We’re All Becoming Distracted Victims of Smartphones

Your phone buzzes at work. You promised yourself you wouldn’t check your phone until you turn in your half-finished assignment that’s due in an hour, so you don’t. But you start to wonder — who is texting you? What does the text say? Your mind wanders.

A new study has found that even when we try to disregard a notification, just being aware of a new message distracts us enough to impair our concentration and hurt our performance. These distractions are equal to actively opening the notification on your mobile device.

A Gallup poll reveals that 81 percent of smartphone users keep their phone in close proximity “almost all the time during waking hours.” Depending on the volume of notifications users receive, keeping a phone so close could lead to a noticeably negative impact on work performance.

Related: The New Workplace Trend — Smartphone Mini-Vacations

The study adds to the growing list of negative affects smartphones can have on users. Other effects include impaired sleep, increased pressure to communicate with friends and family, and the inability to detach from work.

Smartphones are only going to affect more and more individuals. The number of people who own a smartphone has increased from 35 percent in 2011 to 64 percent in April of this year. Among millennials, 84 percent report owning a smartphone.

As millennials begin to enter the workforce and the number of apps available for download increases, the potential for distraction only grows larger.

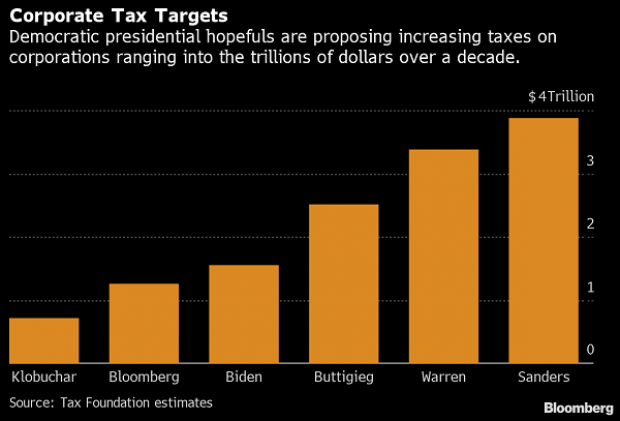

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

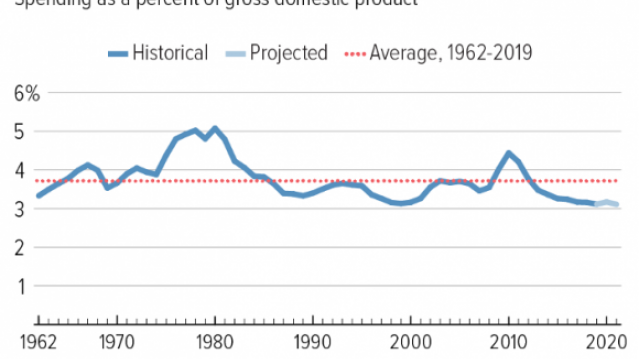

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

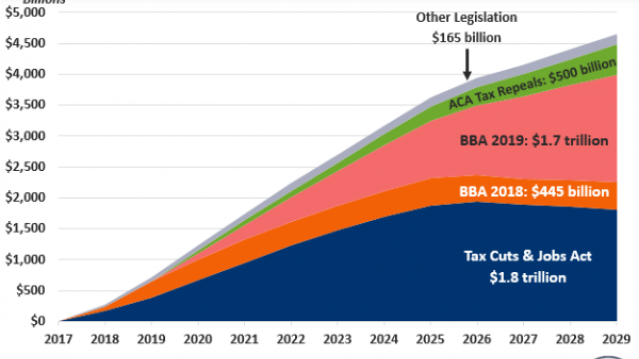

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

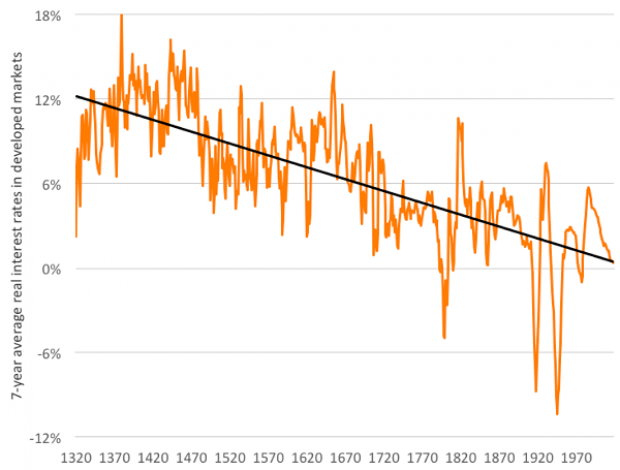

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

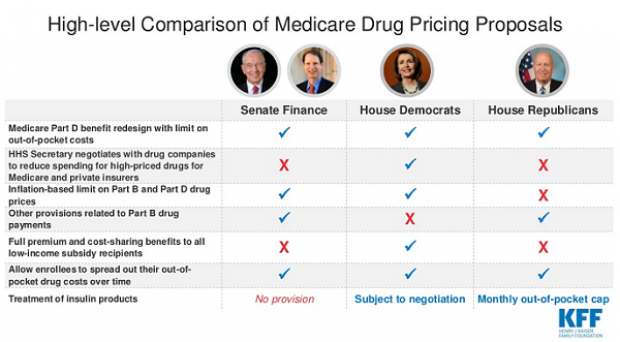

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.