Here’s How Much It Would Cost the Military to Provide Transition Care to Transgender Troops

As the U.S. military studies the implications of lifting a ban on transgender people serving in the armed forces, a new study says that the cost of providing transition-related health care to those service members would be about $5.6 million a year, or “little more than a rounding error in the military's $47.8 billion annual health care budget.”

After U.S. Defense Secretary Ashton Carter announced in mid-July that that Department of Defense would look into lifting the ban, opponents expressed concern about the potential high costs of providing care to transgender individuals. In last week’s debate among Republican presidential candidates, former Arkansas Gov. Mike Huckabee said he wasn’t sure “how paying for transgender surgery for soldiers, sailors, airmen, Marines makes our country safer.”

Related: The Surprising Way the Military Could Save Millions

The new study published in The New England Journal of Medicine estimated that 12,800 transgender troops currently serve and are eligible for health care in the U.S., but only 188 transgender service members would require transition-related care annually. Aaron Belkin, the San Francisco State University researcher who conducted the survey, checked for accuracy using data from the Australian military, which already covers transition-related care, and compared costs with insurance plans offered to University of California employees and their dependents.

Belkin emphasized that costs could be lower than expected for several reasons. Among those, transition-related care would mitigate other serious and potentially costly conditions, such as suicidal thoughts, and might improve job performance.

Acknowledging that the costs might be higher than he estimates, Belkin still says they would be too low to matter and shouldn’t be a factor in deciding whether the ban is lifted or not.

In June, the American Medical Association said there is “no medically valid reason” to prohibit transgender individuals from serving in the military.

Top Reads From The Fiscal Times

- The Pentagon’s Next-Generation Budget Busting Bomber

- Mark Cuban: Here’s Why Republicans Will Lose the Election

- The $1 Trillion Question for the F-35: Is the U.S. Buying an Interior Plane?

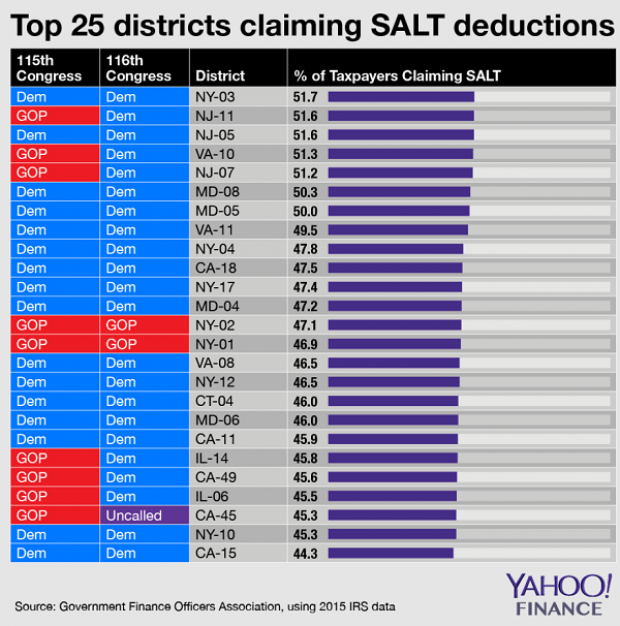

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

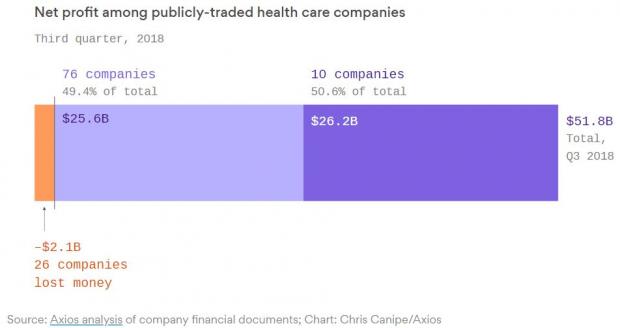

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

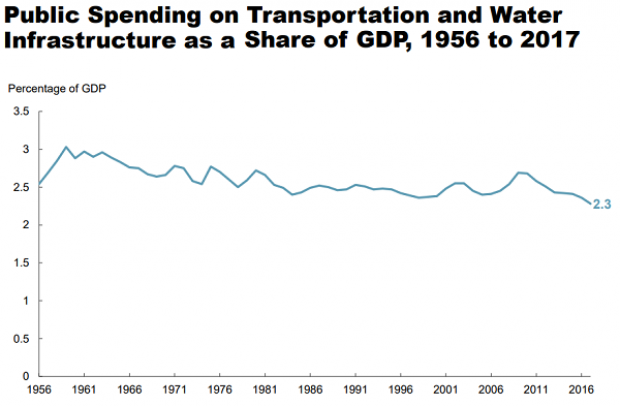

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.