Judgment Day is coming.

No, I'm not talking about the rapture. And no, I'm not talking about James Cameron's vision of a Terminator-style nuclear holocaust. I'm talking about -- brace yourself -- a rise in interest rates from the Federal Reserve, something that hasn't happened since 2006, when Justin Timberlake was bringing sexy back on the airwaves, Apple (APPL) didn't yet sell an iPhone and President George W. Bush suffered a "thumpin'" in the mid-term elections as Democrats retook the House and Senate.

Ancient history, I know.

That day is coming as the U.S. economy, five years into its recovery, finally enjoys some robust job creation and seems to be on the cusp of real wage gains. As a result, the Fed is preparing to end its third iteration of bond-buying stimulus next month and is on track to raise rates sometime in early-to-mid 2015.

Related: The Threat That Could Scar the Economy for Decades

After years of being doped up on cheap money stimulus, and growing comfortable in the belief that the Fed would never forsake the bull market that it created by dropping the cost of credit to the lowest levels in human history, investors are in denial. The percentage of bears in the Investors Intelligence survey has dropped to levels (13.3 percent) not seen since 1987. Morgan Stanley is calling for the S&P 500 to climb 50 percent to 3,000 by 2020. Heady times, to be sure.

Folks either believe the Fed will never pull the punch bowl away or that the economy and the market rest upon solid fundamentals that don't require cheap money to endure. Both are mistaken.

That's because the Fed has a growing understanding that the labor market is closer to normalization than is commonly believed. The unemployment rate has fallen to 6.1 percent — just six-tenths above the Congressional Budget Office's estimate of full employment. And the extra unemployment that remains is comprised mainly of long-term unemployed, a group that has a tenuous connection to the labor market and will be harder, and more expensive, to reintegrate into new jobs.

In other words: The available pool of workers is drying up fast as demand for new workers surges (as shown by the rise in job openings, for instance). Historically, when that's happened, wage gains and higher inflation have closely followed.

There's other evidence that inflationary pressures could be building, including higher housing costs and higher health care costs. On health care, Deutsche Bank analysts are looking for the inflation rate to double to around 3.5 percent over the next year. In their calculations, this factor alone would be enough to push the Fed's preferred measure of whole economy inflation to the central bankers’ 2 percent target.

Fed officials are trying to prepare investors for the inevitable tightening of monetary policy. But they are having a tough time of it. Fed chair Janet Yellen has been warning that investors are becoming overzealous, noting pockets of overvaluation and overly low expectations for volatility. In her words, "indicators of expected volatility in some asset markets have fallen to low levels, suggesting that some investors may underappreciate the potential for losses and volatility going forward."

Some of this chatter resulted in stock market weakness earlier this year, with specific pressure on areas like biotechnology and social media stocks. But losses were quickly reversed as the Fed's admonitions faded into memory.

This week, the bond market is suffering some selling as our central banks keep trying. This time, the catalyst is a new research paper from the San Francisco Federal Reserve in which the authors came to the conclusion that investors are not taking seriously both the potential for sooner-than-expected interest rates hike and the potential for a faster-than-expected pace of rate hikes once they start.

Related: Commodity Prices, Bond Yields Send Warning Signals

To be fair, the Fed has made of mess of its communication strategy over the last few years, repeatedly moving back the goalposts when it comes to policy tightening. That's conditioned investors to not take the Fed's warnings about the end of cheap money seriously.

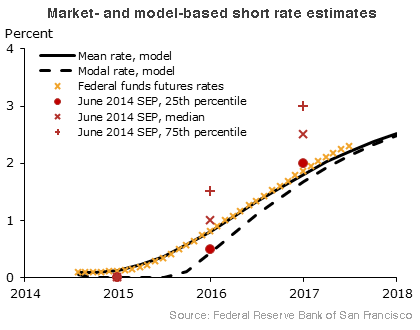

Source: Federal Reserve Bank of San Francisco (http://www.frbsf.org/economic-research/publications/economic-letter/2014...)

But like the parable about the boy who cried wolf, the Fed could be setting itself up to be the cause of a tragedy when it finally starts pulling the plug. That chart above from the San Francisco Fed paper shows why. Currently, the futures market (the yellow "X"s) is pricing a pace and timing of rate hikes that is well below the projections made by Fed policymakers back in June (the red "X"s).

Since then, payroll gains have averaged more than 200,000 per month and the unemployment rate has dropped 0.2 percentage points. These estimates of the timing and pace of rate hikes are due to be updated next week when the Fed wraps up its next policy meeting. It's likely that these estimates will be raised in response to the recent economic data — further widening the gap between where the Fed is and what the market is forecasting.

The result will be additional selling pressure in the bond market, with junk bonds in particular looking shaky as the iShares High Yield Corporate Bond ETF (NYSE: HYG) drops with a severity not seen since July. Long-term Treasury bonds have also been under pressure. Interest rates are on the rise again as the 10-year yield moves above 2.5 percent.

It is fantasy to believe that after enjoying short-term interest rates near 0 percent since 2008, the economy won't suffer ill effects as rates drift higher and the Fed pulls excess cash out of the capital markets.

Related: What Happens When the Fed Stops Propping Up Stocks?

In the end, we are in such unusual times that no one knows for sure what will happen as the Fed starts its tightening cycle. While it's true the Apocalypse probably isn't coming, the environment of low volatility, easy market gains and general investor confidence is set to end. And according to the Fed, it's set to end sooner than most expect.

Top Reads from The Fiscal Times: