Budget Deal Moving Ahead, Despite Outrage on the Right

The bipartisan deal to suspend the debt ceiling and increase federal spending over the next two years will get a vote in the House on Thursday, House Majority Leader Steny Hoyer (D-MD) said late Tuesday. Leaders in both parties have expressed confidence that the bill will pass before lawmakers leave town for their August recess.

"We're gonna pass it," Hoyer told reporters. "I think we'll get a good number [of votes]. I don't know if it's gonna be huge, but we're gonna pass it."

President Trump announced that he backs the deal, removing one possible hurdle for the bill. “Budget Deal gives great victories to our Military and Vets, keeps out Democrat poison pill riders. Republicans and Democrats in Congress need to act ASAP and support this deal,” he tweeted Tuesday evening.

Despite widespread agreement that the bill will pass, however, not everyone is on board.

Grumbles from the left: Some progressive Democrats have been critical of the deal, portraying it as too easy on Republicans. Worried that the agreement could set up a budget crisis in 2021, Rep. Ro Khanna (D-CA) said he was “concerned that it was a two-year deal. Why not a one year deal?... It seems like it’s basically handcuffing the next president.” Other liberals, noting that Democratic leaders have agreed to avoid “poison pill” riders on controversial issues such as abortion and funding for the border wall in the funding bills that must pass this fall, lamented their loss of leverage in those negotiations.

Outrage on the right: Resistance to the deal was more pronounced on the right, with the hardline House Freedom Caucus announcing Tuesday that it would not support the bill due to concerns about the growing national debt. “Our country is undeniably headed down a path of fiscal insolvency and rapidly approaching $23 trillion in debt. … All sides should go back to the drawing board and work around the clock, canceling recess if necessary, on a responsible budget agreement that serves American taxpayers better—not a $323 billion spending frenzy with no serious offsets,” the 31-member group said in a statement.

The deficit hawks at the Committee for Responsible Federal published “Five Reasons to Oppose the Budget Deal,” which include its purported $1.7 trillion cost over 10 years. CRFB noted that the agreement would increase discretionary spending by 21 percent during President Trump’s first term, pushing such spending to near-record levels.

Sen. John Kennedy (R-LA) was more colorful in his criticism, saying, “You don’t have to be Euclid to understand the math here. We’re like Thelma and Louise in that car headed toward the cliff.” Nevertheless, Kennedy said he would consider supporting the deal.

Is the deficit hawk dead? The budget deal represents “the culmination of years of slipping fiscal discipline in Washington,” said Robert Costa and Mike DeBonis of The Washington Post, and it highlights the declining influence of fiscal conservatives in the capital, at least as far as policy is concerned. Sen. James Lankford (R-OK) said the Republican Party’s credibility on fiscal restraint is “long gone.”

Although it may be too early to declare the fiscal hawk extinct – plenty of critics say the bird will return as soon as there’s a Democratic president – it certainly seems to be in ill health. As the University of Virginia's Larry Sabato said Wednesday: “A battered bird has been named to the list of endangered species. The ‘deficit hawk’ is on the road to extinction. Rarely spotted around Washington, D.C., the deficit hawk’s last remaining habitat is found in some state capitals.”

Some Republicans said that fiscal conservatism was never really a core Republican value, dating back to President Reagan’s tax-cut-and-spend policies, and that Paul Ryan’s emphasis on fiscal issues was an aberration. “It was never the party of Paul Ryan,” former House Speaker Newt Gingrich told the Post. “He’s a brilliant guy, but he filled a policy gap. The reality here is that Republicans were never going to get spending cuts with Speaker Pelosi running the House, and they didn’t want an economic meltdown or shutdown this summer.”

Is the whole debate missing the point? William Gale of the Brookings Institution, who served on President George H.W. Bush’s Council of Economic Advisers, said he wasn’t sure why the budget deal was producing so much hostility, since it basically maintains the status quo and – more importantly – is focused solely on discretionary spending. “There *is* a long-term budget issue,” Gale tweeted Tuesday, “but cutting [discretionary spending] is not the way to go.”

Instead, Gale says that any serious fiscal plan must focus on the mandatory side of the ledger, where the rapidly increasing costs of health care and retirement are straining against revenues reduced by repeated rounds of tax cuts. Gale recommends a combination of entitlement reductions and revenue increases – a standard mix of policy options that faces an uncertain future, with well-entrenched interest groups standing opposed to movement in either direction.

Fast Cars and Rampaging Dinosaurs Help Universal Shatter Box Office Record

High-speed car chases, dinosaurs run amok and yellow, pill-like creatures helped Universal Pictures bring in more money this year than any other studio in movie history.

Universal announced Wednesday that the studio has grossed $5.53 billion in worldwide box office so far this year, setting an industry record. The Comcast-owned studio has pulled in $3.59 billion internationally and $1.94 billion domestically.

Related: ‘Jurassic World’ set to become fastest film to gross $1 billion

Three global box office hits -- “Furious 7,” “Jurassic World” and “Minions” -- were the most successful films for the studio. “Furious 7” and “Jurassic World” have each brought in over $1 billion already, with “Minions” expected to top $1 billion after its Sept. 13 debut in China. Universal is expected to become the first studio to release three films in one year that each took in over $1 billion.

And there are still some big films slated to be released by Universal before the year is out, including the N.W.A. biopic “Straight Outta Compton,” “Steve Jobs,” and the Tina Fey and Amy Poehler comedy “Sisters.”

20th Century Fox held the previous record for annual box office, grossing $5.52 billion in 2014.

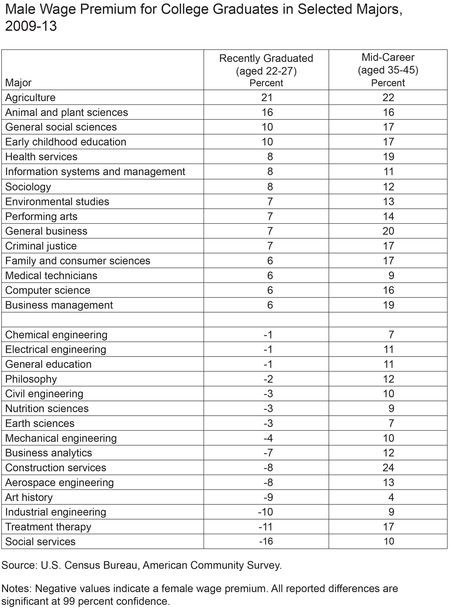

These Women Are Now Earning Almost as Much as Men

That women earn 77 cents for every dollar a man makes has been chronicled and discussed at length, but a new analysis by economists at the Federal Reserve Bank of New York finds a far smaller gap among recent grads.

The country’s youngest (ages 22 to 27) female workers earn roughly 97 cents on the dollar compared to their male peers, when controlling for major and field of employment. For many majors, they actually earn more.

Any early advantage disappears, however, once workers hit mid-career, with men earning 15 percent more than women across the board. Even in majors where women earned more during the early years of their careers, men earn more by age 35.

Related: 10 Worst States for Working Mothers

Researchers point to several potential reasons for the reversal, including possible gender discrimination and women’s tendency to scale back their careers to bear and raise children.

“Because raising a family often requires more flexible schedules, those with family responsibilities who have difficulty satisfying time-sensitive work demands may face lower wages in these types of jobs,” the authors write. “In fact, in jobs where such time demands are largely absent, and more flexibility is possible, the pay gap has been found to be much smaller.”

For some women, that means leaving the workforce entirely. The percentage of women age 25 to 54 who are working has fallen to 69 percent since peaking in 1999 at 74 percent, following a 60-year climb.

Top Reads From The Fiscal Times:

Facebook Patents a Technology That Could Use Your Social Network Against You

All that data Facebook has been gathering on you and your friends could someday be used to approve -- or deny -- your application for a loan.

Facebook was just granted an updated technology patent for “authorization and authentication based on an individual's social network.” This innocent-sounding technology can no doubt be applied in a multitude of ways, many of them benign. But one troubling use of the technology consists of assisting lenders in discriminating against a borrower based on his or her social network connections.

The patent application explains that a lender can use the technology to examine the credit ratings of members of the social network of the individual who is applying for a loan. If the average credit rating of the social network reaches a minimum, pre-defined level, the lender moves forward with the loan process. If the average credit score is too low, the loan application is rejected.

Related: Now Facebook Wants to Know Where You Buy Your Toothpaste

The new technology raises concerns about potential unjust bias, but banks would most likely use it as an additional factor in the loan approval process, not as an end-all metric. The Equal Credit Opportunity Act imposes strict guidelines as to what factors creditors can use when determining whether to approve a loan. It’s unclear if Facebook’s new technology falls under the criteria the federal law defines – things like income, expenses, debt and credit history.

Another fear involves predatory lenders. People rejected for loans through this process would make a nice customer list for unscrupulous financial operators.

Some of the less worrisome uses of the technology include preventing spam email and inappropriate content and improving the accuracy of searches. At this point, it’s not clear how Facebook plans to implement the new technology. Let’s hope the social networking giant stays on the sunny side of the street on this one.

Top Reads from the Fiscal Times:

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

Facebook Patents a Technology That Could Use Your Social Network Against You

All that data Facebook has been gathering on you and your friends could someday be used to approve -- or deny -- your application for a loan.

Facebook was just granted an updated technology patent for “authorization and authentication based on an individual's social network.” This innocent-sounding technology can no doubt be applied in a multitude of ways, many of them benign. But one troubling use of the technology consists of assisting lenders in discriminating against a borrower based on his or her social network connections.

The patent application explains that a lender can use the technology to examine the credit ratings of members of the social network of the individual who is applying for a loan. If the average credit rating of the social network reaches a minimum, pre-defined level, the lender moves forward with the loan process. If the average credit score is too low, the loan application is rejected.

Related: Now Facebook Wants to Know Where You Buy Your Toothpaste

The new technology raises concerns about potential unjust bias, but banks would most likely use it as an additional factor in the loan approval process, not as an end-all metric. The Equal Credit Opportunity Act imposes strict guidelines as to what factors creditors can use when determining whether to approve a loan. It’s unclear if Facebook’s new technology falls under the criteria the federal law defines – things like income, expenses, debt and credit history.

Another fear involves predatory lenders. People rejected for loans through this process would make a nice customer list for unscrupulous financial operators.

Some of the less worrisome uses of the technology include preventing spam email and inappropriate content and improving the accuracy of searches. At this point, it’s not clear how Facebook plans to implement the new technology. Let’s hope the social networking giant stays on the sunny side of the street on this one.

Top Reads from the Fiscal Times:

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

This Is What America’s 'Dream Home' Looks Like

The dream home for today’s American consumer is just over 2,000 square feet and located outside of a major city, according to a report out today by Trulia.

Consumers polled by the real estate Web site said the top features in their dream home were a backyard deck, a gourmet kitchen, and an open floorplan.

Owning a home is still part of the American dream for 70 percent of those polled, down from 77 percent five years ago. The portion of Americans who want to buy a home one day was highest—hitting almost 90 percent—among millennials.

Related: 10 Luxury Home Amenities that Are Trending Up

Those findings echo the results of a Wells Fargo poll in June, which found that nearly two-thirds of consumers say that home ownership is a “dream come true” and an accomplishment to be proud of.

Despite the desire for home ownership, only 14 percent of those surveyed by Trulia said they would buy a home this year. Nearly 70 percent said they planned on waiting at least two years to make a purchase.

The country’s home ownership rate fell to 63.7 percent in the first quarter, the lowest level since 1989. The rate peaked at 69.2 percent in the fourth quarter of 2004, right before the housing bubble burst.

Just 36 percent of millennials who want to buy a home are currently saving to purchase one. As rents in many cities continue to skyrocket, however, homeownership may become more appealing.

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now