The Hole Truth: Celebrating a Huge Day in Doughnut History

Whether you’re a Dunkin’ devotee or are crazy for Krispy Kremes, July 9 is a date you should celebrate.

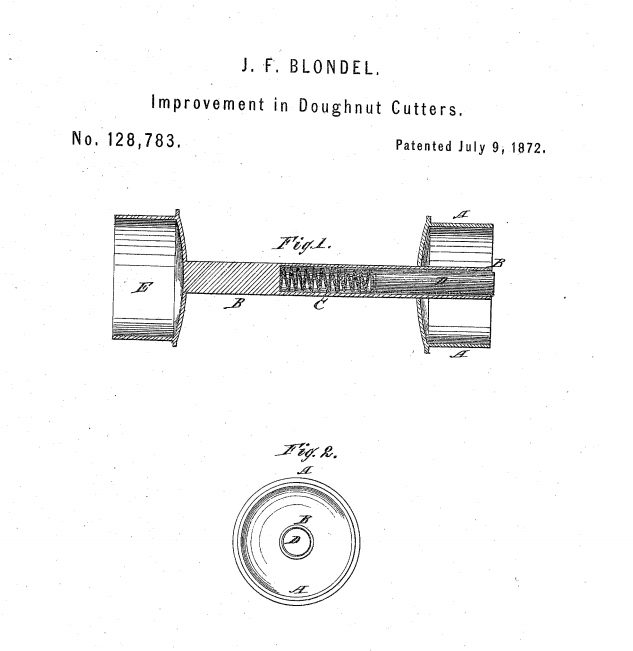

On that date back in 1872, the doughnut took a big step toward becoming the billion-dollar business it is today: John F. Blondel of Thomaston, Maine received a patent for a “new and useful” improvement in doughnut-cutters that would speed the production and consumption of the humble pastry in the United States.

The device described in Patent No. 128,783 was intended to automate the process of cutting those dastardly doughnuts — holes and all — as efficiently as a hole punch. The desired edge could be plain or scalloped. This ingenious contraption would push the dough out of the center tube, leaving it free for making the next doughnut.

Related: Made in the USA: 24 Iconic American Foods

But as Art Cashin — the director of floor operations for UBS Financial Services who regularly sprinkles historical tidbits into his commentary — pointed out in a note Wednesday, before you can talk about Blondel’s doughnut innovation, you have to know the story of one Hanson Crockett Gregory, the young genius who forever changed what you and I get when we order our plain, glazed or chocolate with sprinkles. While the history of the doughnut is disputed, Gregory claimed to have invented “the first doughnut hole ever seen by mortal eyes” as a 16-year-old sailor on a lime-trading ship and then taught the technique to his mother, Elizabeth Gregory.

In case you’re still hungry for more doughnut history, this Friday, July 10, Krispy Kreme is celebrating its 78th birthday by offering a sticky sweet deal at participating locations: Buy any dozen doughnuts at regular price and get a second dozen for 78 cents.

Oh, and if you want to purchase those pesky doughnut holes that get unceremoniously shoved from the middle? You can buy those, too. They’re simply called Doughnut Holes, and they can be bought by cup or box in assorted flavors of Original Glazed, Dipped Chocolate, Powdered, Chocolate Cake, Blueberry Cake and Plain Glazed Cake.

Hanson Crockett Gregory would no doubt be amazed.

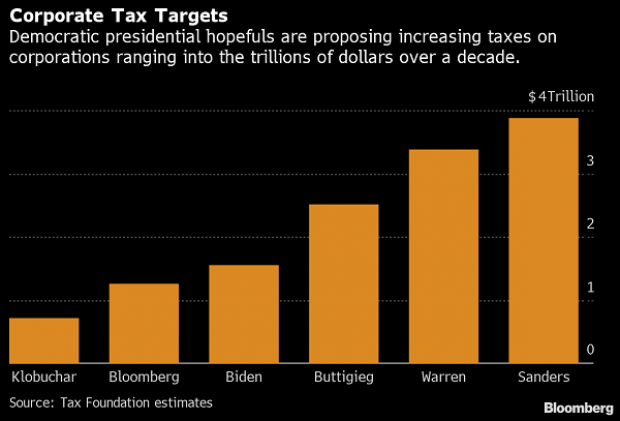

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

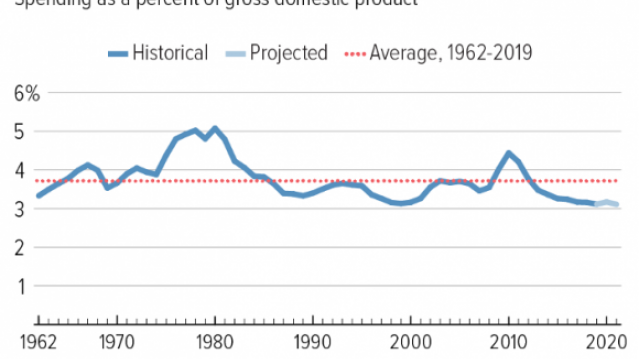

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

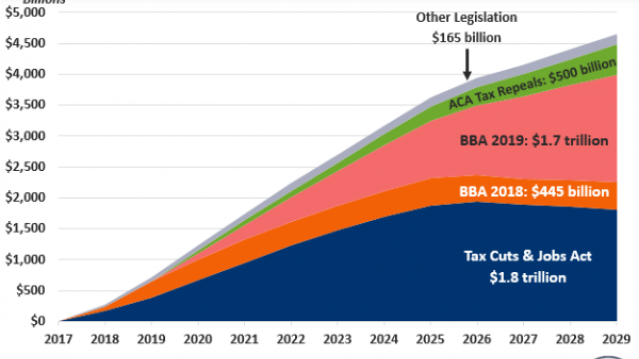

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

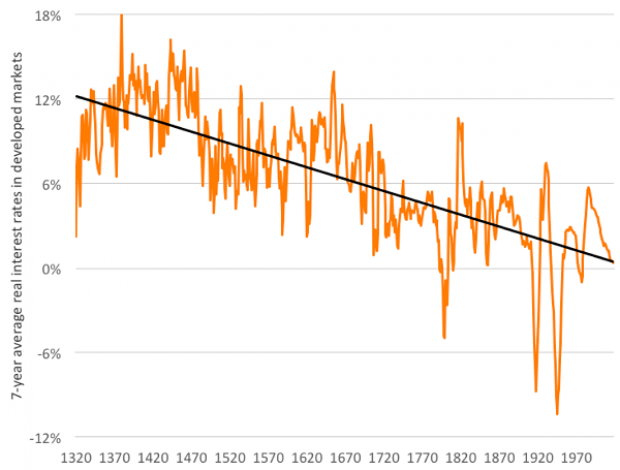

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

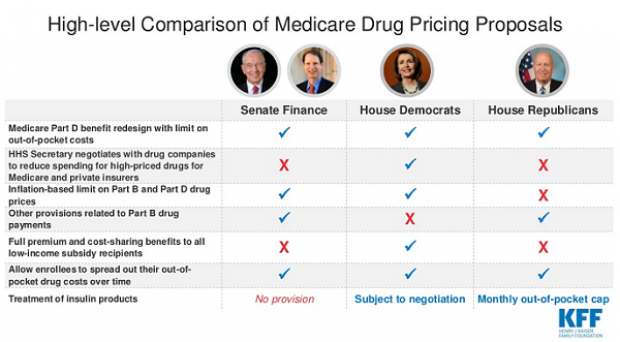

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.