Plenty of analysts are worried that rising inflation could do real damage to the U.S. economy, but Federal Reserve Chair Jay Powell is sticking to his view that the current burst of inflation is transitory.

“Inflation has increased notably in recent months,” Powell said in prepared comments released ahead of his appearance Tuesday before the House Select Subcommittee on the Coronavirus Crisis. The increase is driven by multiple factors, he said, including the statistical distortions created by last year’s unusually low prices for many goods, a sudden burst of consumer spending, and supply bottlenecks that have limited a ramp-up in production. “As these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal,” Powell added.

In light of Powell’s comments, The Wall Street Journal’s Kara Dapena and Peter Santilli took a look at the issue of so-called base effects, the distortions in the data that result from last year’s unusually low prices serving as the point of comparison, or base, for current inflation numbers. Instead of using 2020 as a baseline, the reporters calculated the inflation rate relative to 2019. Doing so cuts the annualized inflation rate in May in half, from 5% to 2.5%.

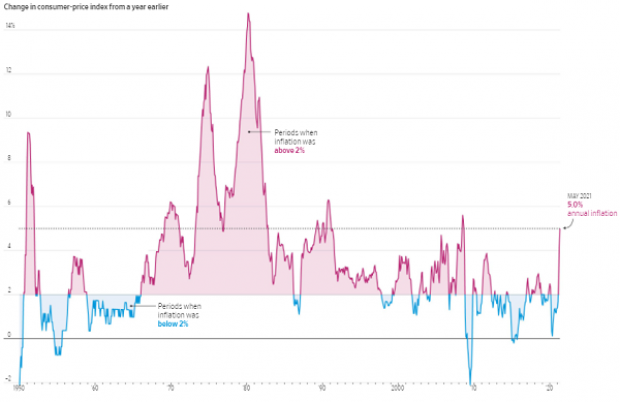

Taking a longer view of changes in inflation also provides some context that may reassure worried analysts. The chart below shows year-over-year inflation in the U.S. since 1950. While the standard measure of inflation shows it rising to a 13-year high in May, the long-term trend suggests that a return to more muted levels is likely.