Former Federal Reserve Chairman Paul Volcker, who made his name taming the double-digit inflation rates of the early 1980s, raised some eyebrows this week by speaking against the conventional wisdom that a recent cooling of inflation is dangerous.

Measures of price level growth have been running below the Fed's desired level. Volcker isn’t sweating it. "I think it's fine. We haven’t got much inflation, and people don’t expect much inflation and that's a good thing," he said. "I'm not somebody that worries about inflation being too low."

Those who do worry about it argue that a persistent lack of inflation in the face of ultra-low interest rates, years of bond-buying stimulus and healthy job creation risks a Japanese-style debt-deflation spiral that could quickly suck the life out of the economy.

Related: Inflation Goal May Be Too Low, Says Fed’s Rosengren

Thus the futures market has pushed back its estimate of the timing of rate liftoff by the Fed to the end of the year, the bond market has pushed down long-term Treasury yields and precious metals have been shunned (since protection against inflation and the accompanying loss of purchasing power was deemed unnecessary).

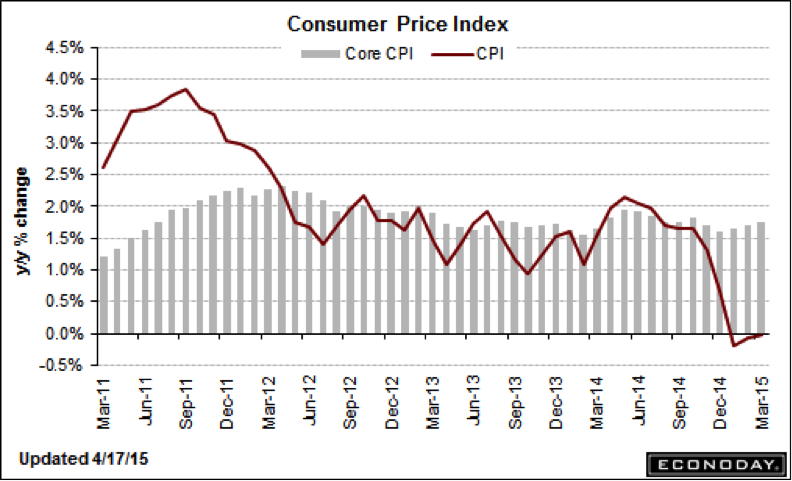

Headline inflation readings have taken a dive because of the recent drop in energy prices, economic slowdowns in Asia and Europe, a recent spate of soft U.S economic data and the strength of the U.S. dollar. The March Consumer Price Index report showed overall prices basically flat on a year-over-year basis — well below the 2 percent rate that the Fed targets. A couple of months ago, prices were falling outright.

The Fed's preferred gauge of inflation, the core Personal Consumer Expenditures price index, is growing at a rate of just 1.4 percent year over year. Combined with expectations of soft first-quarter GDP growth, with the Atlanta Fed's GDPNow real-time estimate tracking at just 0.1 percent, this raises the odds that Volcker's Fed successors will be forced to acknowledge in their next policy announcement on April 29 that a June rate hike is off the table. Instead, as the Fed waits to be sure the threat of a deflation scare has passed, September is now seen as the soonest it will move to raise interest rates for the first time since 2006.

The good news is that there's growing evidence that Volcker's lack of concern is justified; that the economy, and financial markets, are showing signs of preparing for a resurgence of rising prices in the months to come.

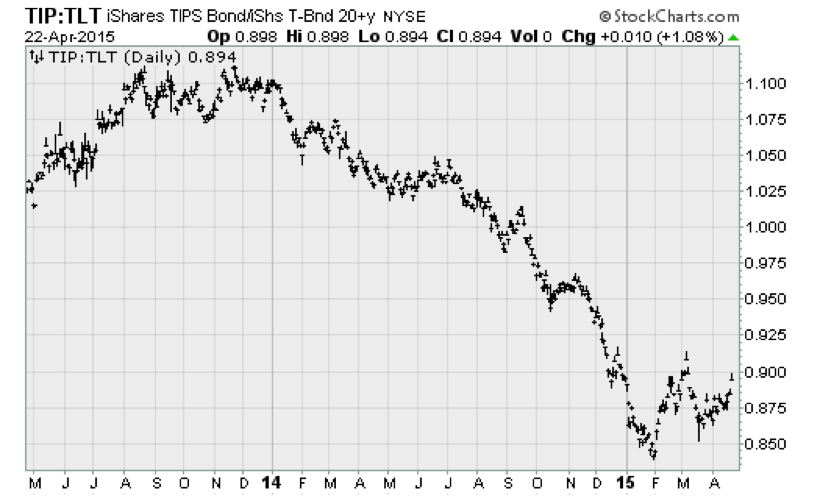

For one, Treasury bonds — as represented by the iShares Barclays 20+ Year Treasury Bond ETF (TLT) — have just suffered their worst three-day losing streak since February, pushing the fund back below its 50-day moving average. Due to the inverse relationship between bond prices and yields, that's reflective of a rise in long-term interest rates. The 10-year Treasury yield is on the cusp of punching through the 2 percent level again.

The drop in T-bond prices, and the rise in yields, stems from both a turnaround in the U.S. macroeconomic surprises (as represented by the slight reversal in the Citigroup Economic Surprise Index, which measures where the data is coming in relative to analyst expectations) as well as a turnaround in inflation expectations.

The latter can be seen in the surge of relative strength in the iShares Barclays TIPS Bond Fund (TIP) relative to the TLT, something that's been exceedingly rare over the last two years as inflation has drifted lower. The TIP represents exposure to a basket of Treasury Inflation-Protected Securities. The ratio of the TIP to the TLT gives a rough approximation of where the bond market thinks inflation is going.

Related: Bernanke Was Right — Interest Rates Aren’t Going Anywhere

After bottoming in late January, when energy prices and U.S. macroeconomic surprises were at their nadir, the ratio has been edging higher. If a sustained uptrend in inflation expectations can be established, it will be the first since late 2013. That's the last time the bond market acted as if inflation was something to monitor.

A big driver behind any rising inflation expectations, according to data compiled by Ed Yardeni of Yardeni research, is nascent wage pressure. Yardeni finds that average hourly earnings for all workers rose at a 3.9 percent seasonally adjusted annualized rate during the first three months of the year — the highest since December 2008.

Related: Behind the Housing Market’s Spring Surge

Signs of strength are also materializing in the housing market, with the ingredients coming together for higher home prices heading into the summer. Existing home sales surged at a 10.4 percent annual rate in March to the best pace since September 2013. In percentage terms, the 6.1 percent month-over-month gain was the strongest since December 2010 and among the very highest in the 16-year history of the data series. The median home price was up 7.8 percent over last year, for the best reading since last February.

If these trends continue, inflation should finally start climbing toward the Fed’s target.

Top Reads from The Fiscal Times: