Jack Dorsey is back, officially. Twitter on Monday said that its 38-year-old co-founder is staying on as CEO after being named to the post on an interim basis in July.

Can Dorsey put the struggling social media company back on track? He faces a daunting challenge —a host of them, from growing the service’s audience to building its appeal to advertisers. In its latest quarter the company had an average of 316 million active monthly users, a relatively paltry 15 percent bump from the same time last year, which is far below the growth rates of other hot social media businesses like Instagram. Twitter shares peaked after its IPO in late 2013, but since then have lost nearly two-thirds of their value. Dorsey’s task will be even more challenging as he’ll still be serving as CEO of another large tech company, Square. Managing one company is a lot, but two is quite another thing — especially if one is in as bad shape as Twitter.

Related: Twitter Gets Crushed: Can the Company Still Be Saved?

Dorsey’s return to Twitter isn’t that uncommon of a story — plenty of other founders and former top executives have been asked to return to save the businesses they created or built up. Their track record isn’t all that encouraging. As James Surowiecki pointed out recently in The New Yorker: “A 2014 study found that profitability at companies run by boomerang C.E.O.s fell slightly, and an earlier study detected no significant difference in long-term performance between firms that reappointed a former C.E.O. and ones that hired someone new.”

Here’s a look at the successes and failures of 11 other recent boomerang CEOs.

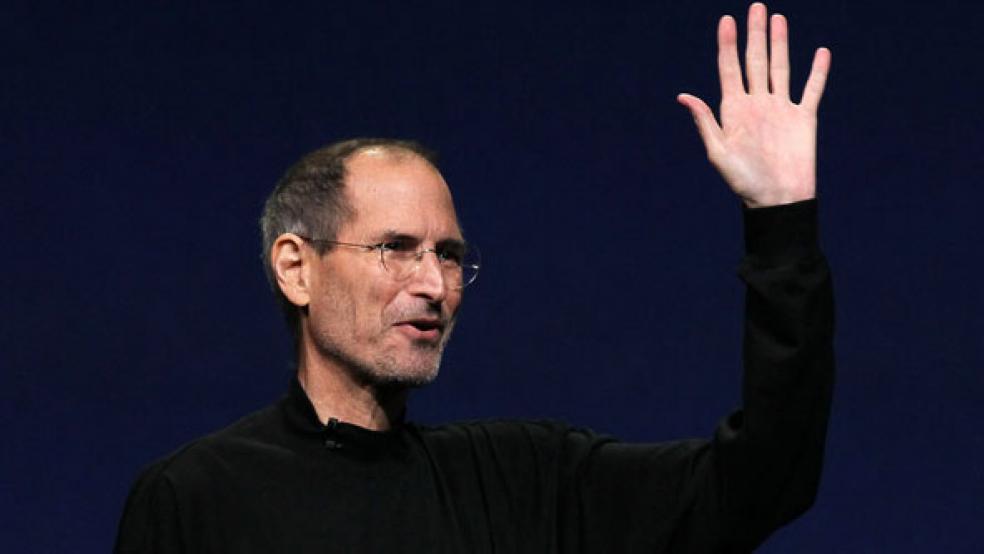

Steve Jobs, Apple

Steve Jobs was forced out of Apple in 1985 after losing a power struggle to then-CEO John Sculley. In his 2005 Stanford commencement address, Jobs said that being pushed out was the driver for his later success: "I didn't see it then, but it turned out that getting fired from Apple was the best thing that could have ever happened to me. The heaviness of being successful was replaced by the lightness of being a beginner again, less sure about everything. It freed me to enter into one of the most creative periods of my life.” Jobs returned to Apple in 1996 and turned the computer maker into a tech powerhouse. Apple is currently the world’s most valuable company.

Verdict: Perhaps the greatest comeback story you’ll ever hear.

A.G. Lafley, Procter & Gamble

Procter & Gamble brought Lafley back in May 2013 after a stretch of disappointing results and criticism from hedge fund manager Bill Ackman, then a top shareholder. Lafley had been CEO of P&G between 2000 and 2009 and returned to the top spot for two years. Lafley streamlined P&G’s product line and ditched lesser-known brands, but given a weaker global economy he failed to repeat the extraordinary success of his first stint as CEO. After a rough 2015, Lafley will step down on Nov. 1 and David Taylor will take over.

Verdict: P&G hoped to restore the old spice it had during Lafley’s first CEO stint, but his return failed to provide much bounce.

Michael Bloomberg, Bloomberg LP

Even though Bloomberg had long said he wouldn’t return to the company he had founded, he rejoined his namesake business in 2014. While the company’s revenue had grown and subscriptions to Bloomberg’s financial-data terminals had climbed under previous CEO Daniel Doctoroff, growth had slowed. Bloomberg has retaken the reins at a time when his company faces a difficult media environment and crucial strategic questions. Bloomberg recently laid off 80 newsroom jobs.

Verdict: It’s clear Bloomberg is making his presence felt, but whether the changes he’s pushing through on everything from the company’s strategic direction to its paper towel dispensers will be a success remains to be seen.

Charles Schwab, Charles Schwab Corp.

Floundering earnings and a disappointing stock price caused the discount brokerage firm to replace Chief Executive David Pottruck with founder Charles Schwab in 2004. Pottruck had shared the role of CEO with Schwab for five years before he was named sole CEO. He lasted in that job just 14 months before Schwab stepped back in to the role. Under Schwab, the company was able to bounce back, helped by a recovering stock market. Schwab stepped down in 2008, replaced by Walter Bettinger, but remains the company’s largest shareholder and chairman.

Verdict: Schwab stock has beaten the S&P 500 over the last five years, though it has lagged again lately as the market turned.

Related: Apple Watch Could Be Apple’s First Major Flop This Century

Michael Dell, Dell

Michael Dell started his computer business in 1984 and went on to become the youngest CEO of a Fortune 500 company. He remained CEO of Dell until 2004, when Kevin Rollins took over the top position and Dell transitioned to chairman. Rollins was fired in 2007 and Dell returned to the CEO job. After the company lost a third of its value with Dell back at the helm, the founder bought the company out in 2013 and he now extolls the virtues of private ownership.

Verdict: After failing to compete with Apple and a series of mobile device flops, Dell remains a dud. Michael Dell is still one of the wealthiest men in the world, though.

Jerry Yang, Yahoo

Yang co-founded the search engine with David Filo in 1995 and took over as CEO in 2007. By then, Yahoo was already struggling to catch up with Google. Yang stepped down after a tumultuous year and a half as CEO. He remained on the company’s board until he was pressured to leave in 2012.

Verdict: Yang failed to turn around Yahoo, but none of his successors have succeeded either. Current CEO Marissa Mayer still faces basic strategic questions.

Howard Schulz, Starbucks

In 2008, after Starbucks stock plummeted 50 percent in one year, Starbucks Chairman Howard Schultz announced he was reclaiming the CEO position, replacing Jim Donald. Schultz had previously served as CEO from 1987 to 2000. Since his return, the coffee conglomerate has seen a remarkable turnaround. Over the past year, Starbucks stock has risen more than 50 percent and the company has seen caffeinated sales growth and a larger profit margin.

Verdict: Schulz was apparently just the jolt that Starbucks needed to regain its traction.

Related: Starbucks: Coffee Shop or Political Organization?

Myron Ullman, J.C. Penney

Seventeen months after Myron Ullman retired as CEO of J.C. Penney, he was called back to repair the damage his successor, Ron Johnson, had done. The retailer had already been struggling, but under Johnson, sales had tumbled by another 25 percent and the company lost nearly $1 billion. Under Ullman, J.C. Penney has made impressive gains. Shares have risen 50 percent this year, with analysts expecting gains in revenue this year.

Verdict: Ullman stepped down in August, but he appears to have pulled Penney back from the brink.

Mark Pincus, Zynga

Zynga still hasn’t been able to repeat its FarmVille success as casual gaming has shifted from the Web to mobile devices. When Pincus returned as CEO of the struggling game maker in April 2015, replacing Don Mattrick, shares plunged 18 percent. They’ve since kept falling. Shares have fallen 7.45 percent over the past year and the company has lost $73.3 million due to an inability to retain paying users.

Verdict: It’s not quite game over, but Pincus hasn’t been able to do much to give Zynga some zing.

Steve Huffman, Reddit

After Ellen Pao was hit with a storm of user criticism for firing a well-liked company executive, Reddit brought back former CEO and co-founder Steve Huffman. After being gone for six years, Huffman returned in July 2015 with a central mission of winning back the confidence of the site’s users. He has swiftly made his mark by introducing a new content policy aimed at reducing harassment and abuse on the site. User reaction to the new policy is mixed.

Verdict: It’s still too early to tell what Huffman’s return will mean for Reddit.