Investors are feeling good right now. Really good. By some measures, bullishness has reached levels not seen in more than 10 years. But the positive vibes are at odds with some hard data that suggests we're on the threshold of a "come back to reality" moment.

What data? How about the fact that forward earnings are rolling over at a pace that's only been seen during recessions? Or that factory activity in the Chicago area slumped to a low not seen since July 2009? Or that overall U.S. economic data is disappointing in a way that it hasn't quite since 2012? Or the wipeout in commodity prices over the last few months, the kind typically seen during recessions? Or that consumer prices, on the headline measure, declined outright for the first time since Lehman Brothers imploded?

Related: America Is In Deflation. So What?

Moreover, the problem is global. So far this year, 20 central banks around the world have cut interest rates. And most other countries — except Singapore, Ireland and Japan — are also seeing earnings downgrades.

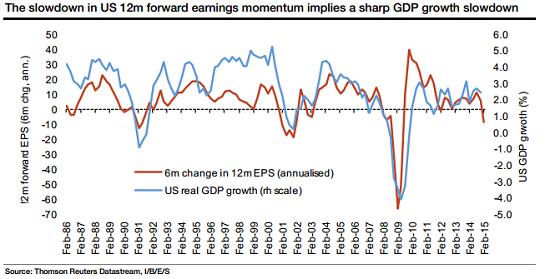

Most troublesome, in my eyes, comes from the rapid decline in forward earnings expectations as illustrated by Societe Generale's global quantitative strategist, Andrew Lapthorne. That's because, unlike metrics such as payroll gains or the unemployment rate, corporate earnings tend to be a leading indicator for the economy. After all, as profits decline businesses are less willing to spend on capital investments, hiring and advertising.

In this cycle, stocks have been powered higher by debt-fueled share buyback programs which, as any corporate finance textbook will tell you, increases the "gearing" or operating leverage of a company. That means that not only could the economy be pulled down by the drop in earnings, but stocks could be more sensitive to the drop in profitability because of the higher fixed costs associated with servicing all that new debt.

As an example, consider that IBM (NYSE:IBM) has taken its debt load from $31.2 billion in 2011 to $45.6 billion now. Operating income, meanwhile, has declined slightly on a trailing twelve-month basis. It's a similar story with some other blue chip names as well.

In plain English: Should the earnings slide continue, it could have a bigger impact on the stock market than in the past.

Related: A Stock Market Alarm Is Sounding for the First Time Since 2007

Many have dismissed the earnings decline as being overwhelmingly caused by the rapid decline in crude oil prices, which is pummeling the energy sector. That's certainly a big part of the story. But it's not the whole story. Weakness has been fairly broad-based, with the consumer staples, materials, utilities and telecom sectors all seeing big drops in earnings expectations.

The risk is that a stalling of earnings in these areas — and the resulting drop in capital expenditures — will bleed out to other areas. Remember that many of those new-tech hotshots like Facebook (NASDAQ:FB) depend on corporate advertising budgets, for example.

Soc Gen's resident bear, strategist Albert Edwards, recently came out of his winter hibernation to resume penning his skeptical views on the markets and the economy. The run up in stocks this month to fresh record highs, despite weakness in the economy and earnings, was enough for him to admit that, "We are at that stage in the cycle where I begin to doubt my own sanity."

He warns that investors are putting far too much trust in the omnipotence of central bankers — especially those at the Federal Reserve — and are ignoring the worst start to a year for the economy since 2009. At least, the “dumb money” stock market investors are.

Related: Gold on a Roll and It Could Go Higher

Yet both "smart money" traders and insiders are bailing out of this market at current levels — based on things like commercial equity hedging in the futures market — amid rapid multiple expansion and severe technical overbought signals. For tech insiders, negativity has reached a five-year high.

The risk, according to Edwards, is that the Fed joins in with the dumb money investors in a classic bout of overconfidence and hikes rates later this year in response to a tightening in the labor market, which is itself a classic lagging indicator of the health of the economy. This would ignore all the signs of weakness we've seen in recent months, from retail sales to factory orders to industrial production and inflation and home sales and the trade balance and more.

The stock bulls haven't suffered the indignity of a serious market pullback since 2011. Only two months into 2015, and that already looks set to change.

Top Reads from The Fiscal Times: