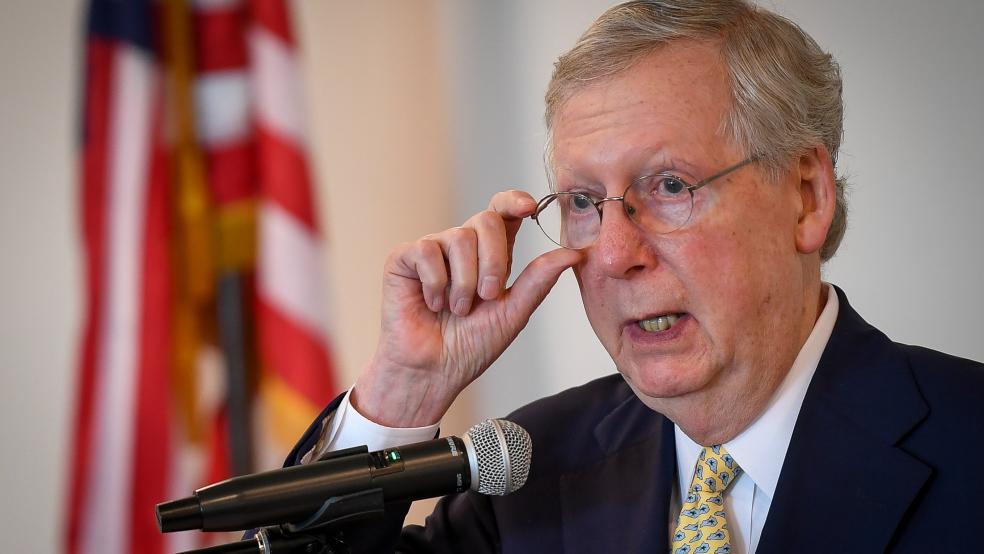

Following the implosion of the Senate’s most recent attempt to repeal and replace the Affordable Care Act, Majority Leader Mitch McConnell indicated on Tuesday that his next step would be to take up a version of legislation passed by Congress in 2015 that would effectively repeal the ACA but delay the effective date of the legislation for two years. The original version was vetoed by then-president Barack Obama.

Speaking on the Senate floor Tuesday morning, McConnell said, “In the coming days, the Senate will take up and vote on a repeal of Obamacare combined with a stable, two-year transition period as we work toward patient-centered health care. A majority of the Senate voted to pass the same repeal legislation in 2015. President Obama vetoed it then. President Trump will sign it now.”

Related: Why Trump Can’t Sell Health Care Reform – and the Price He’ll Pay for It

He added, “Passing this legislation will provide the opportunity for Senators of all parties to engage, with a fresh start, with a new beginning for the American people.”

The 2015 bill that McConnell is planning to resurrect would have eliminated most of the ACA, including individual and employer mandates and subsidy payments, while leaving in place many of the consumer protections that the law put in place. Those elements of the law -- subsidies, mandates and consumer protections -- were meant to work together by offsetting insurers increased costs with a wave of new customers.

In theory, the two-year delay is meant to give Republican lawmakers time to craft an Obamacare replacement plan -- something they have been utterly unable to do in the seven years since they began promising to do away with the ACA. But, given the current Congress’s track record, experts believe that insurance companies won’t be content to wait two years before reacting to the law’s repeal.

“Insurers have shown that one of their key concerns is uncertainty,” said Edwin Park, vice president for health policy at the left-leaning Center on Budget and Policy Priorities. “This would be uncertainty taken to an exponential level.”

Related: The GOP Senate Health Bill Just Died as Two More Senators Say No

He said that he would expect insurers to immediately begin raising premiums, if not leaving the ACA’s individual market insurance exchanges entirely, “pending complete collapse of the individual market.”

A Congressional Budget Office review of a similar scenario largely confirmed Park’s assessment. The agency predicted tens of millions of Americans would lose insurance coverage, leaving fewer Americans insured than before the ACA was passed, with premium costs doubling for those still able to find policies.

But it’s unclear that things will ever get that far, because McConnell may just be setting himself up for another embarrassing legislative failure.

After he promised that there would be a vote on what is being called a “repeal-and-delay” plan, members of his own party began backing away from his plan. As of Tuesday afternoon, at least five GOP senators had expressed concerns about passing a repeal bill with no replacement ready.

Related: There’s a Nasty Surprise Hidden in the Fine Print of the GOP Health Care Bill

Arizona Sen. John McCain, recovering from surgery, called on McConnell and Senate leaders to begin working with Democrats on a bipartisan basis. Sen. Bill Cassidy of Louisiana warned that a repeal and delay bill would probably increase insurance premiums.

Most importantly, three senators expressed outright opposition to the plan. Those three -- Maine’s Susan Collins, West Virginia’s Shelley Moore Capito and Alaska’s Lisa Murkowski -- by themselves represent enough votes to block McConnell’s measure from coming to the floor for debate.

It remained unclear on Tuesday whether McConnell would be willing to subject himself to the embarrassment of losing another battle on health care reform so soon.