This Is America’s Favorite Credit Card

According to consumers, it does pay to Discover.

For the second year in a row, Discover has ranked the highest in customer satisfaction among credit card issuers, according to the results of a new survey by J.D. Power.

Discover received a score of 828 out of 1,000 in the survey, based on credit card terms, billing and payment, rewards, benefits and services, and problem resolution. American Express placed second with a score of 820, and Chase ranked third at 792.

Overall satisfaction with credit cards hit a record high of 790, up from 778 last year.

Related: 3 High-Tech Ideas to Fraud-Proof Our Credit Cards

Consumers were more likely to use their rewards last year, with more than half having done so in the past six months. That could be because rewards are getting better as banks get more creative with wooing and keeping customers, many of whom are still lukewarm about spending.

“When customers feel the rewards are attractive and when they redeem rewards more frequently, satisfaction improves, they spend more, and they are more likely to recommend the card to friends and family members,” Jim Miller, J.D. Power senior director of banking services, said in a statement.

Customers who redeem rewards spend an average of $1,128 per month, compared to $645 by those who don’t redeem rewards.

Even though they’re more satisfied with their credit cards, Americans are still concerned about ID theft. Less than a third of those surveyed felt their personal information was very secure, and just 16 percent thought that security had improved since last year.

Top Reads from the Fiscal Times:

- Trump: ‘I’ve Gained Such Respect for the People That Like Me’

- Why McDonald’s Could Suddenly Be Responsible for Millions of New Employees

- Americans Want Medicare to Negotiate Better Deals on Drugs

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

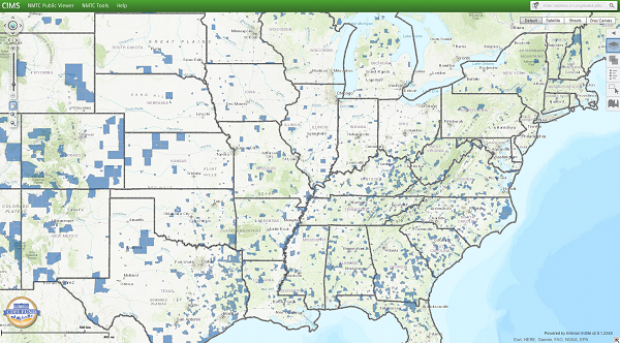

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

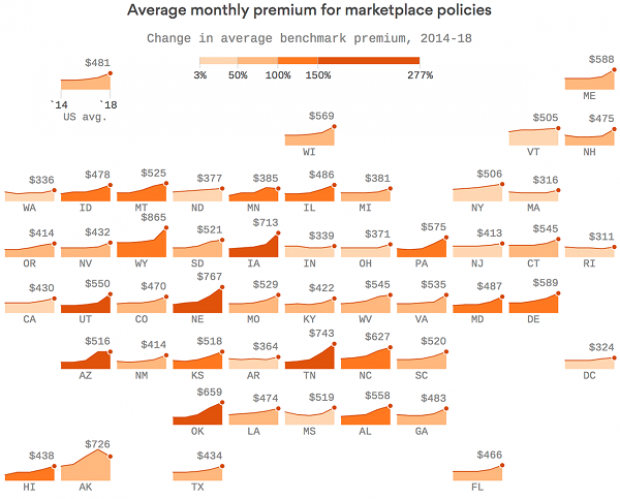

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).