Republicans Push Ahead on Medicaid Restrictions

The Trump administration on Friday approved Ohio’s request to impose work requirements on Medicaid recipients. Starting in 2021, the state will require most able-bodied adults aged 19 to 49 to either work, go to school, be in job training or volunteer for 80 hours a month in order to receive Medicaid benefits. Those who fail to meet the requirements over 60 days will be removed from the system, although they can reapply immediately.

The new work requirements include exemptions for pregnant women, caretakers and those living in counties with high unemployment rates and will apply only to those covered through the expansion of Medicaid under the Affordable Care Act. There are currently about 540,000 people on Medicaid in Ohio who receive coverage through the expansion, according to Kaitlin Schroeder of The Dayton Daily News, compared to roughly 2.6 million Medicaid recipients in the state overall.

Once implemented, the work requirements are expected to result in 36,000 people losing their Medicaid eligibility, according to state officials, though critics say the reductions could be significantly larger. Similar work requirements in Arkansas pushed 18,000 people off the Medicaid rolls in six months.

A larger GOP project: The creation of new work requirements is part of a larger effort by Republicans to limit the expansion of Medicaid, says The Wall Street Journal’s Stephanie Armour. Since the Affordable Care Act passed in 2010, 36 states have expanded their Medicaid programs under the ACA and the number of people in the program has grown by 50 percent, from roughly 50 million to about 75 million. But many red-state governors have expressed concerns about the cost of Medicaid expansion and worries about a lack of self-sufficiency among the able-bodied poor, and are embracing new limitations on the program for both fiscal and political reasons.

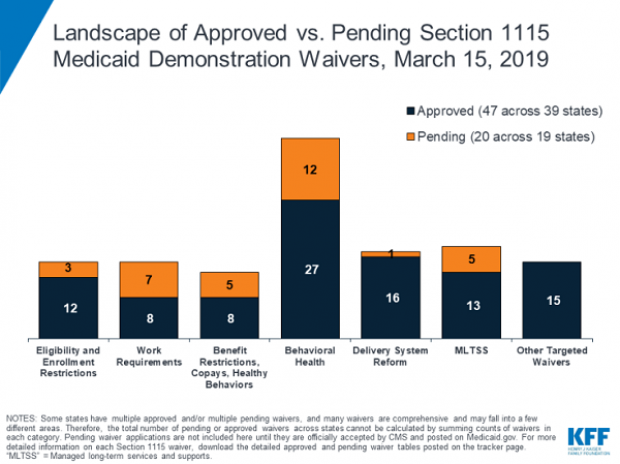

In 2017, the White House in 2017 gave states the green light to explore ways to limit the reach and expense of their Medicaid programs. Governors have proposed a variety of new rules, which require waivers from the federal government to enact. Kentucky, for example, wants to drug-test Medicaid recipients, and Utah wants a partial expansion and a cap on payments. Kaiser Health News summarizes the variety of waivers states have requested, which are governed by Section 1115 of the Social Security Act, in the chart below.

Legal challenges: Efforts to restrict Medicaid have received legal challenges, and U.S. District Judge James Boasberg blocked work requirements in Kentucky last year. The same judge, who has expressed doubts about the administration’s approach to Medicaid, will rule on the legality of work requirements in both Kentucky and Arkansas by April 1.

The bottom line: The Trump administration is seeking fundamental changes in how Medicaid works. Even if Boasberg rules against work requirements, expect the White House and Republican governors to continue to push for new limitations on the program.

Why You Might Want to Cancel That Restaurant Reservation

The cost of dining out rose 3 percent in May year-over-year, while the amount paid to eat at home inched up just 0.6 percent. The growing disparity in prices could prompt consumers to abandon restaurants for home-cooked meals, according to a report today by Bloomberg.

“Eating in hasn’t been this attractive compared to dining out since 2010,” Bloomberg reports. That’s good news for consumers worried about their budgets, but could be a problem for restaurants’ bottom lines.

So far, consumers aren’t making the shift. This spring, spending at restaurants and bars totaled more than sales at grocery stores for the first time.

Related: The 11 Worst Fast Food Restaurants in America

Part of the reason consumers are sticking with restaurants could be that wages are starting to slowly increase, so consumers have a little more money to spend on meals.

They may also be dining out because it’s often an easier option. Shopping and preparing meals takes time – time that people simply don’t have these days. A quarter of employees say that they are working after the standard work day has ended, and about 40 percent work at least one weekend a month, according to Staples Advantage. That leaves little time for food prep.

Supermarkets have responded to the time-pressed consumer by increasingly offering prepared meals that require little more than reheating at home. The prices for such meals tend to be higher than the cost of their ingredients but less than the price of eating out or ordering in.

Here’s What Consumers Were and Weren’t Buying in June

Retail sales were disappointingly soft in June, continuing a zig-zag pattern of strength and weakness this year. Sales fell 0.3 percent, falling shy of economists’ expectations for a 0.3 percent gain after a 1 percent jump in May. The only spending categories to post decent gains were electronics and appliance stores sales, gas station sales and discount stores.

“In May, retail gains signaled that consumers may have started using their so-called pump price dividend toward purchases of discretionary items,” Chris G. Christopher, Jr., the director of consumer economics at IHS Global Insight, wrote in an email to clients. Now, he added, the retail data “are pointing to a consumer that spends their paycheck in fits and starts.”

Related: What the U.S. Must Do to Avoid Another Financial Crisis

Those fits and starts averaged out to a fairly healthy 2.6 percent annualized increase over April, May and June. “The glass half-full take on consumers is that 2.6 percent is still somewhat better than the 2.3 percent consumption growth we've averaged since the beginning of the current expansion,” J.P. Morgan economist Michael Feroli said in a research note. “The glass half-empty view is that there is now even less evidence of a sharp snapback in spending after an unambiguously disappointing Q1.”

Here’s a breakdown from the Bespoke Investment Group of how different retail categories fared:

7 Personal Details You Should Never Divulge Online

What do the following have in common?

- The name of your favorite movie

- Concert tickets or sporting event passes with a barcode

- Your high school

- Your mother’s maiden name

- The name of your best friend in high school

- Your full birthdate, including the year

- The street address of your childhood home

Basically, any of the answers above can be used to answer common security questions that would allow cyber thieves to gain access to an online banking or credit card account. They can be used to reset your password. That’s why you should never post these details publicly on a social media account. Even the name of a beloved pet or school mascot can be fair game.

Related: Think You’ve Been Hacked? 10 Tips to Protect Yourself Now

We already know not to post our vacation plans, where we are meeting friends for drinks or dinner, or where our children go to school. But we should be aware that information we post on our social media accounts can be used by others to profile and target us.

This is especially important when you consider that Facebook users admit that as much as 7 percent of their Friend lists, which can easily number 200 or more, are people they’ve never met in person. If you share your address and phone number on Facebook with Friends only, make sure all of your contacts are people you know; otherwise cut them from your list or relegate them to Acquaintance status.

Even if you don’t have a profile on Facebook, chances are your spouse, co-worker, or teenager does. According to the Pew Research Center, half of Internet users who do not use Facebook themselves live with someone who does. Make sure they’re not giving out your personal information too.

Shopping Showdown: Walmart Takes On Amazon’s ‘Prime Day’

In case it wasn’t already perfectly obvious that Walmart is gunning for Amazon, the Bentonville, Ark. giant just kicked up its e-tailing competition.

Walmart announced today that it will also offer thousands of discounts for online purchases on July 15, the same day Amazon plans on hosting its Prime Day shopping extravaganza. And in its blog post announcing the sales, Walmart took a clear swipe at Amazon’s push to have shoppers subscribe to its $99 a year Prime service.

“We’ve heard some retailers are charging $100 to get access to a sale,” the Walmart blog says. “But the idea of asking customers to pay extra in order to save money just doesn’t add up for us. We’re standing up for our customers and everyone else who sees no rhyme or reason for paying a premium to save.”

Related: Amazon’s Prime Concern—A New Online Blitz by Walmart

Walmart, the world’s largest retailer, is also offering another limited-time deal to boost e-commerce sales. Starting today, customers will receive free standard shipping with online purchases that cost a minimum of $35, instead of the usual $50. The change will be effective for at least 30 days.

In February, Walmart CEO Doug McMillon told analysts on an earnings conference call that the company would invest between $1.2 billion and $1.5 billion in e-commerce throughout the year.

Neither Walmart nor Amazon has released information about specific sale offers yet, so the early hype might prove unwarranted, but the battle is clearly on and now the claws are out.

Update: Amazon responded to Walmart’s gibe with its own accusation. “We’ve heard some retailers are charging higher prices for items in their physical stores than they do for the same items online,” Greg Greeley, vice president of Amazon Prime, wrote in an email to Bloomberg. “The idea of charging your in-store customers more than your online customers doesn’t add up for us.”

We’re All Becoming Distracted Victims of Smartphones

Your phone buzzes at work. You promised yourself you wouldn’t check your phone until you turn in your half-finished assignment that’s due in an hour, so you don’t. But you start to wonder — who is texting you? What does the text say? Your mind wanders.

A new study has found that even when we try to disregard a notification, just being aware of a new message distracts us enough to impair our concentration and hurt our performance. These distractions are equal to actively opening the notification on your mobile device.

A Gallup poll reveals that 81 percent of smartphone users keep their phone in close proximity “almost all the time during waking hours.” Depending on the volume of notifications users receive, keeping a phone so close could lead to a noticeably negative impact on work performance.

Related: The New Workplace Trend — Smartphone Mini-Vacations

The study adds to the growing list of negative affects smartphones can have on users. Other effects include impaired sleep, increased pressure to communicate with friends and family, and the inability to detach from work.

Smartphones are only going to affect more and more individuals. The number of people who own a smartphone has increased from 35 percent in 2011 to 64 percent in April of this year. Among millennials, 84 percent report owning a smartphone.

As millennials begin to enter the workforce and the number of apps available for download increases, the potential for distraction only grows larger.