Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

The Woefully Distorted Federal Policies on Child Abuse

Here’s something just in from the world of grossly distorted government policy:

Every year, roughly 680,000 children are reported victims of neglect or abuse by their parents in this country – a tragic statistic reflective of troubling societal, psychological and economic problems. Even worse, 1,520 children died from maltreatment in 2013, nearly 80 percent of them at the hands of their own parents.

Related: Feds Blow $100 Billion Annually on Incorrect Payments

Federal and state authorities over the years have developed a large and costly system for reporting and investigating maltreatment, removing endangered children from their homes, and preventing and treating problems of parents and children.

But as a new study touted on Wednesday by the Brookings Institution concludes, the federal government provides states with far more money to support kids once they have been removed from their homes and placed in foster care than it provides for prevention and treatment programs to keep the kids out of foster homes in the first place.

And the disparity is startling.

Two of the largest grant programs in Title IV-B of the Social Security Act provide states with funding totaling around $650 million annually for “front end” services designed to prevent or treat parent and child problems that contribute to abuse and neglect. They address problems such as substance abuse, family violence and mental health issues.

Related: Time to Stop Social Safety Net Child Abuse

Yet another series of programs in Title IV-E of the Social Security law provides states with open-ended funding that totaled about $6.9 billion in 2014. Those funds pay almost exclusively for out-of-home care for children from poor families, along with the administrative and training expenses associated with foster care, adoption, and guardianship.

That’s a 10 to 1 disparity in funding for the two efforts – one to try to hold families together and the other to move children out of their homes and into foster care.

“Congress has the opportunity to change the funding formula under Title IV of the Social Security Act so that states have the flexibility to put money where it will be most effective at keeping at-risk children safe, ensuring that they have a permanent home, and promoting their well-being,” wrote Ron Haskins, Lawrence M. Berger and Janet Currie, the authors of the study.

In their policy brief, “Can States Improve Children’s Health by Preventing Abuse and Neglect,” Haskins, a Senior Fellow in Economic Studies at Brookings, Currie of Princeton University and Berger of the University of Wisconsin-Madison, write that revising the grant programs could improve the welfare of children who are at risk of abuse or neglect.

This is something else that lawmakers might consider later this year when they begin to focus on disability insurance and other programs within the Social Security law.

For Most, Social Security Is Pocket Money—Not a Pension

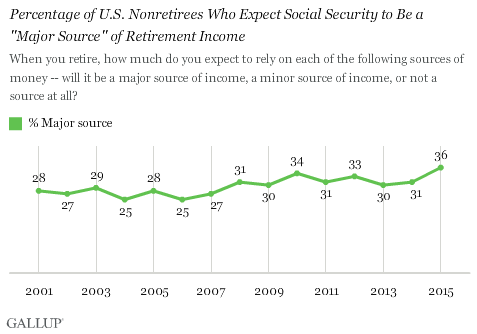

More than one-third of Americans who haven’t reached retirement age believes that Social Security will be a major source of income in their post-work years despite the ongoing funding problems of the government program.

The 36 percent of those polled in a recent Gallup survey who expect to rely heavily on Social Security represents the highest percentage in 15 years. It’s also nearly 10 percentage point higher than a decade ago.

Related: 6 Popular Social Security Myths Busted

In addition, 48 percent told Gallup that they expect Social Security to be a minor source of retirement funds, while only 14 percent said that they don’t expect Social Security to be a source of retirement income at all.

“Generally speaking, the older non-retirees are and the lower their household income is, the more they expect to rely on Social Security as a major source of retirement funds,” according to Gallup.

Close to half of non-retirees whose annual household income is less than $30,000 said Social Security will be a major source of funds.

Believing that Social Security will be a major source of retirement income might not be a great idea.

Social Security currently provides average benefits of about $1,260 a month. Going forward, Social Security checks could shrink if funding problems persist or benefits could start kicking in at an older age.

Work-Life Balance: Why Millennials Get Hit Hardest

Even with (or maybe because of) the proliferation of apps and technology to help workers connect with their jobs round-the-clock, finding a balance between work and life is getting harder, according to a new report from Ernst & Young.

The study finds that about half of managers worldwide work more than 40 hours a week, and 40 percent say their hours have increased over the past five years. In addition to technology shifts, the “always on” work culture reflects lingering effects of the recession that has left fewer employees handling larger workloads.

The balancing act is particularly difficult for millennials, who are becoming managers just as they enter into parenthood. U.S. millennial parents are the most likely to have a spouse that’s also working at least full-time, and they’re the less likely than older generations to have taken a career break when having children.

Related: 10 Easy Ways to Improve Your Work-Life Balance

More than one in four millennials is working more after having children, compared to 13 percent of Gen Xers and 16 percent of boomers. Millennial parents place a high value on flexibility, and say that a flexible schedule would make them more engaged, less likely to quit, and more likely to work flexible hours. Even so, one in six says they have suffered a negative consequence for working a flexible schedule.

More than half of those surveyed said that they would make job and career changes in order to find a better work-life balance. Those findings echo the results of a CareerBuilder survey released last year which found that a third of workers don’t want a leadership role because they don’t want to sacrifice work-life balance.

GOP Governor Asks Voters to Raise Their Own Taxes

Michigan voters go to the polls today to vote on Proposal 1, a referendum that would hike the state sales and gasoline taxes. An unexpected twist in the story, though, is who is backing the plan and why. Support for the proposal speaks to the declining state of infrastructure in the U.S. and the increasing urgency with which states are taking matters into their own hands.

Proposal 1 is a complex mix of policy changes that would raise more than a billion dollars to fund road construction and repair, plus hundreds of millions for education and other purposes. It would do so by hiking the Michigan state sales tax from 6 percent to 7 percent. That represents a 17 percent increase in total sales taxes Michiganders will face on taxable items.

Related: America’s Energy Infrastructure in Desperate Shape

However, the bill also abolishes the sales tax on gasoline – Michigan is one of the few states in which gas is not exempt from state sales tax – and would dramatically increase the wholesale gasoline tax. The net effect, according to the Detroit Free Press, would be an increase of between 7 and 9 cents per gallon in what consumers pay at the pump. The proposal would net about $1.9 billion per year for the state’s coffers, the majority of it coming out of the pockets of Michigan’s taxpayers. (A small percentage would come from out-of-state visitors paying taxes on items purchased in Michigan.)

Normally, a $2 billion tax hike – the biggest in the state in a generation – would be the sort of thing Republican politicians would attack mercilessly, but in Michigan, Republican Governor Rick Snyder is a strong proponent of the deal. And Snyder isn’t alone. Prominent Republican and Democratic lawmakers have thrown their support behind the measure.

Related: Get Ready to Pay More Tolls If Infrastructure Isn’t Funded

The move also has significant support from the business community. Unsurprisingly, the biggest backers of the deal are the construction companies and related industries. But there is also support in the general business community, even among some companies whose products would be more expensive.

Even with substantial support from legislative leaders and businesses, though, the prospects for Proposal 1 looked poor heading into the vote today Public opinion remains generally against the proposition despite a multimillion-dollar advertising campaign by supporters that has dwarfed efforts by the opposition.

Should the vote fail, though, the state’s pothole-pocked roads and crumbling bridges won’t fix themselves, so legislators will have to find the revenue somewhere, either by increasing taxes via a different route, or cutting spending from an already tight state budget.

Tequila’s Stunning Rise: How It Shot Up in U.S. Popularity

Americans are drinking more and better-quality tequila, and not only in margaritas on Cinco de Mayo.

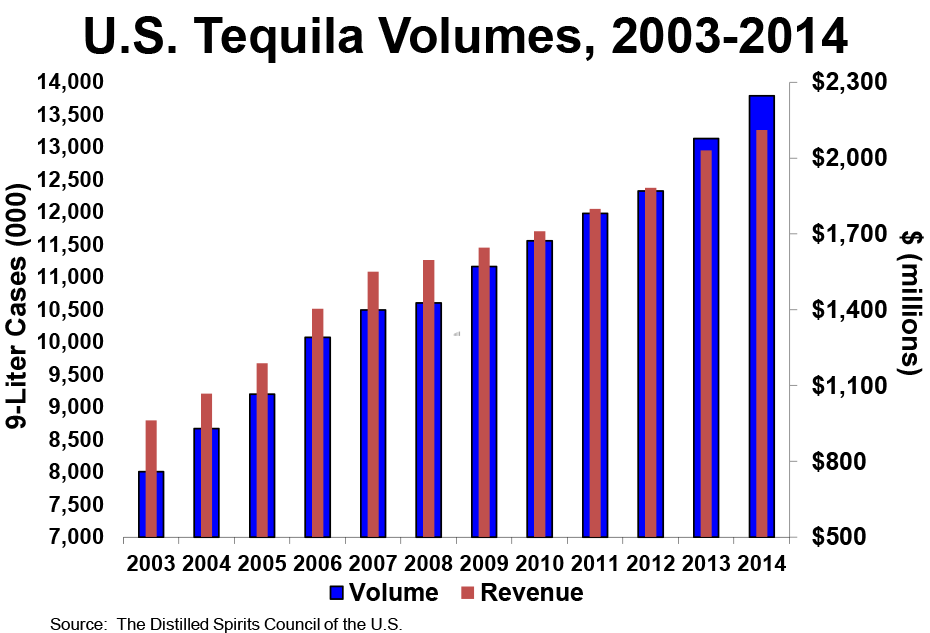

Tequila sales have been growing at an average rate of 5.6 percent a year since 2002, according to February figures from the Distilled Spirits Council of the United States. In 2014 alone, 13.8 million nine-liter cases were sold.

Related: U.S. Surpasses France As Biggest Wine Market

The U.S. represents tequila’s largest market, with about 52 percent of global sales. America’s renewed thirst for mixed cocktails has been a boon for spirits overall, but especially for tequila. Meanwhile, sales in Mexico have remained flat largely because the market there is mature, with little room for growth.

The Distilled Spirits Council said that one of the keys to tequila’s U.S. growth has been distillers’ ability to offer a product for every budget and occasion, but the fastest growth has been in high-end and super-premium brands.

“High-end brands have grown 189 percent in volume since 2002,” it noted. “Virtually unknown in 2002, super-premium tequila volumes have skyrocketed 568 percent and today account for 2.4 million 9-liter cases.”

Celebrity endorsements may have also raised the status of tequila. George Clooney, Sean Combs and Justin Timberlake have all promoted tequila brands.

In addition, distillers are trying to boost the popularity of high-end tequilas further by offering tastings and tours — at least one of which is aimed at the super-wealthy.

Tequila Avion, an ultra-premium tequila maker, is offering a $500,000, three-day trip for 10 to Jalisco, Mexico, to taste its spirits and partake of luxury accommodations, butler service and a private dinner among other amenities.

Related: Kentucky’s McConnell and Paul Offer Tax Breaks for Bourbon

If that seems a tad pricey, Experience Tequila in Portland, Ore., offers four-day tours to Mexico for just under $1,500, and you can find tequila-tasting classes in many cities for about $100.