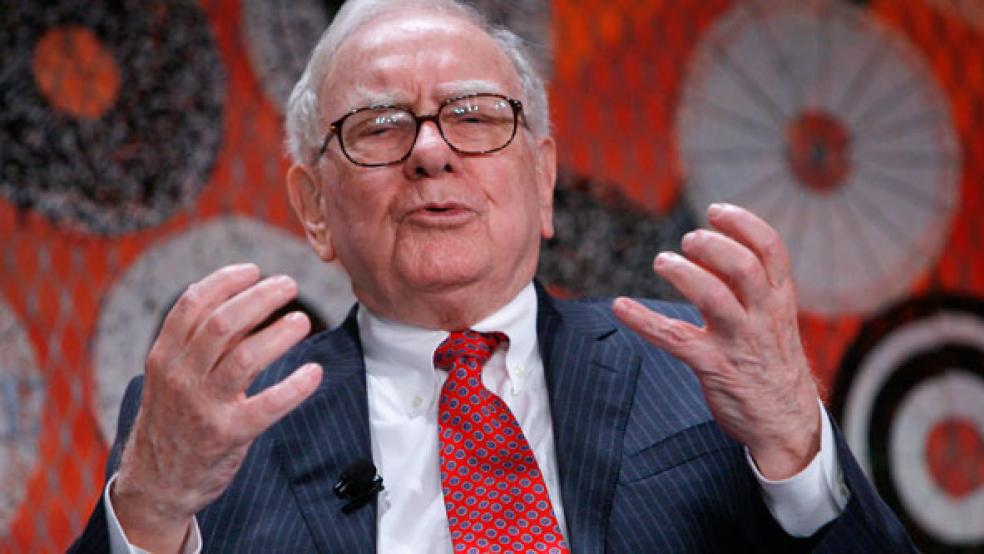

Billionaire investor Warren Buffett has spent the last few months calling on his wealthy business compadres to eschew their coveted tax breaks and lead the charge to increase their own taxes and help rescue the indebted U.S. Treasury. Most don't know that Buffett can actually put his money where his mouth is by simply writing a check.

"My friends and I have been coddled long enough by a billionaire-friendly Congress," Buffett wrote in a New York Times op-ed. "People invest to make money, and potential taxes have never scared them off….Most [mega-rich people] wouldn’t mind being told to pay more in taxes…particularly when so many of their fellow citizens are truly suffering.”

Under Buffet’s proposal, Congress would allow the Bush tax cuts to expire for those who earn more than $1 million a year, and he would increase the taxes they pay on dividends and capital gains. Buffett would also eliminate the preferential tax rates hedge fund managers get on a slice of their investment profits—so-called carried interest income. According to calculations from the Joint Committee on Taxation, the Congressional Budget Office and the Treasury, Buffett’s plan could yield as much as $500 billion in revenue for the federal government over the next 10 years.

Buffett is hardly the only fat cat begging to be taxed more. You can add liberal financier George Soros, former Bear Stearns chairman Alan C. “Ace” Greenberg, and even Pete Peterson—who funds The Fiscal Times—to that roster of “tax me more” advocates. (A spokesperson for Bill Gates declined to comment on Buffett’s proposal.) Dozens of other wealthy Americans signed petitions from Wealth for the Common Good and Patriotic Millionaires for Fiscal Strength opposing those breaks.

Real estate mogul and publisher Mortimer Zuckerman told The Fiscal Times, "It's important that everyone pitch in and show that they're contributing to solving the fiscal crisis. But our economic problems cannot be solved by taxing the wealthy alone--47 percent of Americans pay no federal income tax, and that has to change as well."

America could certainly could use those billions Buffett and his friends have offered. But it’s one thing to stand on a soapbox and quite another to actually open your wallet.

“Nothing is stopping Warren Buffett (or anybody) from making a donation to the Treasury if he feels he’s under-taxed,” tweeted Illinois Republican Rep. John Shimkus. Conservative political pundit Pat Buchanan struck a similar note on MSNBC’s "Morning Joe" yesterday. “I’m a little fed up with these people who come on with their big op-eds and admonitions. Why doesn’t he set an example and send a check for $5 billion to the federal government? He’s got $40 billion.”

He’s right. Buffett or anyone else can do just that. Anyone—wealthy financiers included---can make a tax-deductible charitable contribution to the Treasury’s “Gift to Reduce the Public Debt” program.

Some experts say Buffett and his cohorts are doing a service just by standing up in favor of raising taxes on the wealthy.

“Here’s a well-respected person arguing that we need more revenues and pointing out that people who can afford to supply it are people like him,” said Bob McIntyre, director of Citizens for Tax Justice, a left-leaning think tank. “He’s also pointed out that he’s paying a lower marginal tax rate than ordinary working people and that’s not fair, and by implication, accentuating that rich people understand that and don’t really need that money.”