5 Cities with the Most Credit Card Debt

Why is the Lone Star State racking up so much debt? Its two largest cities—Dallas and Houston/Fort Worth make the list of the cities with the most credit card debt, and San Antonio comes in as No. 1.

The new study from CreditCards.com used credit report data from Experian to compare the average credit card debt in the 25 largest U.S. metro areas with each area’s median income. It assumed that 15 percent of a person's monthly income would be spent on paying down credit card debt.

The analysis claims it would take San Antonio residents with median incomes of $27,491 a full 16 months to pay off an average of $4,880, making monthly payments of $344 a month. By comparison, a resident of San Francisco making $42,613 a year would pay off $4,393 in credit card debt with nine monthly payments of $533 per month.

The cities with the highest credit card debt burdens were:

- San Antonio

- Dallas/Fort Worth

- Atlanta

- Miami/Fort Lauderdale

- Houston

Related: 5 Reasons to Pay Off Your Credit Card Debt Now

The metro areas with the highest debt don’t necessarily have the highest debt burdens when adjusted for income. For example, Washington, D.C. has the nation’s highest average credit card debt at $5,046, but since it also has the highest median income in the nation, its debt burden is lower. By applying 15 percent of their paychecks, residents can pay off that debt in 10 months.

The cities with the lowest credit card debt burdens were:

- New York City

- Minneapolis/St. Paul

- Washington, D.C.

- Boston

- San Francisco/Oakland/San Jose

Matt Schulz, senior industry analyst at CreditCards.com, points out that there isn’t much difference between the city with the highest credit card debt, Washington, D.C. ($5,046), and the city with the lowest credit card debt, the Riverside-San Bernardino area ($4,137), but there is a big difference in income. A higher income means that debts can be paid off more quickly. “It really is all about earnings,” Schulz says. “People are using their credit cards whether they live in the biggest city in the country or they live in the 25th biggest city in the country.”

While most folks won’t be able to increase their income that dramatically, there are still steps they can take to make sure they’re tackling their credit card debt in the most effective way possible.

Related: How to Defuse Exploding Consumer Credit Debt

His advice to consumers? “Absolutely, positively pay more than the minimum on your credit card balance every month.” And the next best thing? “If you can’t pay the full balance, then you have to pay off more than the minimum.”

Schulz also recommends calling the credit card issuer and asking if you can get better terms. “It’s certainly worth a call,” says Schulz. “We did a study last year that showed that 65 percent of people who asked for a lower interest rate got a lower APR.” The same study said that 86 percent of people who asked for a waiver of a late payment fee were successful in getting the charge removed.

Top Reads from The Fiscal Times:

- The Next Debt Crisis Could Be Much Worse than in 2013, GAO Warns

- The New Generation of ‘Genuinely Creepy’ Electronic Devices

- 9 Social Security Tips You Need to Know Right Now

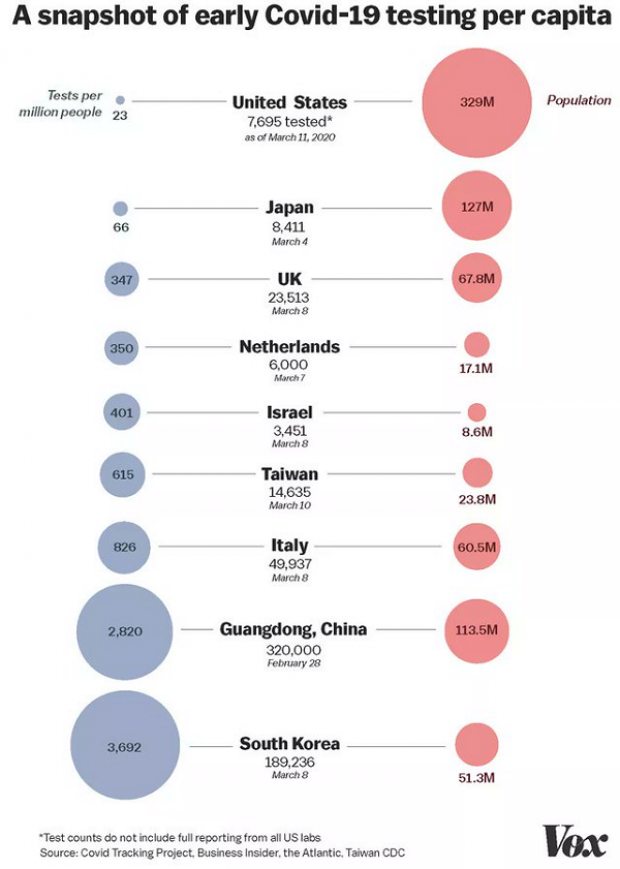

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”