Did Airlines Collude to Keep Air Fares High?

For months now, oil and gas prices have been dropping—and that includes jet fuel. So why haven’t airline ticket prices dropped as well? That’s one of the questions the Justice Department wants answered as it investigates the possibility of collusion among carriers to keep airfares high.

The DOJ also wants to know if companies conspired to limit the number of available seats in order to drive prices up. Yesterday, the Associated Press broke the news that major U.S. carriers had received a letter demanding copies of all communications the airlines had with each other, Wall Street analysts, and major shareholders about their plans for passenger-carrying capacity, going back to January 2010. The civil antitrust investigation is focusing on whether airlines illegally indicated to each other how quickly they would add new flights, routes, and extra seats in an effort to prop up ticket prices.

Related: 6 Sneaky Fees That Are Making Airlines a Bundle

Just minutes after the news broke, stocks of the major U.S. airlines fell four to five percent, with the S&P 500 airlines index off more than four percent. Until now, the U.S. airline industry had been enjoying record profits, due to increasing numbers of Americans flying and a huge drop in the price of jet fuel. In April, the price of jet fuel was $1.94 per gallon, a decrease of 34 percent from the previous year.

The investigation marks a notable shift for the Justice Department, which approved the merger of American Airlines and US Airways back in November 2013, despite previously blocking it over concerns that the airlines would collude on fares. The probe could signal a more aggressive approach on antitrust enforcement, under the strong leadership of Loretta Lynch, who was confirmed in April.

Justice Department spokesperson Emily Pierce confirmed that the department was investigating potential “unlawful coordination” among some airlines.

Just two weeks ago, U.S. Senator Richard Blumenthal (D-CT) urged the Justice Department to investigate what he called “anti-competitive, anti-consumer conduct and misuse of market power in the airline industry.”

Related: United Airlines Bullish on First Quarter from Lower Fuel Costs

Since 2008, various mergers have resulted in four major airlines (down from nine)—American, Delta, Southwest, and United—controlling about 80 percent of all domestic air travel. All four airlines have confirmed that they received the letter and that they were cooperating with the investigation.

According to Bureau of Transportation Statistics, the average domestic airfare rose 13 percent from 2009 to 2014 (adjusted for inflation). The average domestic flight last year cost $391. In the past year alone, airlines received an additional $3.6 billion from bag fees and another $3 billion from reservation-change fees. All of the major airlines—American Airlines, United Continental Holdings, Delta Air Lines, Southwest Airlines, JetBlue Airways, and Alaska Air Group—posted record profits with a consolidated net income of over $3 billion during the first quarter of 2015.

Here’s a Good Sign for the Economy: Americans Are Hitting the Road

Driving is as American as apple pie, but the Great Recession took a big bite out of the nation’s driving habits. Total miles driven in the U.S. hit a peak in the fall of 2007 just before the recession hit and fell for several years after. Total miles driven bottomed out in 2011, moving slowly higher since then.

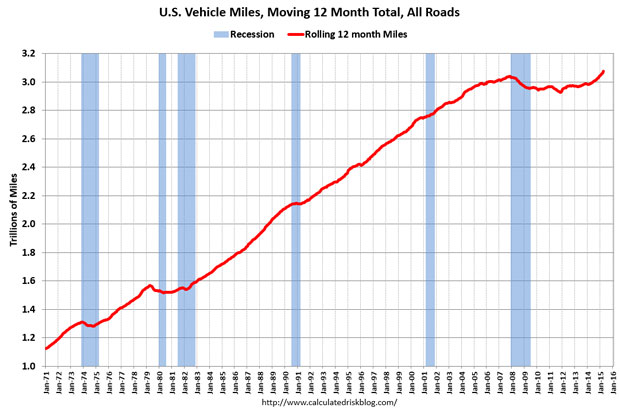

The Department of Transportation reported this week that total miles driven has hit a new, all-time high. Vehicles drove 7.3 billion miles in May, up 2.7 percent from May, 2014. The annual number is even more impressive: Using a moving 12-month figure, total miles traveled in the past year registers at 3.08 trillion miles. This graph from Calculated Risk paints the picture:

This sure seems like good news for the U.S. economy. The data for miles driven reflects booms and busts in the economy, and seeing the numbers climb suggests the economy is still gaining strength.

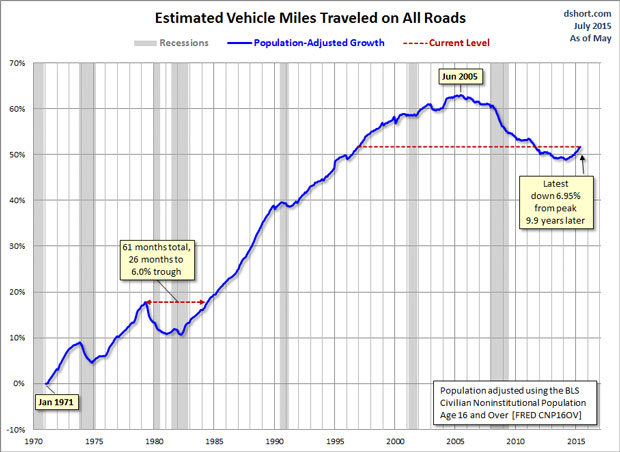

However, the raw numbers may not be quite as good as they first appear. Even though miles driven are up, so is the U.S. population. Once the data is adjusted for population growth, a less robust picture emerges. Doug Short at Advisor Perspectives ran the numbers, concluding that on a per capita basis, miles driven is still well below its pre-recession peak. Here’s his chart:

It looks like the U.S. economy still has a long way to go to get back to its pre-recession strength, at least as measured by by the rough proxy of total miles driven.

Why Investors Prefer Real Estate to Stocks, Bond and Gold

Americans still feel skittish about the stock market. When it comes to long-term investments, real estate is still preferred over cash or the stock market, Bankrate.com reports in a new study. For long term investments over 10 years or more, 27 percent chose real estate, 23 percent preferred cash investments, and 17 percent opted for the stock market. Gold and precious metals came in fourth at 14 percent, and bonds debuted at 5 percent.

Related: Clinton’s Capital Gains Tax Plan Aims at Long-Term Investment

Although the S&P 500 has risen 27 percent over the past two years, Americans were only slightly more inclined to favor stocks in 2015 than they were in 2013.

The only exception to the brick and mortar policy? Households headed by college graduates were the most likely to prefer stocks. In the western U.S., real estate was preferred nearly two to one over any other investment choice.

The survey of 1,000 adults living in the continental U.S. yielded some surprises across gender, age, income, location, and political party. Men were more likely to favor real estate, while women were more likely to favor cash investments.

At 32 percent, the majority of millennials--those between 18 and 29 years old--favored cold, hard cash, while 32 percent of participants between the ages of 30 and 40 stuck with real estate.

Related: U.S. Real Estate ETF Rally Faces Test With Rate Rise

Lower-income workers with salaries of less than $50,000 felt “more secure” than their higher earning counterparts, who were making $50,000 to $74,900. And Republicans were three times more likely to say they felt “less secure” about their jobs as Democrats.

Bankrate’s Financial Security Index for July remained positive for the 14th consecutive month. However the July reading was the second lowest in 2015, due in part to a decline in job security with 22 percent feeling “more secure” about their jobs than 12 months ago and 14 percent feeling “less secure.” Sixty-two percent felt “about the same.”

Thync Before You Act – A New Wearable Device Made for 'The Donald'

If you thought people looked foolish wearing Google Glass, wait until you see one of your coworkers sticking a white piece of plastic on her forehead, hooked around her ear. I learned about Thync, a $300 electric gizmo, reading Geoffrey Fowler’s Wall Street Journal column Tuesday.

Fowler tested it, so I don’t have to, but I just know I’ll be seeing this piece of wearable tech around town among the gadgerati I sometimes hang out with. Thync’s unique selling proposition is vibes, uncommonly known as transdermal electrical neuromodulation. Translation—it’s a low-grade form of shock therapy. The company says they’ve tested the device over years of research with their neuroscientists and engineers to give us Calm vibes or Energy vibes.

You’ll have to go to Fowler’s story to view a graphic of how this dildo for the brain actually functions, but Folwer describes the Energy vibe this way: “The sensation is like drinking an espresso, accompanied by a tingle of prickly heat behind the ear.” He compares the hour-long Calm vibe to having a glass of wine.

Like everything else related to wearable tech and the Internet of Things, the company is well funded by Silicon Valley venture capital firms, which are apparently looking for the next Fitbit. And why not? Brain fitness. I know a few people who could benefit from Thync if it works as promised.

Let’s start by getting the company to give one to Donald Trump, set it permanently on the Calm setting, and turn up the juice.

Top Reads from The Fiscal Times:

- Six Amazing Features Hidden in Your Smartphone

- Facebook Must Hand Over NY Users' Info to Prosecutors

- The Incredible Disappearing American-Made Car

Why You Should Shop Around for Car Insurance Right Now

If you haven’t shopped for auto insurance recently, you might want to spend an hour or so checking out other deals. It pays to review your policy and check what’s out there.

A new survey from insuranceQuotes.com shows that 66 percent of policyholders never or only rarely check to see if they could get the same or better coverage at a better price. The average American driver has been with the same auto insurance company for 12 years, and some have stayed with the same insurer for two to three decades, or longer.

Related: 5 Ways to Lower Your Car Insurance—Right Now

Millennials age 18 to 29 and senior citizens number among those least likely to shop around for auto insurance. At least six in 10 millennials with auto insurance assume you have to wait until your renewal date to switch insurance companies. And they’re not alone: 46 percent of Americans do not know that you can switch your auto insurance company at any time.

One of the reasons auto insurance may not be a priority for consumers? Auto pay options, while convenient, could be keeping car insurance payments and rates out of sight—and out of mind. Human nature and procrastination is another. “People think that it’s a task that might be difficult and time-consuming,” says senior analyst Laura Adams, “but it could be as simple as going to a website like insurancequotes.com, putting your information in for a free quote, and getting multiple quotes back. There’s no financial risk in looking for a new rate.”

Just spending an hour once a year to compare quotes from three different companies could potentially save you hundreds or thousands of dollars.

Related: A Quick Way to Save Big on Your Insurance

Experts suggest checking your car insurance rates the same way you would remember to change the oil in your car or swap the air filters in your home. Here are some tips to get started:

- Ask your current insurer if there are any company discounts you might be eligible for but don’t know about, such as the good-student discount. For college and grad students who have a B-average or better (or their parents) that could result in a significant discount.

- If you find a better deal, tell your current insurance company that you’re thinking of switching unless they can match the new offer or exceed it.

- If your current insurer refuses to negotiate, sign up for the new policy first—and then cancel the old one. “You always want to make sure you’re covered,” says Evans. “Insurance companies do not like to see a gap in coverage, and your rates could rise.”

- To get a wider variety of quotes, get online quotes from insurance company websites, consult with an independent agent, and look into companies that don’t use independent agents as well.

“Being married can cause your rate to decrease,” says Evan. “Marriage, getting good grades--these are all things that you have to self-report, which is why I recommend revisiting auto insurance at least once a year, as your life situation could change.”

Feeling Flush, More Parents Open Their Wallets for College Spending

As lingering financial fears from the recession fade, more parents are willing and able to open their wallets to pay for their children’s educations.

Parents have become the top source of college funding for the first time since 2010. According to a new report from private student loan lender Sallie Mae’s, parental income and savings covered 32 percent of college costs in the academic year 2014-15, while scholarships and grants covered 30 percent.

Families spent an average of $24,164 on college this year, a 16 percent rise in spending from the previous year and the largest increase since 2009-10. The money spent covers costs of tuition, books, and living expenses.

Related: Average Family Has Saved Enough to Send One Kid to College for Half a Year

The report details how fewer parents fear the worst when it comes to the risks associated with college. Fewer parents are worried that their child won’t find a job after graduation, that their income will decline because of layoffs, and that there will be an increase in student loan rates. As confidence has increased, fewer families are using cost-saving techniques, such as having students live at home.

Another factor contributing to the willingness of parents to spend on education is the improving stock market. The average size of a 529 account, the popular college savings investment plan, continues to grow after the recession caused a downturn, hitting a balance of $20,474 as of December 1, 2014. That figure tumbled to $10,690 at the end of 2008, according to data from the College Savings Plan Network.

Although parents may be feeling better about paying for college, the basic trend of increasing prices continues, and loans are still a big part of the funding picture. Between 2001 and 2012, average undergraduate tuition almost doubled, causing an average real rate increase of 3.5 percent each year. Nearly 71 percent of college graduates left school with student loan debt this year, up from 54 percent 20 years prior. The average debt was $35,000 in 2015, an increase of 34 percent from 2010, student loan-tracker Edvisors has found.