The Internal Revenue Service is the agency of the federal government that most people love to hate. As a result, it has been used as a political punching bag on and off for almost as long as it has been in existence. The most recent trend in politicians demonstrating their contempt for the national tax collector -- other than trying to get its commissioner impeached -- is to starve the agency of funding.

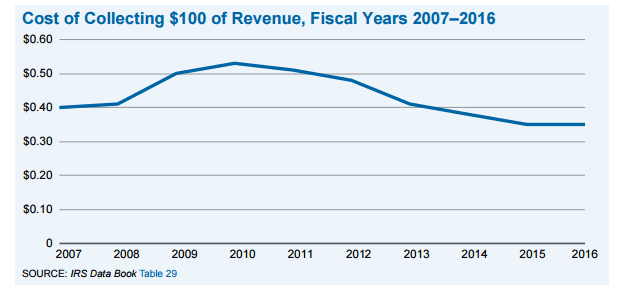

However, despite major budget reductions -- or perhaps partly because of them -- the agency had been doing more with less over the past several years. One of the metrics the IRS uses to measure its performance is by comparing the amount of money the agency receives from Congress to the amount it collects in taxes due, expressing the result in the cost to collect $100.

Related: IRS Still Lacks Enough Auditors to Close the $458 Billion Tax Gap

In 2015 and 2016, that figure stood at $0.35 per $100, down from $0.53 as recently as 2010. It’s also the lowest cost per $100 collected that the agency has recorded since at least 1981, according to the IRS 2016 Data Book.

While some of the recent efficiency gains can be attributed to the increase in electronic tax filing, the bulk of the transition to automatic filing had already occurred by 2011, before the most recent downturn in the cost-per-$100 measurement.

Ironically, at a time when Washington echoes with calls to further slash federal spending, one of the best investments lawmakers could make, at least with respect to return on investment, would be to funnel more money, not less, to the IRS. That’s because, properly directed, more IRS funding would drive those average costs even lower.

The Taxpayer Advocate Service, an independent agency within the IRS, put it this way: “The main reason the IRS is underfunded is because the congressional budget rules were written with classic spending programs in mind — namely, a dollar spent is treated as increasing the budget deficit by one dollar. As the government’s revenue collector, the IRS is the only significant exception to that rule — a dollar spent generates substantially more than one dollar in additional revenue and thus reduces the deficit.”

Related: The IRS Just Invited More Tax Cheating by the Public

One of the effects of constant budget cuts has been a large reduction in agency headcount. The IRS had 50,400 full-time equivalent employees funded by annual appropriations in 2010. By last year, that had fallen to 38,800. One result of this has been the shriveling up of the agency’s enforcement arm.

The IRS left an estimated $458 billion in taxes uncollected last year because it doesn’t have the necessary auditors and enforcement personnel to collect it -- an investment that would cost only a tiny fraction of the expected return.