'Tax Reform Is Hard. Keeping Tax Reform Is Harder': Highlights from the House Tax Cuts Hearing

The House Ways and Means Committee held a three-hour hearing Wednesday on the effects of the Republican tax overhaul. We tuned in so you wouldn’t have to.

As you might have expected, the hearing was mostly an opportunity for Republicans and Democrats to exercise their messaging on the benefits or dangers of the new law, and for the experts testifying to disagree whether the gains from the law would outweigh the costs. But there was also some consensus that it’s still very early to try to gauge the effects of the law that was signed into effect by President Trump less than five months ago.

“I would emphasize that, despite all the high-quality economic research that’s been done, never before has the best economy on the planet moved from a worldwide system of taxation to a territorial system of taxation. There is no precedent,” said Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office. “And in that way we do not really know the magnitude and the pace at which a lot of these [effects] will occur.”

Some key quotes from the hearing:

Rep. Richard Neal (D-MA), ranking Democrat on the committee: “This was not tax reform. This was a tax cut for people at the top. The problem that Republicans hope Americans overlook is the law’s devastating impact on your health care. In search of revenue to pay for corporate cuts, the GOP upended the health care system, causing 13 million Americans to lose their coverage. For others, health insurance premiums will spike by at least 10 percent, which translates to about $2,000 a year of extra costs per year for a family of four. … These new health expenses will dwarf any tax cuts promised to American families. … The fiscal irresponsibility of their law is stunning. Over the next 10 years they add $2.3 trillion to the nation’s debt to finance tax cuts for people at the top – all borrowed money. … When the bill comes due, Republicans intend to cut funding for programs like Medicare, Medicaid and Social Security.”

David Farr, chairman and CEO of Emerson, and chairman of the National Association of Manufacturers: “We recently polled the NAM members, and the responses heard back from them on the tax reform are very significant and extremely positive: 86 percent report that they’ve already planned to increase investments, 77 percent report that they’ve already planned to increase hiring, 72 percent report that they’ve already planned to increase wages or benefits.”

Holtz-Eakin: “No, tax cuts don’t pay for themselves. If they did there would be no additional debt from the Tax Cuts and Jobs Act, and there is. The question is, is it worth it? Will the growth and the incentives that come from it be worth the additional federal debt. My judgment on that was yes. Reasonable people can disagree. … When we went into this exercise, there was $10 trillion in debt in the federal baseline, before the Tax Cuts and Jobs Act. There was a dangerous rise in the debt-to-GDP ratio. It was my belief, and continues to be my belief, that those problems would not be addressed in a stagnant, slow-growth economy. Those are enormously important problems, and we needed to get growth going so we can also take them on.”

“Quite frankly, it’s not going to be possible to hold onto this beneficial tax reform if you don’t get the spending side under control. Tax reform is hard. Keeping tax reform is harder, and the growth consequences of not fixing the debt outlook are entirely negative and will overwhelm what you’ve done so far.”

Steven Rattner: "We would probably all agree that increases in our national debt of these kinds of orders of magnitude have a number of deleterious effects. First, they push interest rates up. … That not only increases the cost of borrowing for the federal government, it increases the cost of borrowing for private corporations whose debt is priced off of government paper. Secondly, it creates additional pressure on spending inside the budget to the extent anyone is actually trying to control the deficit. … And thirdly, and in my view perhaps most importantly, it’s a terrible intergenerational transfer. We are simply leaving for our children additional trillions of dollars of debt that at some point are going to have to be dealt with, or there are going to have to be very, very substantial cuts in benefits, including programs like Social Security and Medicare, in order to reckon with that.”

It’s Not Just in Your Head, the Web Is Slowing Down

It’s not your imagination, and it’s not because AT&T — and possibly others — is purposefully cutting speeds to unlimited data plan users. The Internet is slowing down. The reason: Websites are growing in size, causing slower load times.

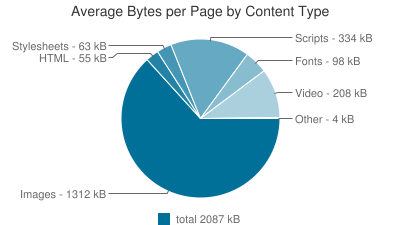

The average website is now 2.1 MB in size, compared to 1.5 MB two years ago, according to HTTP Archive, an Internet data measurement company. Multiple reasons can explain this increase in size.

Sites have been adding more content in an effort to drum up traffic, such as videos, engaging images, interactive plug-ins (comments and feeds) and other code and script-heavy features. Websites are becoming more and more technically advanced, and other sites have to keep adding features to stay competitive.

To keep up with the rapidly increasing number of users accessing sites on various platforms, developers are offering more versions of websites as well as apps to accommodate all devices, including smartphones, watches, tablets, and other gadgets. All of these versions require additional code, ultimately adding to the weight of a given website.

Then there are the advertisers who want to get the user’s attention by creating dramatic displays for their products that consume even more bandwidth.

Websites also want to know who is visiting their pages, both welcome and unwelcome visitors. New tools that track and analyze visitors have increased in popularity, as well as stronger encryption technology to add more security. These security measures and trackers require more code, again slowing load times.

Unfortunately for websites trying to keep up with the times, Google has just introduced a new ‘Slow to Load’ warning sign in mobile search results. Since mobile searches account for more than half of the total Google searches in 10 countries, Google wants to enhance user experience for those on their mobile platform.

Although the weight of a website isn’t all that contributes to slow loading, it’s a major factor. Other reasons include users overusing data, a poor connection, or a high level of traffic in the mobile network.

Google also changed its algorithm in April, so now ‘mobile friendly’ sites are ranked higher on search results, while those that fail to meet its criteria are ranked lower.

Although the internet is only slowing by a matter of seconds, it’s still slowing down. All the more reason for a user to become frustrated with a page that’s taking a couple extra seconds to load and go to a competitor’s site.

Taylor Swift Gets Apple Music to Pay Up

On Sunday morning, Taylor Swift took Apple to task for the royalty agreement on its news music streaming service. Her open letter on Tumblr, titled “To Apple, Love Taylor,” said, “I’m sure you are aware that Apple Music will be offering a free 3 month trial to anyone who signs up for the service. I’m not sure you know that Apple Music will not be paying writers, producers, or artists for those three months. I find it to be shocking, disappointing and completely unlike this historically progressive and generous company.”

Related Link: How the Video Game Industry Is Failing Its Fans

“Three months is a long time to go unpaid, and it is unfair to ask anyone to work for nothing,” the pop singer argued on the behalf of music-makers everywhere, many of whom had voiced their discontent with the royalty policy. She concluded her letter saying, “We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”

It was a sentiment shared by many independent music artists and producers. Just a few weeks earlier, the American Association for Independent Music had chimed in, “Since a sizable percentage of Apple’s most voracious music consumers are likely to initiate their free trials at launch, we are struggling to understand why rights holders would authorize their content on the service before October 1st.”

It took less than 24 hours for the “historically progressive and generous company” to respond via Twitter, and it didn’t wait until morning to make its announcement. Eddy Cue, Apple’s senior vice president of Internet Software and Services, personally called Swift to deliver the news before tweeting at 11:29 p.m., “#AppleMusic will pay artists for streaming, even during customers’ free trial period.”

Cue followed up with a feel-good response a minute later: “We hear you @taylorswift13 and indie artists. Love, Apple.” Later, Cue said that the company will pay artists on a per stream basis during the free trial period, although Cue declined to say what the rate would be. Once the free introductory period is over, Apple Music will pay music owners 71.5 percent of Apple Music’s overall subscription revenue in the United States.

Swift tweeted her response and addressed it to her fans and supporters: “I am elated and relieved. Thank you for your words of support today. They listened to us.”

Related Link: Apple Muscles Into Streaming Music Market

Swift’s crusade on social media showed the increasing weight that collective opinions on Twitter, Instagram and Facebook can have to force a change in corporate policy and direction. In a comic echo of that power, BuzzFeed promptly put together a list of 18 more issues Swift could fix through the power of social media, ranging from the battery life of iPhones to the size of Pringles cans.

Apple Music is launching on June 30, offering users a free, three-month subscription period. After that, the service will charge $9.99 a month for individuals and $14.99 a month for families with up to six members.

Most Americans Wouldn’t Vote for a Socialist President

Memo to Sen. Bernie Sanders:

Americans by overwhelming numbers say they would vote for a qualified presidential candidate nominated by their party who is Catholic, a woman, black, Hispanic or Jewish.

They say they would be somewhat less inclined to support a Mormon, a gay or lesbian, an evangelical Christian or Muslim for president, according to a new Gallup Poll released Monday. Yet more than half of those Americans surveyed said they would be accepting of anyone from this group who managed to garner their party’s presidential nomination. Even a qualified atheist would be acceptable to 58 percent of those questioned.

But only 47 percent said they could vote for a socialist for president. Fifty percent said they would absolutely not.

Related: Where Hillary Clinton, Bernie Sanders and Martin O’Malley Stand on the Issues

Sanders, 73, an independent who is challenging Hillary Clinton for the Democratic nomination, is the only Jewish candidate in the race. And while many wrote him off early on as a fringe candidate with limited appeal, Sanders has subsequently generated considerable buzz among liberals and progressives, and has made respectable showings in some of the early polling, including in New Hampshire.

With his ringing anti-Wall Street populist message, Sanders is tapping into the Democratic Party’s progressive wing – including some who had hoped at one time that Sen. Elizabeth Warren (D-MA) might change her mind and enter the race. However, the former University of Chicago student radical and self-described democratic socialist, supports proposals similar to those of mainstream social democratic governments in Europe, particularly those of Scandinavia.

Five of the declared candidates for president are Catholics – including Republicans Jeb Bush, George Pataki, Marco Rubio and Rick Santorum, and Democrat Martin O'Malley. Two are women -- Clinton and Republican Carly Fiorina. Republican Ben Carson is the only black candidate in the race, while two candidates are Hispanic -- Republicans Rubio and Ted Cruz.

Here are Gallup’s findings:

The Hidden Costs of Home Ownership: $6,000 a Year

Most new homeowners are prepared to pay their mortgages, but they may not be ready for other unavoidable costs that can amount to thousands of dollars every year.

The average homeowner shelled out $6,042 last year in homeowners insurance, property taxes, and utilities, according to a new report from Zillow. The average costs varied by location, with Boston homeowners spending the most ($9,413) and homeowners in Phoenix spending the least ($4,513).

“Home buyers too often fixate on the sticker price or monthly mortgage payment on a house, and don’t budget for the other expenses associated with ownership -- which can add up quickly,” Zillow spokeswoman Amy Bohutinsky said in a statement.

Related: How to Decide if You Should Rent or Buy a Home

The maintenance costs included in the report included things like lawn care and carpet cleaning.

The country’s homeownership rate fell to 63.7 percent in the first quarter, the lowest level since 1989. The rate peaked at 69.2 percent in the fourth quarter of 2004, right before the housing bubble burst.

As rents in many cities continue to skyrocket, however, homeownership may be becoming more appealing. However, in addition to hidden homeownership costs, new buyers should also consider the opportunity costs of potential earnings if buyers had invested their down payment. The New York Times has a handy calculator that incorporates these and other factors to help weigh whether it makes more sense to rent or buy.

Nearly two-thirds of consumers say that home ownership is a “dream come true” and an accomplishment to be proud of, according to a survey released last week by Wells Fargo.

Here’s How Much Boomers Are Giving Their Kids

Money has always tended to flow from parents or grandparents to children and grandchildren, whether it’s as outright gifts, help with living expenses or paying for things like school. But the pace of that inter-generational transfer of wealth has picked up in recent years — and it could be threatening the retirement prospects of some baby boomers, according to a new report from the Employee Benefit Research Institute.

The report finds that the number of cash transfers going from older households to younger family members increased from 1998 to 2010. High-income households are more likely to provide support to their adult children, but middle- and low-income families are also providing cash to younger family members. Overall, from 2008 to 2010, households of adults aged 50 to 64 gave an average of $8,350 to younger family members, and households age 85 and older gave $4,787 to younger family members.

“For older households, cash transfers can reduce their retirement assets, raising concerns about retirement security, particularly for low-income groups,” EBRI research associate Sudipto Banerjee said in a statement.

Related: Sandwich Generation Squeezed Once Again

In just 5 percent of families, wealth is passed from the younger generation to the older, and the amounts are far smaller. During the same period, households age 85 and older received an average of $359 from those in younger generations.

The EBRI numbers confirm a trend highlighted in other recent reports. A 2013 Pew study found that about half of adults ages 40 to 59 have provided some financial support to at least one grown child in the past year, with more than a quarter of them providing the primary support.

Obviously, the economic climate of recent years may be a big reason for the increased cash flowing from parents to their grown children. More than half of parents of millennials think that it is harder for today’s young adults to live within their means than it was for them, according to an April Bank of America survey.