It has been nearly nine full months since Congress allowed a program extending state unemployment benefits to the long-term jobless to expire. In that time, millions of Americans, who less than a year ago would have been eligible for an additional six months of unemployment benefits, have seen them cut off.

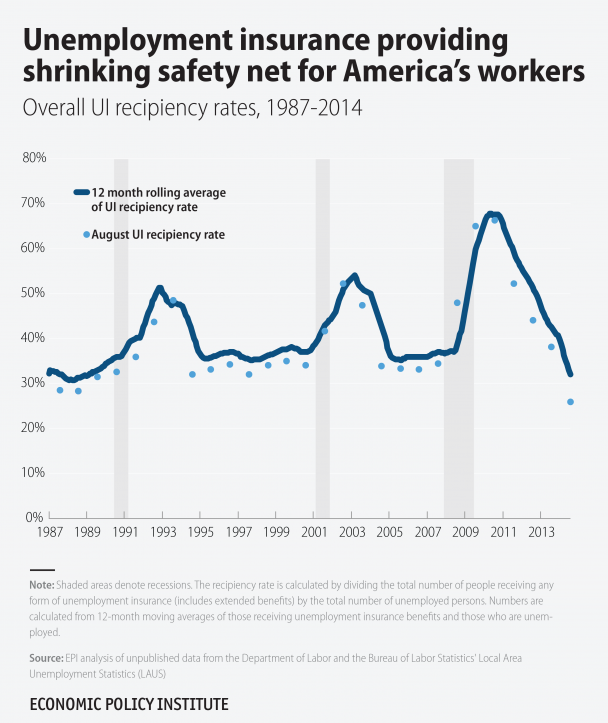

Now, according to a new analysis from the Economic Policy Institute, the percentage of the unemployed who are receiving unemployment assistance has hit an historic low.

Related: Not Making Enough Money? Blame Your Spouse

Josh Bivens, research and policy director for EPI, crunched Department of Labor data that had never been previously published and determined that at the end of August only about one-in-four of the unemployed received unemployment insurance payments. That’s down from nearly 70 percent in the years immediately following the Great Recession, and is also lower than any period Bivens measured going back to 1987.

States are the primary provider of unemployment insurance, but the majority of them cut off benefits after workers have been receiving them for about 26 weeks. In times of economic stress and high unemployment, the federal government has stepped in to extend the program. During the worst years following the Great Recession, benefits were, at times, extended to 99 weeks.

The benefits were later rolled back somewhat, but there seemed to be general agreement that the extension should remain in place, because people seeking work continued to outnumber the pace of job creation by a 3-to-1 margin or worse.

However, the federal extension expired at the end of 2013, and Congress left town in December without extending it. When they returned, the Senate was able to pass a bill extending benefits, after surviving Republican filibuster attempts. In the House, however, Speaker John Boehner (R-OH) refused to take up the Senate bill and also refused to allow a vote on a House Republican-sponsored measure that would have allowed the two chambers to resolve their differences in conference committee.

Related: Many Long-Term Unemployed Still Reeling from the Recession

In the meantime, more than 2 million Americans who would otherwise have been eligible for benefits were stripped of them.

A large reason why Bivens found such a low percentage of the unemployed receiving benefits is that many are considered long-term unemployed – defined as being out of work for more than 26 weeks and still looking for work – and have exhausted the benefits available to them. It’s not clear from the Labor Department data what the average duration of unemployment of the jobless is, but many have likely been looking for work for years.

The large number of long-term unemployed in the U.S. has been a persistent problem for several years now, and is one of the key reasons why Federal Reserve Board Chair Janet Yellen has advocated keeping interest rates low for as long as possible so that more people can be drawn back into the labor force.

Related: Yellen Makes It Clear that the Job Market Is Job #1

It has been a difficult task, though, and some economists worry that as workers become discouraged, their skills atrophy, making them less attractive candidates to employers. The result is they become part of a permanently jobless portion of the U.S. economy.

To be sure, the job market has recovered somewhat but with 2.1 job seekers for every open position, it is clear that the unemployed who are looking for work still face daunting odds, and aren’t getting the sort of support from the government their fellow citizens received in the not-too-distant past.

As Bivens put it, “Congress has essentially shredded the safety net while chances of finding work remain distressingly low.”

Top Reads from The Fiscal Times: