Multinational corporations routinely shift billions of dollars around the world to reduce their tax bills. In 2016, according to researchers from the University of California at Berkeley and the University of Copenhagen, nearly 40% of all profits at multinational firms was shifted to tax havens – or roughly $650 billion. The shifting of profits reduced tax revenues by nearly $200 billion, equivalent to 10% of global corporate tax receipts.

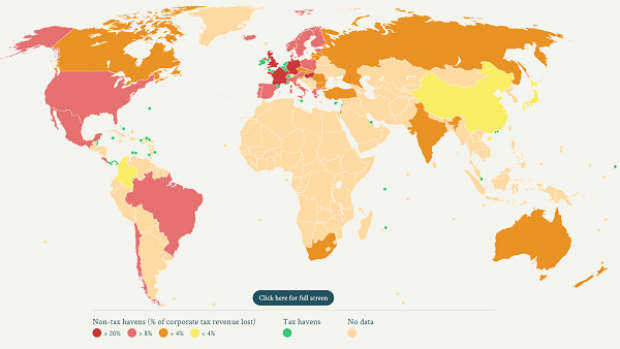

The researchers – economists Gabriel Zucman and Ludvig Wier at Berkeley and Thomas Tørsløv at Copenhagen – have launched a new interactive map that allows users to track the countries that lose and gain profits. According to their analysis, U.S. firms shift about $150 billion in corporate profits each year into tax havens, reducing corporate tax revenues by roughly $60 billion, or 17%.

“The shareholders of U.S. multinationals thus appear to be the main winners from global profit shifting,” the economists say.