For Most Seniors, Social Security Is Their Biggest Source of Income

The 80-year-old Social Security program has long been known as the third rail of American politics -- touch it and you die.

Last year alone, more than 59 million Americans received retirement, disability and survivor’s benefits totaling $863 billion. While some lawmakers and policy experts warn that the system will begin to run short of cash beginning in 2035, seniors’ advocacy groups have vigorously fought major changes and cuts.

Related: Battle Lines Form in the Fight Over Social Security Payment Reductions

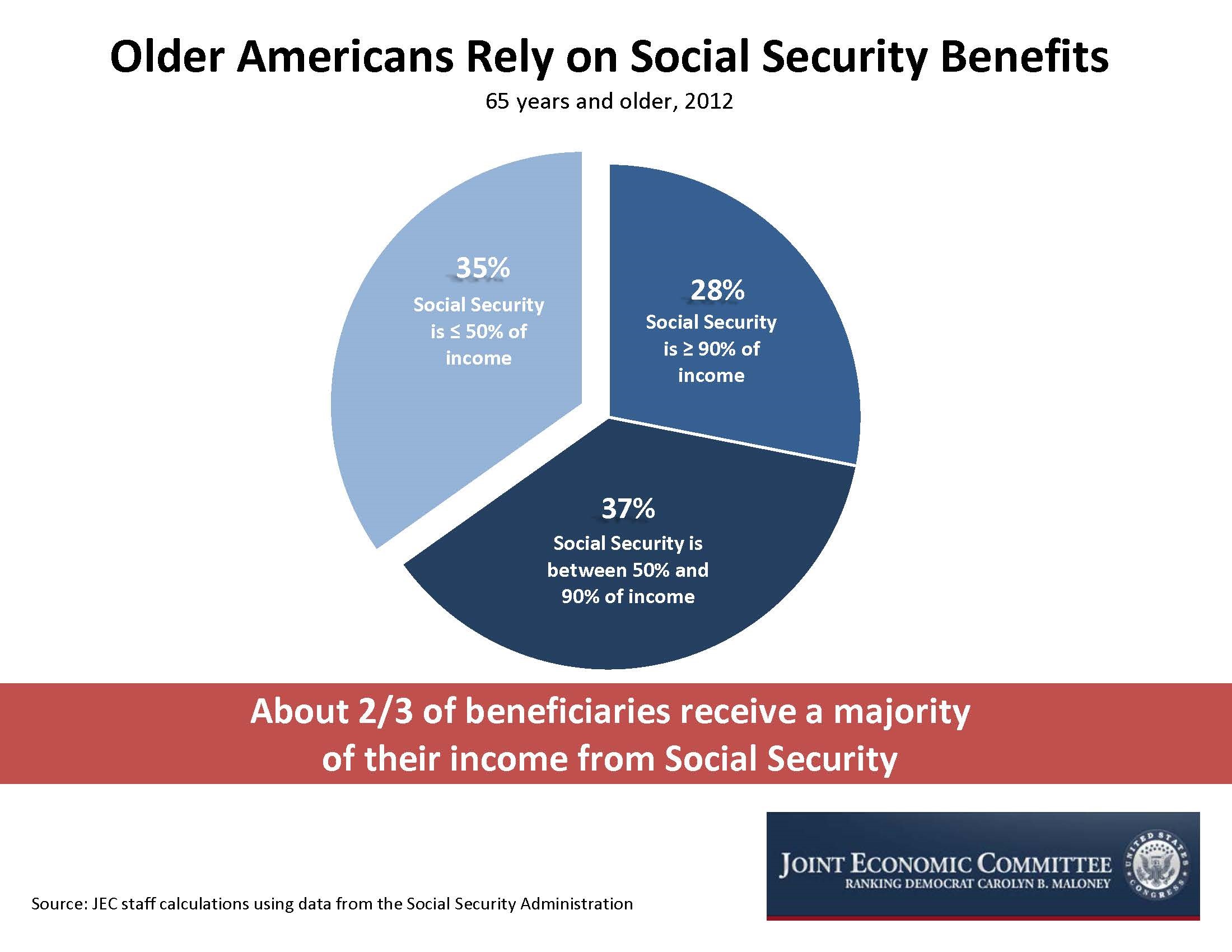

Some nine out of ten people who are 65 or older receive Social Security benefits, according to the Social Security Administration, with an average monthly benefit of $1,294 average for retirees. Overall, Social Security benefits constitute about 38 percent of the income of the elderly, but that number varies greatly from individual to individual.

For the majority of seniors, Social Security makes up the majority of their income. Sixty-five percent of beneficiaries age 65 and older get more than half of their income from the program. Nearly a third (28%) rely on Social Security for 90 percent or more of their income.

Related: 4 Ways to Fix Social Security

The pie chart below, prepared by the staff of the congressional Joint Economic Committee, illustrates the range of seniors’ dependence on Social Security benefits:

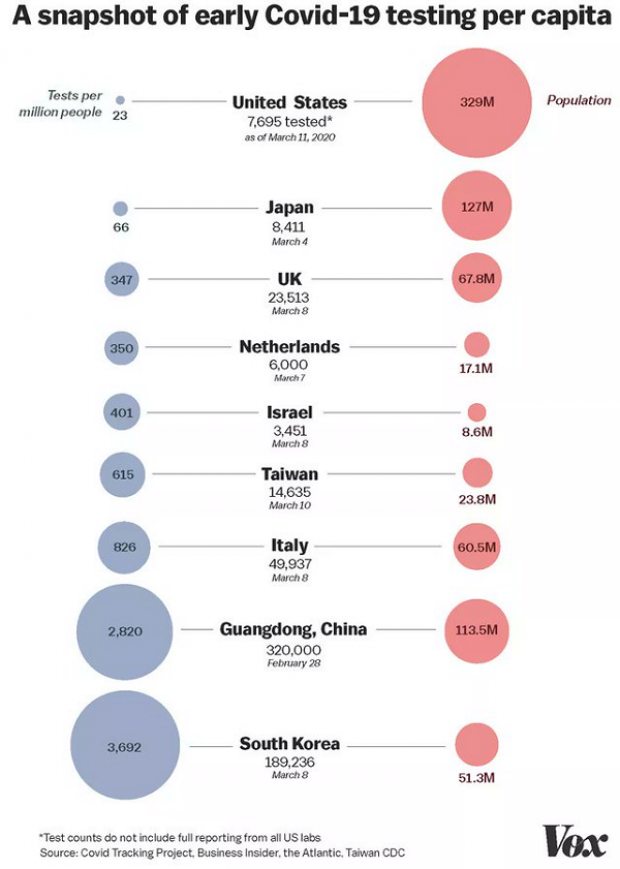

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”