Nearly three out of four companies in the U.S. Fortune 500 operate at least one subsidiary in an offshore tax haven and some have registered more than 100, allowing them to evade taxes on hundreds of billions of dollars in profits every year, according to a study conducted by the U.S. Public Interest Research Group and the Citizens for Tax Justice.

The report found that companies have dramatically increased their use of accounting techniques that allow cash earned overseas to be booked in the name of subsidiaries that are incorporated in low- or no-tax jurisdictions, sometimes with little more than a mailbox as their physical presence. Between 2008 and 2014, the amount of money U.S. firms claimed as profits attributable to offshore entities doubled to $2.1 trillion.

Related: Audit Uncovers $124.7 Billion of Overpayments and Fraud in Medicare and Medicaid

A side effect of the increased avoidance of taxes is that the Treasury Department loses an estimated $90 billion in tax revenue annually, revenue that could be used to reduce taxes domestically.

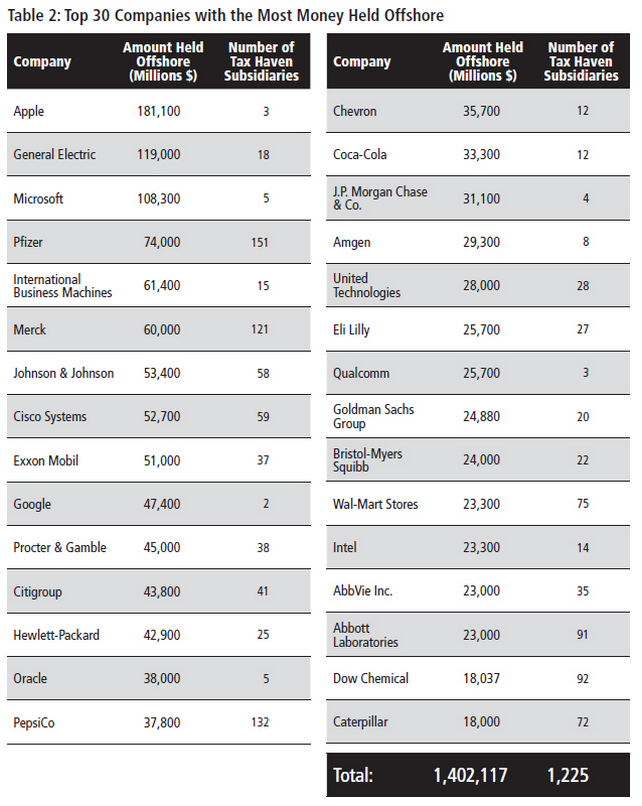

The U.S. firm that leads the pack in offshore profits is Apple, and by a large margin. The Cupertino, Calif., electronics manufacturer has an estimated $181 billion in profits booked offshore. Second is General Electric, with $119 billion, and third is Microsoft, with $108 billion.

According to the study, Apple paid an effective 2.3 percent in taxes on its overseas billions and would owe the Treasury Department as much as $59.2 billion if that money were not considered overseas for tax purposes.

The idea that the funds are “considered” to be held offshore is important, because much of the money is actually kept in U.S.-based banks and other financial institutions.

Related: Boomerang CEOs – 10 Top Executives Who Came Back to Rescue Their Companies

“Much if not most of the profits kept ‘offshore’ are actually housed in U.S. banks or invested in American assets, but are registered in the name of foreign subsidiaries,” the study notes, echoing the findings of a U.S. Senate investigation. “In such cases, American corporations benefit from the stability of the U.S. financial system while avoiding paying taxes on their profits that officially remain booked ‘offshore’ for tax purposes.”

The study recommends a number of steps that could be taken by Congress to reduce the amount of tax revenue lost to offshore tax havens.

The simplest solution would be to change the law, which currently allows companies to “defer” the payment of taxes on overseas income until that money is officially brought back to the United States. The study notes that such a change would bring in an estimate $900 billion in additional tax revenue over ten years.

Related: Ouch! ATM Fees Just Hit a New Record

The authors also advocate closing multiple tax loopholes in the current system, such as the practice of selling patents and other intellectual property to shell companies in tax havens and then directing a large share of profits to the company in the guise of payment for a license to use it.

Finally, the report calls for increased transparency. Multinational corporations should report their profits on a country-by-country basis so they can’t mislead each nation about the share of their income that was taxed in the other countries.