As the stock market began recovering from its “Black Monday” upheaval, the non-partisan Congressional Budget Office released a soothing report on Tuesday projecting that this year’s budget deficit will be even smaller than previously thought and that the U.S. economy is on track to grow by a healthy 3.1 percent in 2016.

The deficit in the fiscal year ending Sept. 30 will total $426 billion, according to CBO, or $59 billion below what it was last year — and $60 billion smaller than what the agency projected in March. At the same time, publicly held debt will hold fairly steady at around 74 percent of gross domestic product by the end of the current fiscal year, a slight improvement over the previous year.

Related: New CBO Director Renews Warning on Long-Term Debt

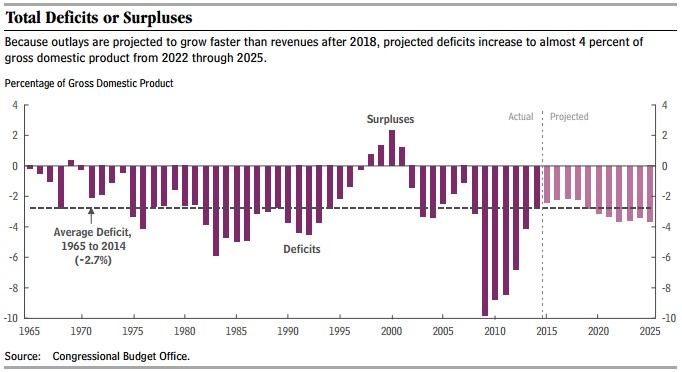

The Obama administration for months has been hailing its success in controlling a deficit that breached $1 trillion a year during the worst of the financial crisis and recession. Indeed, the new projections for the fiscal 2015 deficit would represent the smallest since 2007. “And at 2.4 percent of gross domestic product, it would be below the average deficit — relative to the size of the economy — over the past 50 years,” the CBO pointed out.

One reason that things are looking up on the deficit front is that federal revenues are expected to rise by 8 percent this year, to $3.3 trillion or 18.2 percent of the overall economy. In particular, tax receipts from corporate and individual taxes turned out to be greater than anticipated.

At the same time, federal spending is projected to climb by 5 percent this year to a total of $3.7 trillion, or roughly 20 percent of the overall economy. That increase is the result of nearly a 10 percent increase in mandatory spending on Social Security, Medicare and other entitlements, offset by lower net interest payments on the debt and domestic and defense outlays.

According to the revised CBO baseline projections, the deficit will dip to $414 billion next year as the economy continues to improve but then will begin to rise substantially, to $1 trillion by 2025 absent any major change in existing tax and spending legislation. As policy experts have repeatedly warned, without significant changes in entitlement spending, the growth in retirement and health care programs for seniors and interest on the federal debt will far outpace growth in revenues down the road.

Related: CBO Says Long Term Debt Poses ‘Serious Negative Consequences’

On the economic front, CBO says that the economy will grow “modestly” for the remainder of this year before picking up steam over the next few years. Assuming no change in current policy, the CBO is projecting that real GDP will grow by 2.0 percent this calendar year, 3.1 percent in 2016 and 2.7 percent in 2017. Then the economy will grow by an average yearly rate of 2.2 percent in 2018 and 2019, according to the budget agency.

Senate Budget Committee Chair Mike Enzi (R-WY) said in a statement that the CBO findings illustrates “the tremendous impact the budget caps approved as part of the 2011 Budget Control Act have had on our overspending.” He added, however, that “Our nation’s long-term debt is not so rosy,” and he urged lawmakers from both parties not to use the report as an excuse to boost spending in the coming year.

Related: Four Political Issues That Could Tank the Markets

Congress has been operating under a two-year budget deal that temporarily lifted stringent caps on domestic and defense spending, but that is due to expire at the end of this fiscal year.

The Obama administration and congressional Democrats are pressing the Republican majority in Congress to continue to hold the caps in abeyance in the coming year to provide additional spending on both defense and domestic programs. Enzi and other conservative favor preserving the caps, which sets the stage for a major budget tussle this fall before the start of the new fiscal year.