Hillary Clinton — has raked in substantial income by giving speeches while also consulting and managing investments for others.

“Jeb Bush had a successful career in commercial real estate and business before serving as Florida’s governor,” Kristy Campbell, a spokeswoman for Bush, told the Post. “He has always operated with the highest level of integrity throughout his business career.”

And yet the Post’s lengthy review of Bush’s business career — culled from records, lawsuits, interviews and newspapers accounts dating back more than 30 years — reveals a picture of a young man on the make who “often benefited from his family connections and repeatedly put himself in situations that raised questions about his judgement and exposed him to reputational risks.”

Related: Can Jeb Bush Unite the GOP’s Establishment and Religious Wings?

Five of Bush’s former business associates have been convicted of crimes; one remains an international fugitive on fraud charges. Bush has disavowed any knowledge of the wrongdoing and conceded that some of the businessmen he met in Florida took advantage of his relative youth and naiveté.

One thing that comes through loud and clear in the Post report is that Jeb Bush had no compunction about trading on his family name in trying to make a buck.

Major case in point: In early 1989, seven weeks after his father, George H.W. Bush, took office as president, Jeb Bush took a trip to Nigeria with the executive of a Florida company called Moving Water Industries. Bush had just been hired to help market the firm’s water pumps.

With no less than a special escort from the U.S. ambassador to Nigeria, Bush and his new boss met with the nation’s political and religious leaders as part of the company’s effort to land a deal that would be worth $80 million.

“My father is the president of the United States, duly elected by people that have an interest in improving ties everywhere,” the young Bush told the group. “The fact that you have done this today is something I will report back to him very quickly when I get back to the United States.”

Just days after Bush returned to the U.S., his father sent the president of Nigeria a handwritten note thanking him for hosting his son. Not surprisingly, Moving Water Industries eventually landed the deals it was seeking, according to the Post.

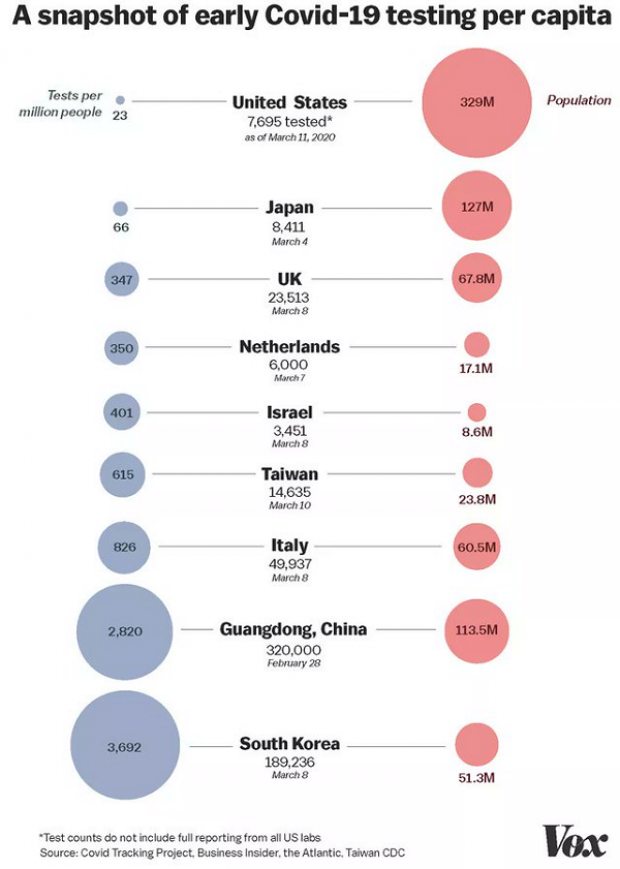

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”