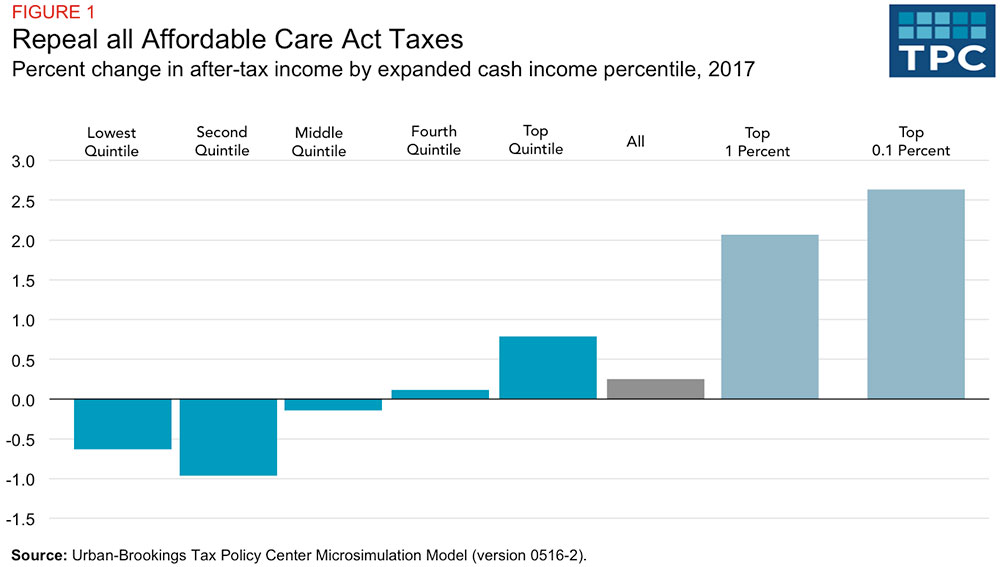

Repealing the Affordable Care Act remains the top priority for the incoming administration of Donald Trump -- ranking even higher than tax cuts -- but a new analysis of the effects of Obamacare repeal suggest that doing away with the law would be a de facto tax cut in and of itself, with the benefits disproportionately going to the wealthy and very wealthy.

“Repealing the Affordable Care Act would cut taxes significantly for the highest income one percent of US households,” write Howard Gleckman of the Urban-Brookings Tax Policy Center in Washington. “At the same time, it would raise taxes on average for low- and moderate-income households.”

Related: Trump’s Top 3 Priorities: Obamacare Repeal, Tax Cuts, More Tax Cuts

The reason why repealing a health care law would have a large impact on people’s tax returns is that major elements of Obamacare were implemented through the tax code. Premium subsidies to help low-income families afford insurance were delivered as refundable tax credits. Penalties on those who failed to adhere to the individual mandate were imposed via a tax. And major tax provisions -- including the Medicare surtax, the net investment tax and the “Cadillac” tax on expensive employer-provided health plans -- were all enacted to fund the ACA.

The impact of repeal would result in subsidies being stripped away from people in the low end of the income distribution, and taxes that disproportionately hit the wealthy being eliminated.

Gleckman finds that, on average, people in the lowest income bracket would face about a $90 per year tax increase, but that number varies widely. Some would actually see a tax break of $1,200, while others would lose thousands of dollars’ worth of insurance premium subsidies.

Middle income households would generally see little change, except for the three percent or so at the low end of the spectrum who would be subject to the loss of an average $6,200 in premium subsidies.

Related: A Full Repeal of Obamacare Could Spur Medicare’s Bankruptcy

But if the results are ambiguous for the lower and middle-income brackets, there’s no doubt that repeal would be a windfall for the very wealthy.

“[N]early everyone in the highest income one percent would enjoy a substantial tax cut, averaging $33,000 or about 2.1 percent of after-tax income,” Gleckman writes. “Those in the top 0.1 percent would get an average tax cut of about $197,000, raising their after-tax incomes by 2.6 percent, thanks to the repeal of the net investment tax and the extra Medicare tax.”