Shopping Showdown: Walmart Takes On Amazon’s ‘Prime Day’

In case it wasn’t already perfectly obvious that Walmart is gunning for Amazon, the Bentonville, Ark. giant just kicked up its e-tailing competition.

Walmart announced today that it will also offer thousands of discounts for online purchases on July 15, the same day Amazon plans on hosting its Prime Day shopping extravaganza. And in its blog post announcing the sales, Walmart took a clear swipe at Amazon’s push to have shoppers subscribe to its $99 a year Prime service.

“We’ve heard some retailers are charging $100 to get access to a sale,” the Walmart blog says. “But the idea of asking customers to pay extra in order to save money just doesn’t add up for us. We’re standing up for our customers and everyone else who sees no rhyme or reason for paying a premium to save.”

Related: Amazon’s Prime Concern—A New Online Blitz by Walmart

Walmart, the world’s largest retailer, is also offering another limited-time deal to boost e-commerce sales. Starting today, customers will receive free standard shipping with online purchases that cost a minimum of $35, instead of the usual $50. The change will be effective for at least 30 days.

In February, Walmart CEO Doug McMillon told analysts on an earnings conference call that the company would invest between $1.2 billion and $1.5 billion in e-commerce throughout the year.

Neither Walmart nor Amazon has released information about specific sale offers yet, so the early hype might prove unwarranted, but the battle is clearly on and now the claws are out.

Update: Amazon responded to Walmart’s gibe with its own accusation. “We’ve heard some retailers are charging higher prices for items in their physical stores than they do for the same items online,” Greg Greeley, vice president of Amazon Prime, wrote in an email to Bloomberg. “The idea of charging your in-store customers more than your online customers doesn’t add up for us.”

Quote of the Day: A Big Hurdle for the Tax Cuts

“He goes in and campaigns on an issue, and the challenge is he then talks about executing drug dealers. Why do you think the press is going to cover the tax cuts if you’ve given them the much more exciting issue?”

-- Grover Norquist, president of tax-cutting advocacy group Americans for Tax Reform, on President Trump’s failure to sell the tax law.

The Obamacare Mandate That Could Produce $12 Billion in Fines in 2018

Republicans effectively eliminated the individual Obamacare mandate in the tax package signed late last year. Although the new regulation reducing the mandate penalty to zero doesn’t take effect until 2019, President Trump has cited the rule change as a victory over the health law so many conservatives oppose. “Essentially, we are getting rid of Obamacare. Some people would say, essentially, we have gotten rid of it," Trump told a crowd in Michigan two weeks ago.

However, many parts of the Affordable Care Act are still in effect and will continue to operate even after the individual mandate is eliminated in 2019.

In particular, the employer mandate, which requires companies with more than 50 employees to offer health benefits or face fine of roughly $2,000 per worker, will continue to play a significant role in the Obamacare system. The Congressional Budget Office estimates that the mandate will produce more than $12 billion in fines in 2018 alone.

Some conservative groups are pushing lawmakers to stop enforcing the employer mandate, but the IRS is still working to enforce the law. According to The New York Times Monday, the IRS is sending out notices to more than 30,000 businesses that have failed to comply.

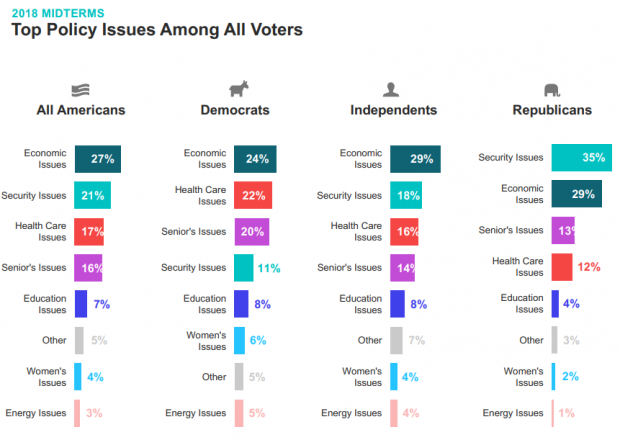

Chart of the Day: It’s Still the Economy, Stupid

Security may be the top policy issue for Republican voters, but the economy is the top concern for Democrats, independents and voters overall, according to Morning Consult’s latest polling on the midterm elections. Health care is third on the list, followed by “seniors’ issues.” The results are based on surveys with more than 275,000 registered U.S. voters from February 1 to April 30.

Number of the Day: $13 Billion

An analysis by Bloomberg finds that the roughly 180 companies in the S&P 500 that have reported earnings for the first three months of the year saved almost $13 billion thanks to the corporate tax cut enacted late last year. Those companies’ effective tax rate dropped by more than 6 percentage points on average. About a third of the tax savings went to 44 financial firms.

How a Florida Doctor with Social Ties to Trump Delayed a $16B Billion VA Project

A West Palm Beach doctor who is friends with Ike Perlmutter, the chairman of Marvel Entertainment and an informal adviser to President Trump on veterans’ issues, has held up “the biggest health information technology project in history — the transformation of the VA’s digital records system,” Politico’s Arthur Allen reports. Dr. Bruce Moskowitz “objected to the $16 billion Department of Veterans Affairs project because he doesn’t like the Cerner Corp. software he uses at two Florida hospitals, according to four former and current senior VA officials. Cerner technology is a cornerstone of the VA project. … Moskowitz’s concerns effectively delayed the agreement for months, the sources said.” Read the full story.