'Tax Reform Is Hard. Keeping Tax Reform Is Harder': Highlights from the House Tax Cuts Hearing

The House Ways and Means Committee held a three-hour hearing Wednesday on the effects of the Republican tax overhaul. We tuned in so you wouldn’t have to.

As you might have expected, the hearing was mostly an opportunity for Republicans and Democrats to exercise their messaging on the benefits or dangers of the new law, and for the experts testifying to disagree whether the gains from the law would outweigh the costs. But there was also some consensus that it’s still very early to try to gauge the effects of the law that was signed into effect by President Trump less than five months ago.

“I would emphasize that, despite all the high-quality economic research that’s been done, never before has the best economy on the planet moved from a worldwide system of taxation to a territorial system of taxation. There is no precedent,” said Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office. “And in that way we do not really know the magnitude and the pace at which a lot of these [effects] will occur.”

Some key quotes from the hearing:

Rep. Richard Neal (D-MA), ranking Democrat on the committee: “This was not tax reform. This was a tax cut for people at the top. The problem that Republicans hope Americans overlook is the law’s devastating impact on your health care. In search of revenue to pay for corporate cuts, the GOP upended the health care system, causing 13 million Americans to lose their coverage. For others, health insurance premiums will spike by at least 10 percent, which translates to about $2,000 a year of extra costs per year for a family of four. … These new health expenses will dwarf any tax cuts promised to American families. … The fiscal irresponsibility of their law is stunning. Over the next 10 years they add $2.3 trillion to the nation’s debt to finance tax cuts for people at the top – all borrowed money. … When the bill comes due, Republicans intend to cut funding for programs like Medicare, Medicaid and Social Security.”

David Farr, chairman and CEO of Emerson, and chairman of the National Association of Manufacturers: “We recently polled the NAM members, and the responses heard back from them on the tax reform are very significant and extremely positive: 86 percent report that they’ve already planned to increase investments, 77 percent report that they’ve already planned to increase hiring, 72 percent report that they’ve already planned to increase wages or benefits.”

Holtz-Eakin: “No, tax cuts don’t pay for themselves. If they did there would be no additional debt from the Tax Cuts and Jobs Act, and there is. The question is, is it worth it? Will the growth and the incentives that come from it be worth the additional federal debt. My judgment on that was yes. Reasonable people can disagree. … When we went into this exercise, there was $10 trillion in debt in the federal baseline, before the Tax Cuts and Jobs Act. There was a dangerous rise in the debt-to-GDP ratio. It was my belief, and continues to be my belief, that those problems would not be addressed in a stagnant, slow-growth economy. Those are enormously important problems, and we needed to get growth going so we can also take them on.”

“Quite frankly, it’s not going to be possible to hold onto this beneficial tax reform if you don’t get the spending side under control. Tax reform is hard. Keeping tax reform is harder, and the growth consequences of not fixing the debt outlook are entirely negative and will overwhelm what you’ve done so far.”

Steven Rattner: "We would probably all agree that increases in our national debt of these kinds of orders of magnitude have a number of deleterious effects. First, they push interest rates up. … That not only increases the cost of borrowing for the federal government, it increases the cost of borrowing for private corporations whose debt is priced off of government paper. Secondly, it creates additional pressure on spending inside the budget to the extent anyone is actually trying to control the deficit. … And thirdly, and in my view perhaps most importantly, it’s a terrible intergenerational transfer. We are simply leaving for our children additional trillions of dollars of debt that at some point are going to have to be dealt with, or there are going to have to be very, very substantial cuts in benefits, including programs like Social Security and Medicare, in order to reckon with that.”

Commerce IG Accused of Whistleblower Retaliation Suddenly Quits

Embattled Commerce Department Inspector General Todd Zinser, who has been accused of misconduct and retaliation against whistleblowers, just announced that he is stepping down after seven years at the agency.

In an internal email to his staff, Zinser said he would be leaving his watchdog post to “pursue opportunities outside of government service,” GovExec first reported.

Zinser, the top watchdog in charge of keeping tabs on the Commerce Department, has been under intense scrutiny for nearly a year amid allegations of whistleblower retaliation and improperly hiring a woman with whom he was said to be romantically involved.

Related: Corruption in Commerce Dept? Lawmakers Want Him Out

For months, Rep. Eddie Bernice Johnson (D-TX) and two independent watchdog groups, have been calling on President Obama to fire Zinser over the alleged misconduct, which has been the subject of at least one federal probe by the White House Office of Special Council.

The White House has not responded to comment on whether Zinser was asked to leave.

A bipartisan group of lawmakers have been probing into multiple allegations brought by whistleblowers against Zinser for the better part of a year.

“The Committee has uncovered evidence questioning whether the Commerce IG’s office is functioning with integrity. We must determine if these allegations are true and if so, they are the result of systemic issues that may require legislative action,” the lawmakers wrote in a letter published last year.

Related: Why This Government Watchdog Needs Watching

In one instance, the IG reportedly failed to discipline two employees in his office who intimidated potential whistleblowers.

Another whistleblower told the committee that the IG improperly hired his “girlfriend” for a senior role in the office, which had an annual salary of $150,000 plus bonuses. Zinser maintained that he and the woman were not romantically involved and defended her employment.

He told the Council of Inspectors General for Integrity and Efficiency (CIGIE) that she was hired solely “on business necessity.”

There is currently a Government Accountability Office investigation into Zinser’s office conduct that is expected to be published in the coming months.

Zinser previously served as the Transportation Department’s acting inspector general and deputy inspector general.

6.6M Homes at Risk of Hurricane Damage This Year. Here’s Which States They’re In

As hurricane season gets underway, real estate analytics firm CoreLogic is warning that there are more than 6.6 million U.S. homes at risk of being hit by a storm surge. That could lead to as much at $1.5 trillion in damage.

The homes are in 19 states and the District of Columbia along the Atlantic and Gulf Coasts. Six states account for more than three-quarters of all at-risk homes, with Florida having the most (2.5 million), followed by Louisiana (760,000), New York (465,000), New Jersey (446,148), Texas (441,304) and Virginia (420,052).

Related: How Climate Change Costs Could Soar to the Billions

“The number of hurricanes each year is less important than the location of where the next hurricane will come ashore,” CoreLogic’s senior hazard risk analyst said in a statement. “It only takes one hurricane that pushes storm surge into a major metropolitan area for the damage to tally in the billions of dollars. With new home construction, and any amount of sea-level rise, the number of homes at risk of storm surge damage will continue to increase.”

The District of Columbia has the lowest number of properties at risk (3,700), followed by New Hampshire (12,400) and Maine (22,500

State Table (Ranked by Number of Homes at Risk)

|

Rank |

State |

Extreme |

Very High |

High |

Moderate |

Low* |

Total |

|

1 |

Florida |

793,204 |

461,632 |

524,923 |

352,102 |

377,951 |

2,509,812 |

|

2 |

Louisiana |

97,760 |

104,059 |

337,495 |

138,762 |

82,196 |

760,272 |

|

3 |

New York |

127,325 |

114,876 |

131,039 |

91,294 |

N/A |

464,534 |

|

4 |

New Jersey |

116,581 |

178,668 |

73,303 |

77,596 |

N/A |

446,148 |

|

5 |

Texas |

45,800 |

70,894 |

112,189 |

116,168 |

96,253 |

441,304 |

|

6 |

Virginia |

94,260 |

115,770 |

98,463 |

84,015 |

27,544 |

420,052 |

|

7 |

South Carolina |

107,443 |

57,327 |

65,885 |

46,799 |

30,961 |

308,415 |

|

8 |

North Carolina |

73,463 |

51,927 |

48,595 |

40,155 |

37,347 |

251,487 |

|

9 |

Massachusetts |

31,420 |

65,279 |

74,413 |

49,325 |

N/A |

220,437 |

|

10 |

Maryland |

47,990 |

39,966 |

27,591 |

28,975 |

N/A |

144,522 |

|

11 |

Georgia |

41,970 |

52,281 |

28,852 |

19,190 |

8,465 |

150,758 |

|

12 |

Pennsylvania |

1,467 |

45,776 |

37,983 |

32,426 |

N/A |

117,652 |

|

13 |

Mississippi |

14,809 |

20,643 |

29,387 |

27,507 |

10,588 |

102,934 |

|

14 |

Connecticut |

25,292 |

23,656 |

22,230 |

26,529 |

N/A |

97,707 |

|

15 |

Alabama |

7,403 |

12,707 |

10,182 |

13,749 |

14,086 |

58,127 |

|

16 |

Delaware |

11,523 |

10,854 |

13,528 |

13,811 |

N/A |

49,716 |

|

17 |

Rhode Island |

6,595 |

5,988 |

6,720 |

7,187 |

N/A |

26,490 |

|

18 |

Maine |

5,159 |

2,753 |

7,368 |

7,211 |

N/A |

22,491 |

|

19 |

New Hampshire |

2,514 |

3,470 |

4,234 |

2,272 |

N/A |

12,490 |

|

20 |

District of Columbia |

N/A** |

N/A** |

545 |

3,123 |

N/A |

3,668 |

|

Total |

1,651,978 |

1,438,526 |

1,654,925 |

1,178,196 |

685,391 |

6,609,016 |

* The "Low" risk category is based on Category 5 hurricanes, which are not likely along the northeastern Atlantic coast. States in that area have N/A designated for the Low category due to the extremely low probability of a Category 5 storm affecting that area.

** Washington, D.C. has no Atlantic coastal properties, but can be affected by larger hurricanes that push storm surge into the Potomac River. Category 1 and 2 storms will likely not generate sufficient storm surge to affect properties in Washington, D.C.

Jamie Dimon Is Now a Billionaire

The vast majority of the billionaires in the U.S. made their money in one of two ways—they started a company, or they inherited their fortune or business.

But Jamie Dimon, chairman and CEO of JPMorgan Chase, has shown another path to riches. As a corporate manager, he may have amassed enough stock and boosted the share price enough to join the 10-figure club.

According to Bloomberg, Dimon is now worth $1.1 billion. His stake in JPMorgan through shares and options is worth $485 million and he also has real estate valued at $32 million. In addition, he has wealth from "an investment portfolio seeded by proceeds" from his previous stint at Citigroup.

Related: America’s Highest Paid CEO: It’s Not Who You Think

While highly unusual, Dimon isn't the first billionaire professional manager or executive who gained his wealth from stock in a company he didn't found or take public. The first manager-billionaire in the U.S. was believed to be Roberto Goizueta, CEO of Coca-Cola during the 1980s and 1990s. During his tenure, Coca-Cola's stock jumped more than 70-fold and Goizueta had stock and options totaling more than $1 billion.

More recently, the billionaire managers have been from finance. James Cayne, the colorful CEO and chairman of Bear Stearns became a billionaire on paper—before Bear Stearns collapsed during the financial crisis.

Richard Fuld, CEO of Lehman Brothers, also became a paper billionaire in 2007—before the investment bank became the largest bankruptcy in U.S. history in 2008.

Plenty of other finance chiefs have become billionaires—from hedge-funders to private-equity kings Steve Schwarzman and David Rubenstein. Citi founder Sandy Weill was a billionaire, but he created the company.

So while he may not be the first, Dimon may make history another way—by becoming the first manager-billionaire in finance to run a bank that thrives for decades after his leadership.

This article originally appeared on CNBC.

Read more from CNBc.

CNBC Charts the top 100 firms

Shift from slaes to planning fuels fee-only business

Harvard Receives Laegest Ever Gift

Most Americans Think Our Morals Are Going To Hell

Ask anyone about the state of moral values in the U.S. and you’re likely to get a response along the lines of, “we’re going to hell.”

Most Americans — 72 percent — are convinced that moral values in the U.S. are decaying, according to a new Gallup poll, and most people believe the current state of moral values isn’t all that great to begin with. Nearly half of those polled, 45 percent, called the state of moral values in the U.S. “poor,” while 34 percent said they are “only fair.”

Just 19 percent rated American morals as either “excellent” or “good,” and only 22 percent say the state of moral values is getting better.

Unsurprisingly perhaps, social conservatives have consistently been most likely to tell pollsters that the nation’s moral values are deteriorating, but the latest Gallup findings showed an uptick from 2014 to 2015 among social moderates and social liberals who believe moral values are regressing.

Related: How U.S. Morals Stack Up Against the World

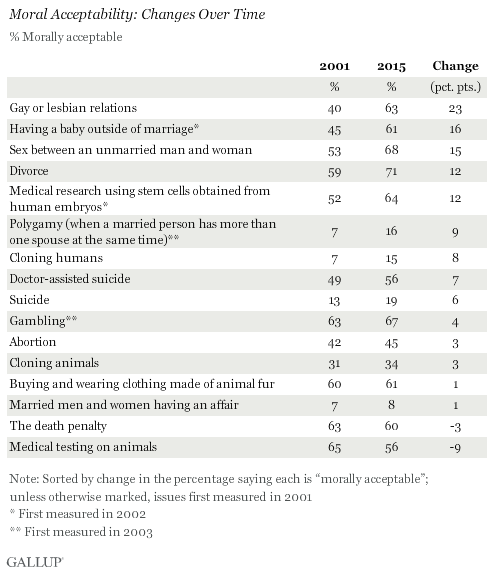

Gallup also found that Americans’ views of the moral acceptability of a number of key issues has been shifting to the left since 2001. The largest shift was on gay or lesbian relations, with a 23 percentage point increase in the share of people who say that behavior is morally acceptable. The change coincides with a sharp increase in support for same-sex marriage.

Sex between unmarried people has also become more acceptable, as has having babies outside of marriage. Polygamy and divorce are also now acceptable to a greater portion of the population than in 2001. On the other hand, the views of married men and women having an affair haven’t changed much, with just 8 percent of Americans saying it’s morally tolerable.

However, respondents to the poll about the current and future state of moral values weren’t necessarily responding with those charged social and political issues in mind. In many cases, Gallup suggests, their views of the moral direction of the country were rooted in something much more basic: “That is, their views have less to do with greater acceptance of same-sex marriage or having babies out of wedlock and other hot-button issues, and more to do with matters of basic civility and respect for each other,” Gallup’s Justin McCarthy wrote.

Clearly, the Golden Rule is still the bedrock of our moral code: Love thy neighbor as thyself.

Obama’s Approval Tanks Over the Economy and ISIS

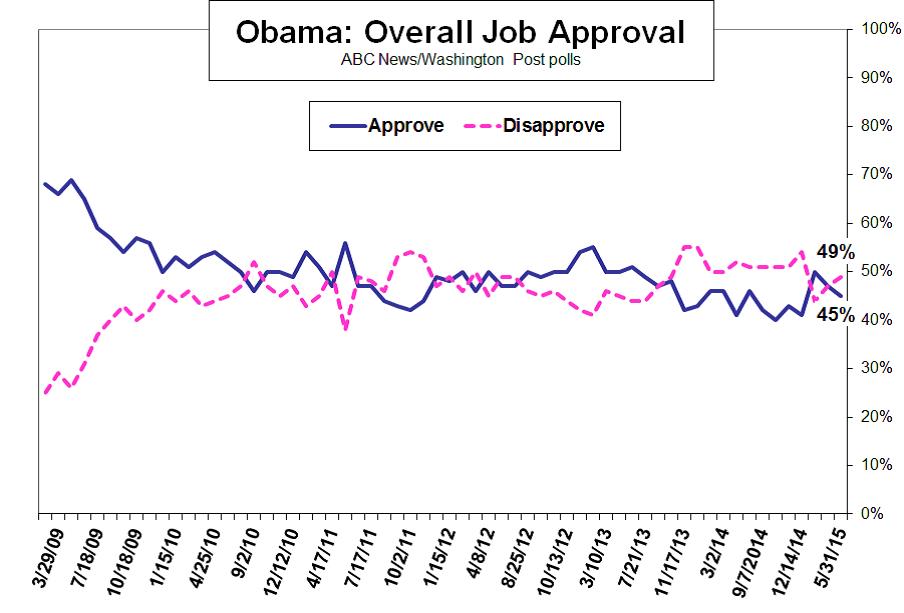

For a while, President Obama enjoyed a revival in popularity after years of public unease and displeasure with his stewardship of the economy and foreign policy. His approval rating jumped as high as 49 percent in mid-January, according to Gallup, and then tapered off a little amid renewed uncertainty about the economic recovery.

In the latest Washington Post/ABC News poll, however, 45 percent of Americans say they approve of Obama’s job performance, while 49 percent disapprove. That is his weakest rating in the survey since late 2014. The president effectively lost five points in approval since January and he hasn’t seen majority support since May 2013, according to survey analysis.

Analysts blame the decline in the president’s approval on continued economic anxiety at home – despite a drop in the unemployment rate to 5.4 percent in April and other signs of economic revival – and the advance of ISIS and other Islamic extremists in Iraq and Syria.

The condition of the economy consistently has topped the list of voters’ concerns heading into the 2016 campaign. The economic gains touted by the administration since the end of the Great Recession in June 2009 apparently haven’t been enough to calm fears, analysts say.

Seventy-three percent of those surveyed recently remain worried about the economy’s direction, and among them Obama’s approval drops to 35 percent, according to the survey. What’s more, Obama gets only a 31 percent approval rating specifically for handling the advance of ISIS militants, with 55 percent disapproving. Public approval of the president’s handling of the war against ISIS is 16 percentage points worse than his rating on handling the economy.