In another sign of the strength of the economic rebound that’s pushing the Federal Reserve to move toward raising interest rates later this year, U.S. auto sales are expected to increase for the sixth straight year in 2015 — the first such streak in more than 50 years.

Car-buying service TrueCar expects that 17 million new vehicles will be sold this year. That would represent a year-over-year increase of as much as 3 percent. The estimate is in line with forecasts done by Bank of America Merrill Lynch analyst John Murphy and the National Automobile Dealers Association. For the auto industry overall, revenue is expected to have jumped 89 percent this year over 2009, according to TrueCar.

“The industry hasn’t been at the 17 million-unit level since 2005, and considering that the U.S. population has expanded by roughly 9 percent since then, it’s clear we’re in a market with strong natural growth drivers,” said John Krafcik, TrueCar’s president, in a press release. “Even in the economic boom years of the 1990s the industry didn’t achieve six consecutive years of growth.”

Related: Why Gas Prices Are Set to Drop (Again)

The service is forecasting an average transaction price this year of $32,589, an increase of 2.1 percent from last year. That would also be the sixth straight gain. Incentives are expected to average around $2,902, or about 8.9 percent of the transaction price, the highest since 2011. In 2009, incentive spending equaled 11.2 percent of a transaction price.

The industry, though, got off to a slow start this year because of unseasonably cold weather in part of the country. The pace of sales slowed to annualized rate of 16.2 million in February. Analysts, though, think the pace of activity will pick up during the rest of the year as the economy continues its recovery from its worst slowdown since the Great Depression.

For one thing, employers have added 200,000 or more jobs in each of the past 12 months, which hasn’t happened since 1977. Unemployment fell to 5.5 percent in February, its lowest point in 7 years. Many economists expect the U.S. economy to grow 3 percent in 2015, the first time that’s happened in a decade.

Even wages, which have long been stagnant, are starting to move as Wal-Mart and other firms raise workers’ pay as labor markets tighten. Retail and food sales are rising, as is consumer confidence, which has posted seven straight monthly gains.

Related: This Is the Cheapest Car to Insure in 2015

One potential red flag, though, is the growth in subprime auto loans, which has led some to fear another lending bubble is brewing. “Dire warnings that subprime auto lending is getting out of hand are generalizing the practices of predatory and poorly originated lending as the norm for all subprime lenders when, in reality, our data does not support those warnings,” credit-reporting agency Equifax, which examined data from more than 210 million auto loans, said in a February report (PDF). “Unlike the wildfire growth of the housing market and subprime and non-traditional mortgages from 2004 through 2008, subprime auto lending has consistently grown at a controlled, steady pace. In fact, Equifax data shows that prime lending is growing at more than double the rate of subprime lending.”

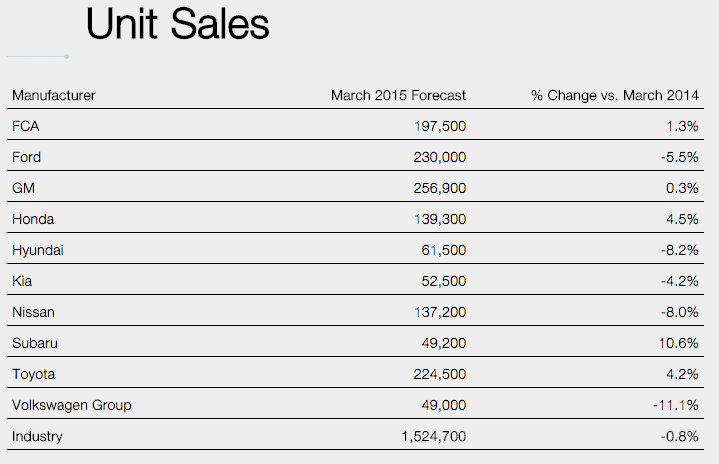

Here are TrueCar’s projections for sales by company this month, with Fiat Chrysler Automobiles (FCA) representing the Chrysler, Jeep, Dodge, Ram and Fiat brands.

Top Reads from The Fiscal Times: