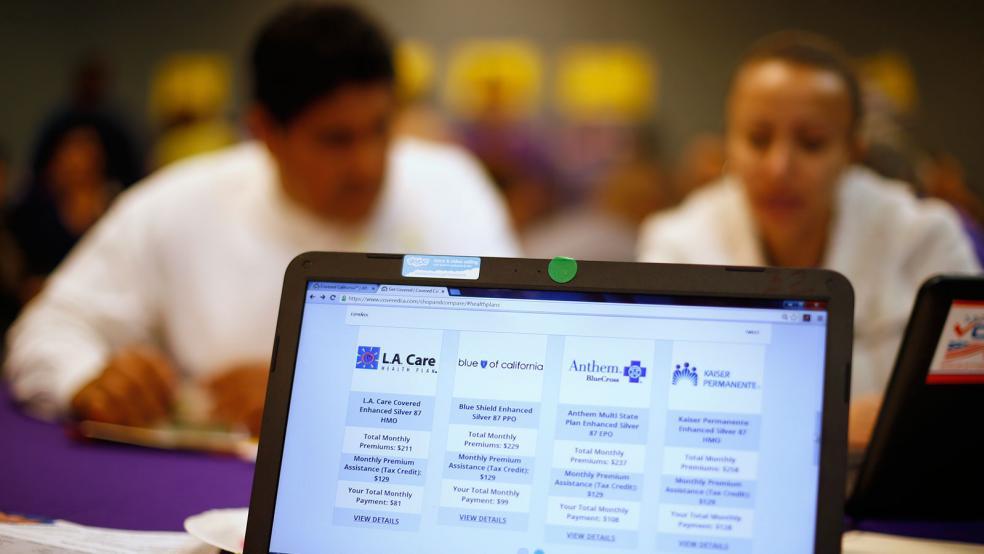

Shopping for health insurance can be a baffling maze of unfamiliar terms and puzzling acronyms — premiums, deductibles, PPOs, HMOs, POS. The Affordable Care Act, also known as Obamacare, added new elements that can heighten the confusion: Consumers have to navigate four different levels of plans, determine what subsidies they’re eligible for based on their income and calculate what plan would work best for them over the coming year.

That’s why some Obamacare shoppers who signed up through healthcare.gov have chosen plans that cost too much.

Related: Obamacare Gap Traps Millions with Coverage Who Can’t Afford Care

One major problem that experts at the Commonwealth Fund have identified is that some health care shoppers are unaware of the subsidies they are eligible to get if their income is between 100 and 250 percent of the federal poverty level ($11,770 to $29,425). The catch is that they receive the cost-sharing reductions and lower deductibles if they’re enrolled in a silver level plan, which is the marketplace’s standard plan, where insurers cover about 70 percent of out-of-pocket costs.

A survey conducted by the Commonwealth Fund, a nonpartisan health care research foundation, found that 24 percent of those who were eligible for subsidies if enrolled in silver plans were instead enrolled in bronze plans, which have the cheapest premiums but may carry higher out-of-pocket costs. Experts speculated that either people didn’t know about the subsidies or they chose a bronze plan because of the lower premium. By foregoing the silver plan, people are giving up subsidies and may end up paying more out of their own pocket.

In 2015, the average deductible for a bronze plan was around $5,203 across all 51 marketplaces. On the other hand, the average deductible for people with silver plans ranged from $229 for those with incomes between 100 percent and 149 percent of the poverty level to $2,078 for people with incomes between 200 percent and 249 percent of the poverty level.

While those silver plans might come with a higher premium, even after the subsidies, factoring in those lower deductibles could make the silver plans cheaper than the bronze ones. Choosing a plan on premium prices alone could wind up costing consumers.

Related: How to Apply for Obamacare in 2015

State and federal officials are trying to make sure Obamacare shoppers consider the subsidies when choosing a plan. In Kentucky, for example, people with low incomes are now shown silver level plans first, along with an explanation of the subsidies a silver-level plan offers, on the state’s Kynect marketplace. (Even though Kentucky reported the second sharpest drop in its uninsured rate from 2014 to 2013, only 38 percent of enrollees received cost-sharing subsidies, with many choosing plans with low premiums or not realizing they qualified for financial help.)

Similarly, HealthCare.gov and some other state marketplaces have also introduced new shopping tools that tell consumers the various health plans’ overall costs. The federal government is also launching an advertising campaign to inform low-income individuals about the health care subsidies.