Federal Reserve officials continue to talk up the chance of an interest rate hike — which would be the first since 2006 — sometime later this year.

San Francisco Fed President John Williams said he believes it is still appropriate for the Fed to raise rates before the end of the year — reiterating concerns about waiting too long to take action. Richmond Fed President Jeffrey Lacker said he dissented against the September policy decision because of his belief that the economy needs higher rates due to labor market tightness. St. Louis Fed President James Bullard, who is not a voting member of the rate-setting committee, said he would've dissented against the decision and believes the case for policy normalization is strong. All those comments come in the context of a possible government shutdown and the impending start of the sure-to-be-disappointing third-quarter earnings season.

But the market is sending its own message concerning a rate hike: It doesn't want one. Futures put the odds of a December rate hike at about even while the odds of an October hike are at less than 25 percent. Traders apparently want the Fed to drop any and all hints of a 2015 interest rate hike. And they will continue with the selloff tantrums until that is accomplished.

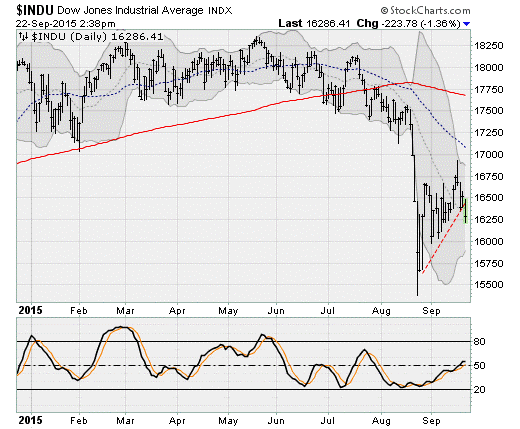

As a result, the Dow Jones Industrial Average broke down out of a multi-week bear flag pattern, setting the stage for a possible retest of the Aug. 24 "Black Monday" lows. We're also seeing inflation-sensitive assets like commodities suffer. Inflation expectations, based on the bond market, are pulling back. And the CBOE Volatility Index (VIX) is perking up in a big way.

Unless Janet Yellen removes the possibility of an October or December rate hike when she speaks on Thursday at the University of Massachusetts, Amherst, the selloff is likely to continue. That seems unlikely.

One hope for relief from the threat of policy tightening, and something that Yellen might well pick up on, is the growing risk of a government shutdown and fiscal standoff in Washington starting as soon as Oct. 1. On Monday, Atlanta Fed President Dennis Lockhart sounded a dovish note by warning that a government shutdown would create more uncertainty about the path of the economy — leaving open the possibility that the Fed pushes any rate hikes into 2016.

Concerning that, budget expert Stan Collender warned in Politico that there is a 75 percent chance of a shutdown as the GOP push against funding Planned Parenthood hardens as the clock ticks away on a budget for the new fiscal year. The debt ceiling is also coming back into play, with Societe Generale warning that a deal will need to be made within the next six weeks or so.

Related: Another Government Shutdown? Washington Prepares for a Nervous Breakdown

With the September Fed "no hike" decision last week a tough call, according to Yellen’s post-meeting comments, another fiscal standoff will surely give her pause about raising rates for the first time since 2006. But the fear that the Fed my push ahead anyway will keep Wall Street nervous until the possibility is definitively ruled out.

That's because in addition to the threat of another fiscal fight, stock market fundamentals aren't looking so great heading into the start of the third quarter earnings season. Alcoa (AA) unofficially kicks things off on Oct. 8.

The Q2 season was marred by ongoing issues with foreign economic weakness, low commodity prices and a strong dollar. Those problems look set for a repeat performance: Ed Yardeni of Yardeni research notes that analysts are busily cutting their estimates for the quarter. Currently, S&P 500 earnings are expected to fall 2.9 percent over last year.

One gets the feeling from all this that with the Fed so sensitive to the market's performance when determining monetary policy, and with the stock market's steadfast refusal to get happy about the end of nearly seven years of near 0 percent interest rates, maybe rates will never go up.

Yellen was asked that question last week by Ann Saphir of Reuters. Her response was telling, because she didn't dismiss the possibility outright:

"I would be very surprised if that’s the case. That is not the way I see the outlook or the way the committee sees the outlook. Can I completely rule it out? I can't completely rule it out. But really that's an extreme downside risk that in no way is near the center of my outlook."

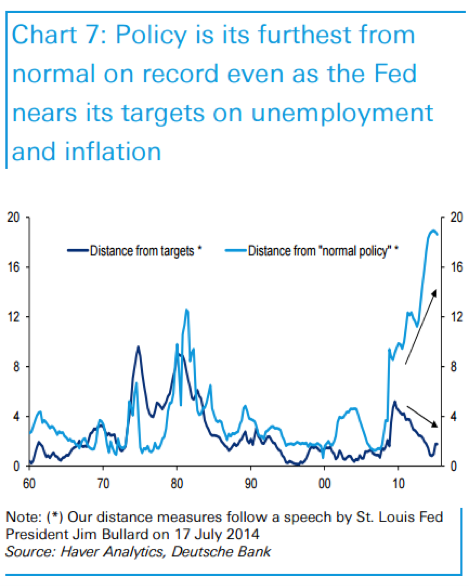

As long as stocks keep falling — which represents a "tightening of financial conditions" in Yellen's words — the Fed isn't going to pull away the monetary punch bowl. That's dangerous since, as any parent of toddlers knows so well, giving in to tantrums only encourages more bad behavior. And as Deutsche Bank points out in the chart above, Fed policy is far from neutral despite the progress it has already made toward achieving its policy goals on employment and inflation. And as I've discussed before, the risks of maintaining full-tilt monetary stimulus are growing, making an eventual rate hike that much more painful.

The liquidity junkies on Wall Street are screaming, crying and stomping their feet. Will Yellen give in to them again?