Why Prescription Drug Prices Keep Rising – and 3 Ways to Bring Them Down

Prescription drug prices have been rising at a blistering rate over the last few decades. Between 1980 and 2016, overall spending on prescription drugs rose from about $12 billion to roughly $330 billion, while its share of total health care spending doubled, from 5% to 10%.

Although lawmakers have shown renewed interest in addressing the problem, with pharmaceutical CEOs testifying before the Senate Finance Committee in February and pharmacy benefit managers (PBMS) scheduled to do so this week, no comprehensive plan to halt the relentless increase in prices has been proposed, let alone agreed upon.

Robin Feldman, a professor at the University of California Hastings College of Law, takes a look at the drug pricing system in a new book, “Drugs, Money and Secret Handshakes: The Unstoppable Growth of Prescription Drug Prices.” In a recent conversation with Bloomberg’s Joe Nocera, Feldman said that one of the key drivers of rising prices is the ongoing effort of pharmaceutical companies to maintain control of the market.

Fearing competition from lower-cost generics, drugmakers began over the last 10 or 15 years to focus on innovations “outside of the lab,” Feldman said. These innovations include paying PBMs to reduce competition from generics; creating complex systems of rebates to PBMs, hospitals and doctors to maintain high prices; and gaming the patent system to extend monopoly pricing power.

Feldman’s research on the dynamics of the drug market led her to formulate three general solutions for the problem of ever-rising prices:

1) Transparency: The current system thrives on secret deals between drug companies and middlemen. Transparency “lets competitors figure out how to compete and it lets regulators see where the bad behaviors occur,” Feldman says.

2) Patent limitations: Drugmakers have become experts at extending patents on existing drugs, often by making minor modifications in formulation, dosage or delivery. Feldman says that 78% of drugs getting new patents are actually old drugs gaining another round of protection, and thus another round of production and pricing exclusivity. A “one-and-done” patent system would eliminate this increasingly common strategy.

3) Simplification: Feldman says that “complexity breeds opportunity,” and warns that the U.S. “drug price system is so complex that the gaming opportunities are endless.” While “ruthless simplification” of regulatory rules and approval systems could help eliminate some of those opportunities, Feldman says that the U.S. doesn’t seem to be moving in this direction.

Read the full interview at Bloomberg News.

Behind the Housing Market’s Spring Surge

The housing market is emerging from its winter doldrums: Several different measures released this morning all point to a recent pickup in the real estate market.

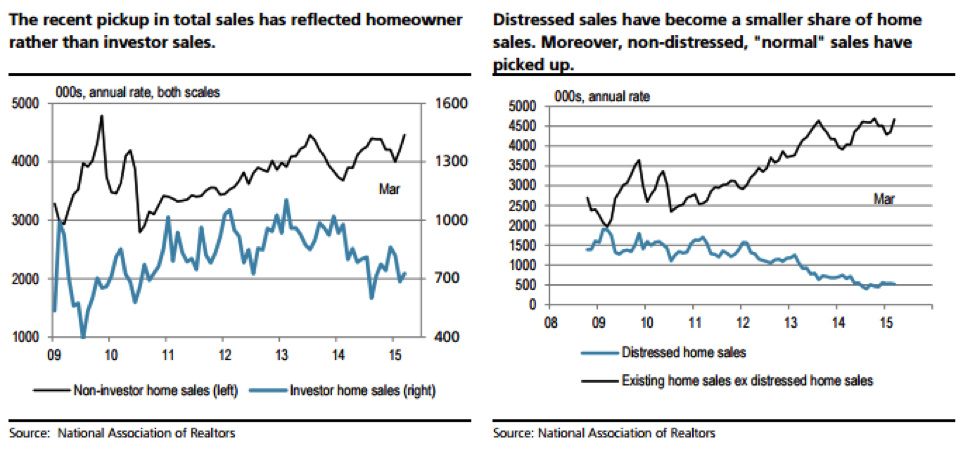

Sales of existing homes jumped 6.1 percent in March to a seasonally adjusted annual rate of 5.19 million — well above expectations and the best month since September 2013. “The pickup in sales is echoed in stronger mortgage applications, new home sales, and faster rising prices—all suggesting a rebound in demand as the spring selling season approaches,” UBS economists wrote Wednesday.

Related: Why the Housing Market Is About to Perk Up

The median sale price last month was $212,100, up 7.8 percent from a year earlier (compared with a 7.2 percent annual gain as of February). “It looks like the combination of limited available inventory and a decline in the share of distressed sales in the market continue to put upward pressure on prices,” J.P. Morgan economist Daniel Silver wrote.

US Existing Home Sales data by YCharts

Mortgage purchase applications, meanwhile, rose 5 percent on a seasonally adjusted basis in the week ending April 17, suggesting that the increased activity from March has also continued into April.

Related: Americans Spend More on Taxes Than on Food, Clothing and Shelter

That trend may also reflect a policy change by the Federal Housing Administration in January. “Almost immediately after the mortgage insurance premium was cut by 50 basis points, purchase applications started to climb to highs not seen since the summer of 2013,” the IHS Global Insight economists Patrick Newport and Stephanie Karol wrote Wednesday. “We expect that the rule change will support market entry among younger buyers.” First-time homebuyers played an important part in the March increase, they suggest, as they increased their purchases by 10 percent year-over-year. Investors, meanwhile, bought 9 percent fewer properties than they had in March 2014, as the charts below from UBS detail.

The housing recovery had softened in recent months, even beyond the winter’s weather-related issues, so the new data — while not yet signaling a stronger trend — is an encouraging sign for increased activity in the spring and potentially beyond. “Home sales should pick up through the rest of 2015,” Gus Faucher, senior economist at PNC Financial Services Group, wrote Wednesday. “The fundamentals for housing are solid, with average job growth (200,000+ per month), good affordability, very low mortgage rates, increasing consumer confidence, expanding access to credit, and significant pent-up demand after years of depressed sales.”

Top Reads from The Fiscal Times:

- America’s Highest Paid CEO: It’s Not Who You Think

- Car Sales Are on Pace to Do Something They Haven’t in 50 Years

- The Companies Americans Hate Dealing With the Most

Christie for President? New Jersey Says ‘Fuhgetaboutit!’

If Governor Chris Christie is looking for a boost to his flagging presidential ambitions, he’s probably not going to get it from the folks back home.

A Quinnipiac University Poll released Monday shows that many New Jersey voters are turned off by Christie and his presidential ambitions, with 56 percent saying they disapprove of his job performance. More than half of those interviewed say that their shoot-from-the-hip Republican governor isn’t trustworthy and that he doesn’t care about their needs. Christie’s 38 percent approval rating is the lowest he has registered since becoming governor in January 2010.

Related: Christie’s Presidential Prospects on a Steady Slide

But it gets worse: 65 percent of Garden State voters say Christie would not make a good president (vs. 29 percent who think he would do a good job), and by similar margins voters say he shouldn’t run.

Meanwhile, more than a third of those interviewed said Christie should be removed from office if it is ultimately determined that he ordered or knew about the infamous closing of traffic lanes in Fort Lee, N.J., that led to massive traffic jams on the George Washington Bridge in early September 2013.

Recently, two reports, commissioned by the state legislature and Christie’s office, failed to turn up any evidence that Christie participated in the scheme – said to be political retaliation against the Democratic mayor of Fort Lee – or knew about it as it happened. However, the U.S. attorney’s office is conducting a criminal investigation of the bridge scheme; there is no indication of when that will be concluded.

Related: Rubio Lashes Out at Clinton on Foreign Policy

The new telephone survey was conducted April 9 to 14 and involved 1,428 New Jersey voters. The findings have a margin of error of +/- 2.6 percentage points.

More Quick Hits from The Fiscal Times:

- 100-Year-Old Coke Bottle Is About to Become a Movie Star

- More Americans Have Health Insurance (Whether They Want it or Not)

The FBI’s Lies, Damned Lies

How many more government agencies will be branded as devious, unreliable or outright fraudulent before the penalties the Justice Department imposes has teeth? Oh, wait, the Justice Department is on the hook for targeting private phone records from Fox News and the Associated Press because of so-called “leaks.”

Then, there are the scandals at the IRS, the Department of Homeland Security, HUD, the Secret Service, Veterans Affairs, the Patent and Trademark Office, the Drug Enforcement Agency, the Labor Department and FEMA — to name just a few.

The FBI case tops all, however, because what they did actually killed people. The Washington Post broke the story on Saturday:

The Justice Department and FBI have formally acknowledged that nearly every examiner in an elite FBI forensic unit gave flawed testimony in almost all trials in which they offered evidence against criminal defendants over more than a two-decade period before 2000.

Of 28 examiners with the FBI Laboratory’s microscopic hair comparison unit, 26 overstated forensic matches in ways that favored prosecutors in more than 95 percent of the 268 trials reviewed so far, according to the National Association of Criminal Defense Lawyers (NACDL) and the Innocence Project, which are assisting the government with the country’s largest post-conviction review of questioned forensic evidence.

The cases include those of 32 defendants sentenced to death. Of those, 14 have been executed or died in prison, the groups said under an agreement with the government to release results after the review of the first 200 convictions.

What’s interesting about all these violations of the public trust is that no one ever seems to go to jail for their crimes. Is the government too big to succeed? We complain about Wall Street execs getting off scott free for their roles in the Great Recession. Why is this different?

More Quick Hits from The Fiscal Times:

Cuomo to Cuba: What's the Payoff?

Maybe a bigger trade in apples from Upstate New York

Andrew Cuomo's trip to Cuba may not actually come home with much, but

100-Year-Old Coke Bottle Is About to Become a Movie Star

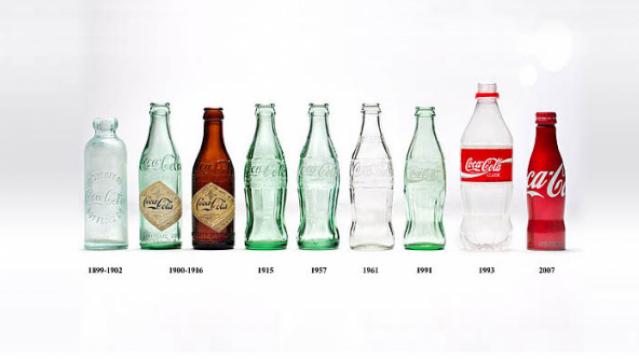

The Coca-Cola bottle, with its distinctive contoured glass, was created a century ago as a way for the soft drink company to give its product a competitive edge. As the company website explains, “In 1915, Coca-Cola attempted to fend off a host of copycat brands by strengthening its trademark. The company and its bottling partners issued a creative challenge to a handful of U.S. glass companies: To develop a “bottle so distinct that you would recognize if by feel in the dark or lying broken on the ground.”

The winning design, created by the Root Glass Company of Terre Haute, Ind., worked — so well, in fact, that a century later the company is still using that basic concept to market its signature brand. Coca-Cola this year is celebrating the 100th anniversary of the bottle — and its influence in pop art and other realms — through a global advertising campaign, art exhibitions and a photo book, among other avenues.

Now the bottle and its history will also be the subject of a new “authorized” documentary, according to The Hollywood Reporter. (Coke will help pay for the movie’s marketing.)

Related: Why the Soda Industry Is Still Full of Hot Air

“When I can hold up a Coca-Cola bottle and ask, ‘is this art or is this commerce?’ and most commonly hear ‘it’s both,’ that sets the stage for an intriguing narrative,” the movie’s producer and co-director, Matthew Miele, told THR.

That narrative could include how the Coke bottle became the first commercial product to make it to the cover of Time magazine in 1950, or how it provided fodder for artists like Andy Warhol — and, especially if the film touches on today’s backlash against soda, it might even mention that the 10- and 12-ounce bottles that made their debut in 1955 were called “King Size” and a 26-ounce bottle was marketed as “Family Size.”

Miele and his team reportedly hope their documentary will premiere in November to coincide with the Nov. 16, 1915 date that the bottle design first won a patent.

Top Reads from The Fiscal Times:

- The Harsh Truth About Fast Food for Kids

- The Companies Americans Hate Dealing With the Most

- The 15 Worst Supermarkets in America in 2015