Nerves were on edge at the start of this first-quarter earnings season after fourth-quarter results were hit so hard by the drop in energy prices and the rise in the U.S. dollar, which pulls down the value of foreign earnings.

With the bulk of the first-quarter earnings season now behind us, though, the good news is that earnings held up pretty well, thanks largely to accounting trickery and Wall Street’s usual game of managing expectations; but sales, which aren't as easily manipulated, suggest corporations remain under stress.

Related: What’s Really Driving Stocks to Record Highs

As of Monday, three-fourths of S&P 500 companies have reported, along with nearly two thirds of mid-cap companies and about half of Russell 2000 small cap components. For the three market-cap categories, the percentage beating earnings per share estimates stands at 73 percent, 69 percent and 61 percent respectively. But the percentage beating top-line estimates stands at 48 percent, 49 percent and 47 percent.

At the sector level, energy, financials and consumer staples have seen a big improvement in the pace of earnings beats vs. the fourth quarter, while tech (on PC demand and inventories), materials and industrials have slipped.

A rebound in energy prices has certainly helped: Crude oil stabilized throughout the first quarter, trading mainly in a range between $55 and $45 a barrel. Wholesale gasoline did even better, hitting a low of $1.23 in January before rising 46 percent by the end of the quarter.

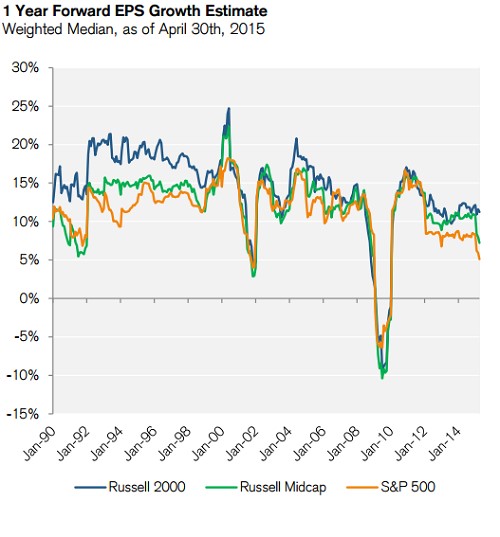

Looking ahead, the consensus current year earnings per share growth estimate for the S&P 500 has fallen to just 5 percent — the weakest since the financial crisis and in line with the lows of the early 1990s.

Relief, in the form of newly raised earnings expectations, could come later this year on a rebound in manufacturing activity and a pullback in the dollar. The production subindex of the latest ISM manufacturing report just posted its largest acceleration since last summer, setting the stage for a rise in sales. Credit Suisse analysts believe this could provide a lift to earnings per share growth expectations in the back half of the year.

Related: U.S. Defense Industry Outperforms S&P by 100 Percent

The U.S. dollar index recently dropped below its 50-day moving average for the first time since last summer on hopes that Federal Reserve, mindful of recent softness in the macro data, will hold off on interest rate hikes until later this year or possibly into 2016.

If all this comes together, industries to watch for opportunities — where earnings revisions have been negative but appear to be bottoming — include automakers; banks; consumer stocks; energy; food and beverage; tobacco; media; and telecoms.

Top Reads from The Fiscal Times: