Monday was a bloodbath in global markets, continuing the weakness from last week. The Dow Jones Industrial Average fell more than 1,000 points at the open, rallied back and then gave up most of those gains to close down 587 points, or about 3.6 percent. The S&P 500 and the Nasdaq also ended the day off nearly 4 percent, after the Nasdaq had earlier dropped nearly 9 percent as popular momentum stocks like Facebook (FB) rolled over.

The rout was global. Japan's Nikkei fell 4.6 percent. The Hang Seng fell 5.2 percent. Germany's DAX was down 7 percent, entering bear market territory. The dollar is dropping hard while crude oil fell to a $37-a-barrel handle. The CBOE Volatility Index (VIX), Wall Street's fear gauge, hit levels not seen since December 2008.

Related: As Stocks Tank, Trump Warns China Could ‘Bring Us Down’

As I've discussed at length, there are many catalysts in play in the market’s turn, from fears about China to corporate earnings and commodity prices. But at the core, much of this plunge is about a loss of faith in cheap money stimulus. It's as simple as that.

The immediate cause of Monday's wipeout was a lack of action over the weekend by the People's Bank of China to unveil fresh monetary policy easing in the form of an interest rate cut and/or a reduction in the so-called reserve ratio requirement, which dictates how much deposit money the banks must hold. Action is being demanded as Chinese economic data raises fears of a slowdown, stock market volatility intensifies despite aggressive efforts by Beijing to stop it, and everyone worries about the uncertain implications of a recent devaluation in the yuan.

With all that piling up and the threat of a September rate hike from the Federal Reserve still on the table, traders stampeded for the exits.

Related: The Silver Lining Behind Black Monday’s Stock Market Plunge

The nosedive reveals just how addicted markets have become to the flow of central bank stimulus and the faith that cheap money remains the path to economic deliverance. The problem: Both are at risk.

A recent working paper by the vice president of the St. Louis Federal Reserve Bank finds that after six years of quantitative easing that swelled the Fed's balance sheet to $4.5 trillion, "casual evidence suggests that QE has been ineffective in increasing inflation" and only seems to have boosted stock prices.

Complaints once in the realm of conspiracy theorists wearing tin foil hats are now being embraced by the Wall Street establishment. In a note to clients, Deutsche Bank analysts warned that "the fragility of this artificially manipulated financial system was exposed" and that "the only thing preventing another financial crisis has been extraordinary central bank liquidity and general interventions from the global authorities."

They argue that "the genesis of this recent sell-off has been the threat of the Fed raising rates next month, but China's confrontational move two weeks ago and the subsequent knock-on through [emerging markets] have accelerated us towards something more serious."

As a result, they've dropped their odds of a September hike from 54 percent to 34 percent and add that they "always thought something would get in the way of the Fed raising rates" so soon.

Related: Why You Should Ignore the Stock Market Sell-Off

Over at Barclays Capital, economists Michael Gapen and Rob Martin pushed back their rate hike forecast to March 2016. They admit Fed policymakers are "market dependent" and won't tighten policy in the maw of a stock correction, even as they see "economic activity in the U.S. as solid and justifying modest rate hikes." Should the market turmoil continue, the rate hike could be pushed past March.

Alberto Gallo, head of credit research at RBS, is more direct:

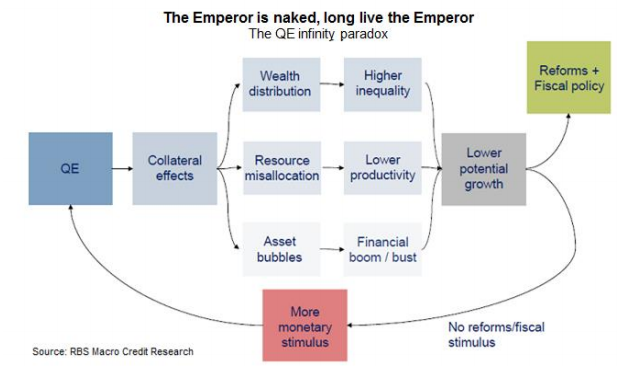

"Policymakers responded to the financial crisis with easy monetary policy and low interest rates. The critics — including us — argued against 'solving a debt crisis with more debt.' Put differently, we said that QE was necessary, but not sufficient for a recovery. We are now coming to the moment of reckoning: central bankers look naked, and markets have nothing else to believe in."

Gallo believes an overreliance on excess liquidity has actually hindered capital investment — as companies have focused on debt-funded share buybacks and dividend hikes instead — limiting the global economy's potential growth rate.

Now, contagion from China — lower commodity prices, lower demand, currency volatility — has revealed the structural vulnerabilities. More stimulus, in his words, "could be self-defeating without fiscal and reform support."

As for Fed hike timing, Gallo sees the odds of a September liftoff at just 30 percent, down from 36 percent last week, based on futures market pricing. December odds are at 60 percent.

The open question is: Should the Fed delay its rate hike and the People's Bank of China ease, will stocks actually rebound? Or has the Pavlovian reaction function been broken by a loss of confidence? We're about to find out.