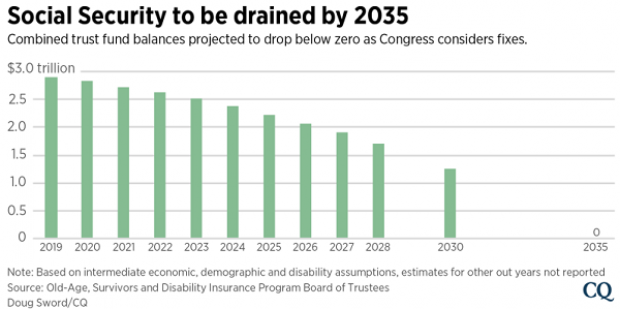

According to the annual trustees’ report released Monday, the combined trust funds for Social Security, currently valued at $2.9 trillion, will be exhausted by 2035 (see the chart from CQ Roll Call below). At that time, the Social Security system will have to cut benefit payments by about 20% – unless, that is, Congress acts in the meantime to stabilize the program’s finances.

The good news is that there is no shortage of ideas for how to fix Social Security so that it continues to pay out full benefits for many decades to come. Roll Call’s Doug Sword highlighted some of the leading legislative proposals Tuesday:

* A plan to raise the payroll cap and tax investment income: A bill spearheaded by presidential candidate Sen. Bernie Sanders (I-VT) and Rep. Peter A. DeFazio (D-OR) would apply the current Social Security payroll tax of 12.4% to incomes over $250,000. The tax, which is split between employers and employees, currently applies only to incomes up to $132,900. In addition, the bill would create a new 6.2% tax on investment income for high-earning households ($200,000 for individuals, $250,000 for couples). Sanders says these changes would affect less than 2% of wage earners.

The increased revenues from these taxes would be used to provide more generous benefits while pushing the trust funds’ exhaustion date back to 2071, according to Social Security’s actuaries.

* A straightforward payroll cap increase: A bill from Sen. Mazie K. Hirono (D-HI) and Rep. Ted Deutch (D-FL) would phase out the Social Security earnings cap over seven years, while also making the inflation adjustment used for benefit increases more generous. The Social Security actuary said this approach would keep the Social Security trust funds solvent until 2053.

* A plan for permanent solvency: A bill from Rep. John B. Larson (D-CT), Sen. Richard Blumenthal (D-CT) and Sen. Chris Van Hollen (D-MD) would apply the payroll tax to incomes over $400,000 while phasing in a higher tax rate of 14.8% over 24 years. The lawmakers also propose to increase Social Security benefits, shield more benefits from income tax and provide a higher minimum benefit for low-income retirees. The plan, which has 203 House co-sponsors, would extend the solvency of the Social Security trust funds for at least 75 years, the projection period used by the Social Security actuaries.

Sword says that Rep. Larson’s plan has the best chance to move forward in the current Congress, although it’s unlikely that any House plan will advance to the GOP-controlled Senate. One key Republican, Rep. Tom Reed (NY), the ranking member on the Ways and Means Social Security subcommittee, made his opposition to any bill that increases taxes clear at a hearing earlier this month.

“The mission of the Republicans on this subcommittee is to secure benefits without tax increases,” said Reed, adding that by 2043, Larson’s bill would impose an additional payroll tax of $600 on someone making $50,000 a year.