The Fiscal Times Newsletter - August 28, 2017

|

Cyberattacks on Washington Are Up 50 to 100 Percent

As the government struggles to hire skilled workers to fend off hackers, cyberattacks on federal agencies are up between 50 and 100 percent in the past year.

A new survey by the Professional Services Council found that at least 28 percent of chief information officers at federal agencies reported an increase in cyberattacks of 51 to 100 percent over the past year.

Related: Cyber Security Office Deemed Dysfunctional

The increasing threat of cyber hacks against the government isn’t surprising. Earlier this year, the Government Accountability Office listed federal IT operations as one of the most serious weaknesses in the federal government and in its annual “High Risk” report, the GAO labeled this vulnerability a major threat to national security.

Just last week, the Obama administration announced that Chinese cyber thieves hacked into the Office of Personnel Management’s massive government data system and accessed more than 4 million federal workers’ personal data. ABC News reported that the hackers potentially gained access to some Cabinet member data as well.

In the aftermath of the breach, President Obama called on agencies to ramp up cyber security efforts. However, the problem, according to the PSC survey, is that the government is having trouble recruiting skilled cyber experts.

Related: Federal Government Hacked: Chinese Cyber Thieves Target Fed’s Personal Info

Some 63 percent of CIOs reported that their agencies were not sufficiently prepared to develop necessary talent. Most cited limited resources and government salaries as obstacles to competing with employers in the private sector.

Commerce Department CIO Steve Cooper said hiring young people is a major challenge. The average age of Commerce employees is about 50 years old, NextGov noted.

The CIOs’ responses are in line with a separate GAO report from earlier this year that found there is a major skills gap within the federal workforce when it comes to IT and cybersecurity.

Why Your Next Phone Could Be Powered By Seawater

Lithium is more than just a pretty solid Nirvana track – it’s also the reason that the portable computer in your pocket can keep on tweeting, e-mailing and otherwise vibrating for hours on end.

But soon there may not be enough available to go around.

As the demand for long-lasting batteries in cell-phones, laptops, and electric cars increases, so too does demand for Lithium, their key ingredient.

The U.S. Geological Survey estimated recently that conventional lithium reserves provide enough for production of 37,000 tons of the element per year for 365 years. That sounds like a lot, but with over a million electric cars expected in 2020, the development of battery clusters that power smart homes (like Tesla’s Powerwall), and increasing availability of lithium-powered consumer electronics, demand is sure to rise exponentially every year.

To battle the problem of Lithium shortage, researchers are looking to some unconventional sources. In Japan, for instance, scientists at the Atomic Energy Agency are working on a method to extract lithium from seawater through dialysis. According to a report from MIT Technology Review, “The system is based on a dialysis cell with a membrane consisting of a superconductor material,” a sentence which presumably means something to someone, somewhere.

Though the method is a long way away from being used commercially, one of the lead scientists on the project, Tsuyoshi Hoshino wrote that this particular method of extracting Lithium “shows good energy efficiency and is easily scalable.” Hoshino adds that his method could be commercialized in five years.

If Hoshino’s method makes it to commercialization, it could be a huge boom for the lithium battery industry, especially to powerhouse Tesla. Mineral assays of Nevada’s salt lakes have shown promising concentrations of lithium, which also happens to be where the battery pioneer plans to build its massive battery production plant, known as the “Gigafactory.”

For now, though, we’re stuck with a reliance on more conventional lithium sources.

More Americans Smell Fear—not Roses—When They Retire

The shine is coming off of Americans’ expectations for their Golden Years.

Two-thirds of Americans anticipate being stressed about their finances in retirement, and nearly 60 percent don’t think they’ll have enough money, according to a new report by Merrill Edge.

The report found that younger generations—Gen Xers and Millennial--are the most likely to expect to feel stress in retirement. Nearly half of those who aren’t retired expect to work in retirement, and 41 percent said they’ll rely on the government for financial help in retirement.

It may not be as bad as they expect. The survey also looked at how current retirees were doing, and it found a brighter picture. About 75 percent of current retirees believe they’ll have enough money to last through retirement, while just 57 percent of pre-retirees feel the same.

Related: 5 Things No One Ever Tells You About Retirement

One promising finding in the report: Americans are putting a higher priority on saving for the future, perhaps because of their anxiety about running out of money. More than 60 percent of those surveyed said they would prioritize saving for the future, versus less than half of those asked the same question last year.

“In comparison to a year ago, we’re seeing a significant jump in positive investment behaviors and intent,” Aron Levine, head of Bank of America Preferred Banking and Merrill Edge said in a statement. “It’s encouraging to see Americans prioritizing the future along with the present and turning financial concerns into positive investment decisions.”

Marriage?? Young Americans Aren't Even Shacking Up

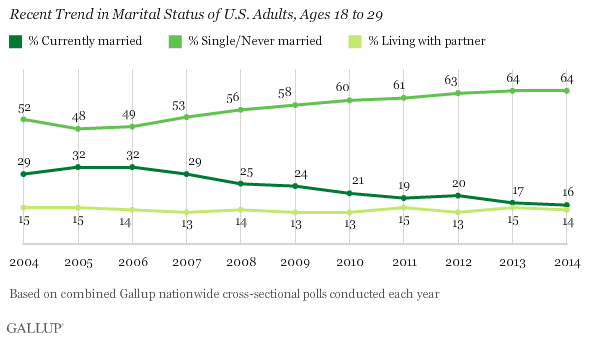

You’ve probably heard that marriage among young adults has been on the decline, but a new Gallup poll finds that the percentage of 18-to-29-year-olds living with a partner has flatlined in recent years.

“This means that not only are fewer young adults married, but also that fewer are in committed relationships,” Gallup’s Lydia Saad wrote Monday. “As a result, the percentage of young adults who report being single and not living with someone has risen dramatically in the past decade.”

Related: The Bad News About All the Singles in America

That percentage has risen from 52 percent in 2004 to 64 percent last year, Gallup says. The data doesn’t necessarily mean young adults are avoiding relationships entirely. Young people are just less likely to make a serious commitment associated with moving in together.

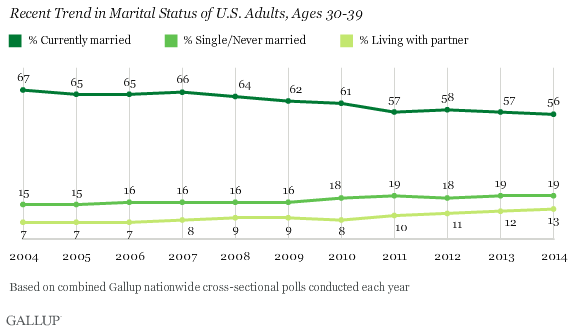

The trend hasn’t carried through to Americans in their 30s, who are only a bit more likely to be single than they were a decade ago. Marriage among people in this age group has also declined in popularity, but the percentage of 30-somethings living with a partner has jumped from 7 percent to 13 percent.

The new data suggests that, if young people don’t feel ready for marriage, they may not feel up for long-term commitment yet, either. (In some cases, that may be because they’re still living with their parents.) “This doesn't necessarily mean young adults are staying out of relationships, just that they are less likely to be making the more serious commitment associated with moving in together — whether in marriage or not,” Saad wrote.

The societal question, she said, is whether those single 20-somethings stay that way into their 30s. A Gallup poll from 2013 suggests that young adults may not be avoiding marriage altogether, but are just pushing it back. In that survey, 56 percent of Americans aged 18 to 34 said they were unmarried but did want to tie the knot at some point. Only 9 percent in the same age group said they were unmarried and wanted to stay that way. The most common reasons people listed for not being married yet included having not found the right person, being too young or not ready to get married and money concerns.

In other words, they might someday say “I do,” but for now they definitely don’t.

Obama Says King v. Burwell Is an ‘Easy Case’

House Republicans are gearing up to grill Health and Human Services Secretary Sylvia Mathews Burwell this week over how the administration will handle any potential fallout if the Supreme Court strikes down federal subsidies for health insurance coverage in 34 states operating on the federal exchange. Burwell will testify before the House Ways and Means Committee on Wednesday, ahead of the high court’s ruling in the high-stakes case of King v. Burwell, expected later this month.

The plaintiffs in that case contend that the law’s language only provides for subsidies to people in states that created their own exchange. The Obama administration and authors of the law maintain that the law was intended to offer subsidies to all enrollees who are eligible based on their income regardless of which exchange they used.

Related: If Obamacare Collapses, These 9 Ideas Could Save Health Care

If the court rules against the administration, an estimated 6.5 million people could lose their subsidized health coverage. If that happens, experts say it could create a ripple effect throughout health insurance markets in federal exchange states. Nearly everyone agrees that such a ruling would be devastating for millions of Americans. However, there is little agreement over what, if anything, to do to stem such fallout if the court rules for the plaintiffs.

Asked why his administration has given little guidance to states on how to prepare for the potential loss of federal insurance subsidies, President Obama on Monday said, “there is no reason why the existing exchanges should be overturned through a court case.”

King v. Burwell “should be an easy case,” Obama said. “Frankly, it probably shouldn’t even have been taken up. And since we’re going to get a ruling pretty quick, I think it’s important for us to go ahead and assume that the Supreme Court is going to do what most legal scholars who’ve looked at this would expect them to do.”

Obama added that Congress could also resolve any problems raised by a court ruling “with a one-sentence provision.”

Related: Double Digit Rate Hikes Loom for Obamacare 2016

That kind of response is unlikely to satisfy House Republicans, who are likely to again question Burwell’s previous claims that the administration does not have a “Plan B” in place if the court strikes down federal subsidies for millions of Americans.

Last week, during a Wall Street Journal breakfast, Burwell explained that the administration’s authority is limited. She added that her agency would work with states that are considering creating their own exchanges or using workarounds to avoid losing out on the federal subsidies.

“As always, we will stand ready to work with states, but in terms of administrative authority, we can’t do much,” Burwell said.

Republicans, who have long sought to repeal Obamacare, have criticized the administration for not having a contingency plan in place if the subsidies get struck down.