Republicans Push Ahead on Medicaid Restrictions

The Trump administration on Friday approved Ohio’s request to impose work requirements on Medicaid recipients. Starting in 2021, the state will require most able-bodied adults aged 19 to 49 to either work, go to school, be in job training or volunteer for 80 hours a month in order to receive Medicaid benefits. Those who fail to meet the requirements over 60 days will be removed from the system, although they can reapply immediately.

The new work requirements include exemptions for pregnant women, caretakers and those living in counties with high unemployment rates and will apply only to those covered through the expansion of Medicaid under the Affordable Care Act. There are currently about 540,000 people on Medicaid in Ohio who receive coverage through the expansion, according to Kaitlin Schroeder of The Dayton Daily News, compared to roughly 2.6 million Medicaid recipients in the state overall.

Once implemented, the work requirements are expected to result in 36,000 people losing their Medicaid eligibility, according to state officials, though critics say the reductions could be significantly larger. Similar work requirements in Arkansas pushed 18,000 people off the Medicaid rolls in six months.

A larger GOP project: The creation of new work requirements is part of a larger effort by Republicans to limit the expansion of Medicaid, says The Wall Street Journal’s Stephanie Armour. Since the Affordable Care Act passed in 2010, 36 states have expanded their Medicaid programs under the ACA and the number of people in the program has grown by 50 percent, from roughly 50 million to about 75 million. But many red-state governors have expressed concerns about the cost of Medicaid expansion and worries about a lack of self-sufficiency among the able-bodied poor, and are embracing new limitations on the program for both fiscal and political reasons.

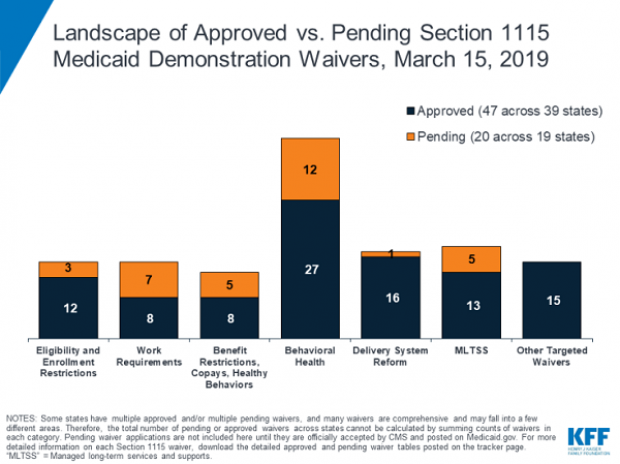

In 2017, the White House in 2017 gave states the green light to explore ways to limit the reach and expense of their Medicaid programs. Governors have proposed a variety of new rules, which require waivers from the federal government to enact. Kentucky, for example, wants to drug-test Medicaid recipients, and Utah wants a partial expansion and a cap on payments. Kaiser Health News summarizes the variety of waivers states have requested, which are governed by Section 1115 of the Social Security Act, in the chart below.

Legal challenges: Efforts to restrict Medicaid have received legal challenges, and U.S. District Judge James Boasberg blocked work requirements in Kentucky last year. The same judge, who has expressed doubts about the administration’s approach to Medicaid, will rule on the legality of work requirements in both Kentucky and Arkansas by April 1.

The bottom line: The Trump administration is seeking fundamental changes in how Medicaid works. Even if Boasberg rules against work requirements, expect the White House and Republican governors to continue to push for new limitations on the program.

Commerce IG Accused of Whistleblower Retaliation Suddenly Quits

Embattled Commerce Department Inspector General Todd Zinser, who has been accused of misconduct and retaliation against whistleblowers, just announced that he is stepping down after seven years at the agency.

In an internal email to his staff, Zinser said he would be leaving his watchdog post to “pursue opportunities outside of government service,” GovExec first reported.

Zinser, the top watchdog in charge of keeping tabs on the Commerce Department, has been under intense scrutiny for nearly a year amid allegations of whistleblower retaliation and improperly hiring a woman with whom he was said to be romantically involved.

Related: Corruption in Commerce Dept? Lawmakers Want Him Out

For months, Rep. Eddie Bernice Johnson (D-TX) and two independent watchdog groups, have been calling on President Obama to fire Zinser over the alleged misconduct, which has been the subject of at least one federal probe by the White House Office of Special Council.

The White House has not responded to comment on whether Zinser was asked to leave.

A bipartisan group of lawmakers have been probing into multiple allegations brought by whistleblowers against Zinser for the better part of a year.

“The Committee has uncovered evidence questioning whether the Commerce IG’s office is functioning with integrity. We must determine if these allegations are true and if so, they are the result of systemic issues that may require legislative action,” the lawmakers wrote in a letter published last year.

Related: Why This Government Watchdog Needs Watching

In one instance, the IG reportedly failed to discipline two employees in his office who intimidated potential whistleblowers.

Another whistleblower told the committee that the IG improperly hired his “girlfriend” for a senior role in the office, which had an annual salary of $150,000 plus bonuses. Zinser maintained that he and the woman were not romantically involved and defended her employment.

He told the Council of Inspectors General for Integrity and Efficiency (CIGIE) that she was hired solely “on business necessity.”

There is currently a Government Accountability Office investigation into Zinser’s office conduct that is expected to be published in the coming months.

Zinser previously served as the Transportation Department’s acting inspector general and deputy inspector general.

6.6M Homes at Risk of Hurricane Damage This Year. Here’s Which States They’re In

As hurricane season gets underway, real estate analytics firm CoreLogic is warning that there are more than 6.6 million U.S. homes at risk of being hit by a storm surge. That could lead to as much at $1.5 trillion in damage.

The homes are in 19 states and the District of Columbia along the Atlantic and Gulf Coasts. Six states account for more than three-quarters of all at-risk homes, with Florida having the most (2.5 million), followed by Louisiana (760,000), New York (465,000), New Jersey (446,148), Texas (441,304) and Virginia (420,052).

Related: How Climate Change Costs Could Soar to the Billions

“The number of hurricanes each year is less important than the location of where the next hurricane will come ashore,” CoreLogic’s senior hazard risk analyst said in a statement. “It only takes one hurricane that pushes storm surge into a major metropolitan area for the damage to tally in the billions of dollars. With new home construction, and any amount of sea-level rise, the number of homes at risk of storm surge damage will continue to increase.”

The District of Columbia has the lowest number of properties at risk (3,700), followed by New Hampshire (12,400) and Maine (22,500

State Table (Ranked by Number of Homes at Risk)

|

Rank |

State |

Extreme |

Very High |

High |

Moderate |

Low* |

Total |

|

1 |

Florida |

793,204 |

461,632 |

524,923 |

352,102 |

377,951 |

2,509,812 |

|

2 |

Louisiana |

97,760 |

104,059 |

337,495 |

138,762 |

82,196 |

760,272 |

|

3 |

New York |

127,325 |

114,876 |

131,039 |

91,294 |

N/A |

464,534 |

|

4 |

New Jersey |

116,581 |

178,668 |

73,303 |

77,596 |

N/A |

446,148 |

|

5 |

Texas |

45,800 |

70,894 |

112,189 |

116,168 |

96,253 |

441,304 |

|

6 |

Virginia |

94,260 |

115,770 |

98,463 |

84,015 |

27,544 |

420,052 |

|

7 |

South Carolina |

107,443 |

57,327 |

65,885 |

46,799 |

30,961 |

308,415 |

|

8 |

North Carolina |

73,463 |

51,927 |

48,595 |

40,155 |

37,347 |

251,487 |

|

9 |

Massachusetts |

31,420 |

65,279 |

74,413 |

49,325 |

N/A |

220,437 |

|

10 |

Maryland |

47,990 |

39,966 |

27,591 |

28,975 |

N/A |

144,522 |

|

11 |

Georgia |

41,970 |

52,281 |

28,852 |

19,190 |

8,465 |

150,758 |

|

12 |

Pennsylvania |

1,467 |

45,776 |

37,983 |

32,426 |

N/A |

117,652 |

|

13 |

Mississippi |

14,809 |

20,643 |

29,387 |

27,507 |

10,588 |

102,934 |

|

14 |

Connecticut |

25,292 |

23,656 |

22,230 |

26,529 |

N/A |

97,707 |

|

15 |

Alabama |

7,403 |

12,707 |

10,182 |

13,749 |

14,086 |

58,127 |

|

16 |

Delaware |

11,523 |

10,854 |

13,528 |

13,811 |

N/A |

49,716 |

|

17 |

Rhode Island |

6,595 |

5,988 |

6,720 |

7,187 |

N/A |

26,490 |

|

18 |

Maine |

5,159 |

2,753 |

7,368 |

7,211 |

N/A |

22,491 |

|

19 |

New Hampshire |

2,514 |

3,470 |

4,234 |

2,272 |

N/A |

12,490 |

|

20 |

District of Columbia |

N/A** |

N/A** |

545 |

3,123 |

N/A |

3,668 |

|

Total |

1,651,978 |

1,438,526 |

1,654,925 |

1,178,196 |

685,391 |

6,609,016 |

* The "Low" risk category is based on Category 5 hurricanes, which are not likely along the northeastern Atlantic coast. States in that area have N/A designated for the Low category due to the extremely low probability of a Category 5 storm affecting that area.

** Washington, D.C. has no Atlantic coastal properties, but can be affected by larger hurricanes that push storm surge into the Potomac River. Category 1 and 2 storms will likely not generate sufficient storm surge to affect properties in Washington, D.C.

Jamie Dimon Is Now a Billionaire

The vast majority of the billionaires in the U.S. made their money in one of two ways—they started a company, or they inherited their fortune or business.

But Jamie Dimon, chairman and CEO of JPMorgan Chase, has shown another path to riches. As a corporate manager, he may have amassed enough stock and boosted the share price enough to join the 10-figure club.

According to Bloomberg, Dimon is now worth $1.1 billion. His stake in JPMorgan through shares and options is worth $485 million and he also has real estate valued at $32 million. In addition, he has wealth from "an investment portfolio seeded by proceeds" from his previous stint at Citigroup.

Related: America’s Highest Paid CEO: It’s Not Who You Think

While highly unusual, Dimon isn't the first billionaire professional manager or executive who gained his wealth from stock in a company he didn't found or take public. The first manager-billionaire in the U.S. was believed to be Roberto Goizueta, CEO of Coca-Cola during the 1980s and 1990s. During his tenure, Coca-Cola's stock jumped more than 70-fold and Goizueta had stock and options totaling more than $1 billion.

More recently, the billionaire managers have been from finance. James Cayne, the colorful CEO and chairman of Bear Stearns became a billionaire on paper—before Bear Stearns collapsed during the financial crisis.

Richard Fuld, CEO of Lehman Brothers, also became a paper billionaire in 2007—before the investment bank became the largest bankruptcy in U.S. history in 2008.

Plenty of other finance chiefs have become billionaires—from hedge-funders to private-equity kings Steve Schwarzman and David Rubenstein. Citi founder Sandy Weill was a billionaire, but he created the company.

So while he may not be the first, Dimon may make history another way—by becoming the first manager-billionaire in finance to run a bank that thrives for decades after his leadership.

This article originally appeared on CNBC.

Read more from CNBc.

CNBC Charts the top 100 firms

Shift from slaes to planning fuels fee-only business

Harvard Receives Laegest Ever Gift

Most Americans Think Our Morals Are Going To Hell

Ask anyone about the state of moral values in the U.S. and you’re likely to get a response along the lines of, “we’re going to hell.”

Most Americans — 72 percent — are convinced that moral values in the U.S. are decaying, according to a new Gallup poll, and most people believe the current state of moral values isn’t all that great to begin with. Nearly half of those polled, 45 percent, called the state of moral values in the U.S. “poor,” while 34 percent said they are “only fair.”

Just 19 percent rated American morals as either “excellent” or “good,” and only 22 percent say the state of moral values is getting better.

Unsurprisingly perhaps, social conservatives have consistently been most likely to tell pollsters that the nation’s moral values are deteriorating, but the latest Gallup findings showed an uptick from 2014 to 2015 among social moderates and social liberals who believe moral values are regressing.

Related: How U.S. Morals Stack Up Against the World

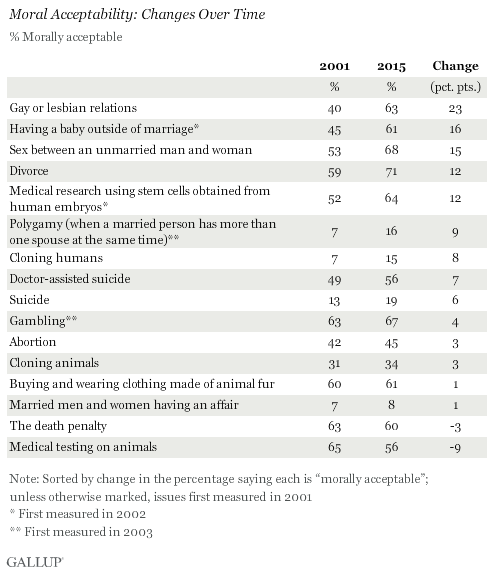

Gallup also found that Americans’ views of the moral acceptability of a number of key issues has been shifting to the left since 2001. The largest shift was on gay or lesbian relations, with a 23 percentage point increase in the share of people who say that behavior is morally acceptable. The change coincides with a sharp increase in support for same-sex marriage.

Sex between unmarried people has also become more acceptable, as has having babies outside of marriage. Polygamy and divorce are also now acceptable to a greater portion of the population than in 2001. On the other hand, the views of married men and women having an affair haven’t changed much, with just 8 percent of Americans saying it’s morally tolerable.

However, respondents to the poll about the current and future state of moral values weren’t necessarily responding with those charged social and political issues in mind. In many cases, Gallup suggests, their views of the moral direction of the country were rooted in something much more basic: “That is, their views have less to do with greater acceptance of same-sex marriage or having babies out of wedlock and other hot-button issues, and more to do with matters of basic civility and respect for each other,” Gallup’s Justin McCarthy wrote.

Clearly, the Golden Rule is still the bedrock of our moral code: Love thy neighbor as thyself.

Obama’s Approval Tanks Over the Economy and ISIS

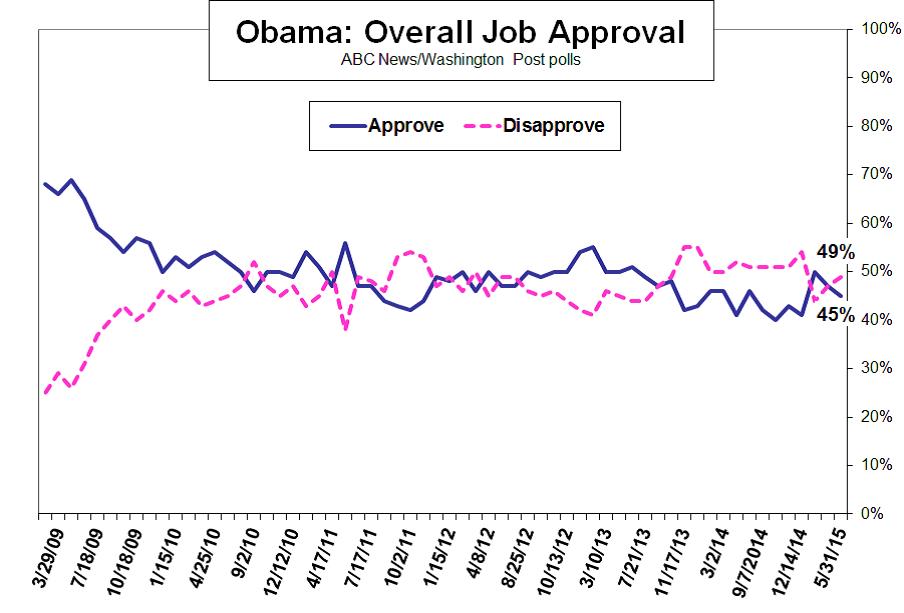

For a while, President Obama enjoyed a revival in popularity after years of public unease and displeasure with his stewardship of the economy and foreign policy. His approval rating jumped as high as 49 percent in mid-January, according to Gallup, and then tapered off a little amid renewed uncertainty about the economic recovery.

In the latest Washington Post/ABC News poll, however, 45 percent of Americans say they approve of Obama’s job performance, while 49 percent disapprove. That is his weakest rating in the survey since late 2014. The president effectively lost five points in approval since January and he hasn’t seen majority support since May 2013, according to survey analysis.

Analysts blame the decline in the president’s approval on continued economic anxiety at home – despite a drop in the unemployment rate to 5.4 percent in April and other signs of economic revival – and the advance of ISIS and other Islamic extremists in Iraq and Syria.

The condition of the economy consistently has topped the list of voters’ concerns heading into the 2016 campaign. The economic gains touted by the administration since the end of the Great Recession in June 2009 apparently haven’t been enough to calm fears, analysts say.

Seventy-three percent of those surveyed recently remain worried about the economy’s direction, and among them Obama’s approval drops to 35 percent, according to the survey. What’s more, Obama gets only a 31 percent approval rating specifically for handling the advance of ISIS militants, with 55 percent disapproving. Public approval of the president’s handling of the war against ISIS is 16 percentage points worse than his rating on handling the economy.