A senior Republican senator is challenging an Internal Revenue Service interpretation of the tax code which would make some individuals currently in the U.S. illegally eligible for several years’ worth of Earned Income Tax Credit payments. Sen. Chuck Grassley said Monday that he would introduce legislation in an effort to change the tax code to block such payments.

The issue arose in a hearing last month, in which Sen. Grassley questioned IRS Commissioner John Koskinen about President Obama’s plan to give some five million illegal immigrants protection from deportation and the ability to work in the U.S. legally. A previous interpretation of the tax code by IRS staff had allowed retroactive claims for EITC payments.

Related: A GOP Minority Is Holding the Party Hostage Over Immigration

Grassley had two basic questions. Would the undocumented immigrants covered by the executive actions be eligible to apply for retroactive tax credits for work they did and taxes they paid prior to gaining temporary legal status? And if so, would the IRS reconsider its interpretation of the rules?

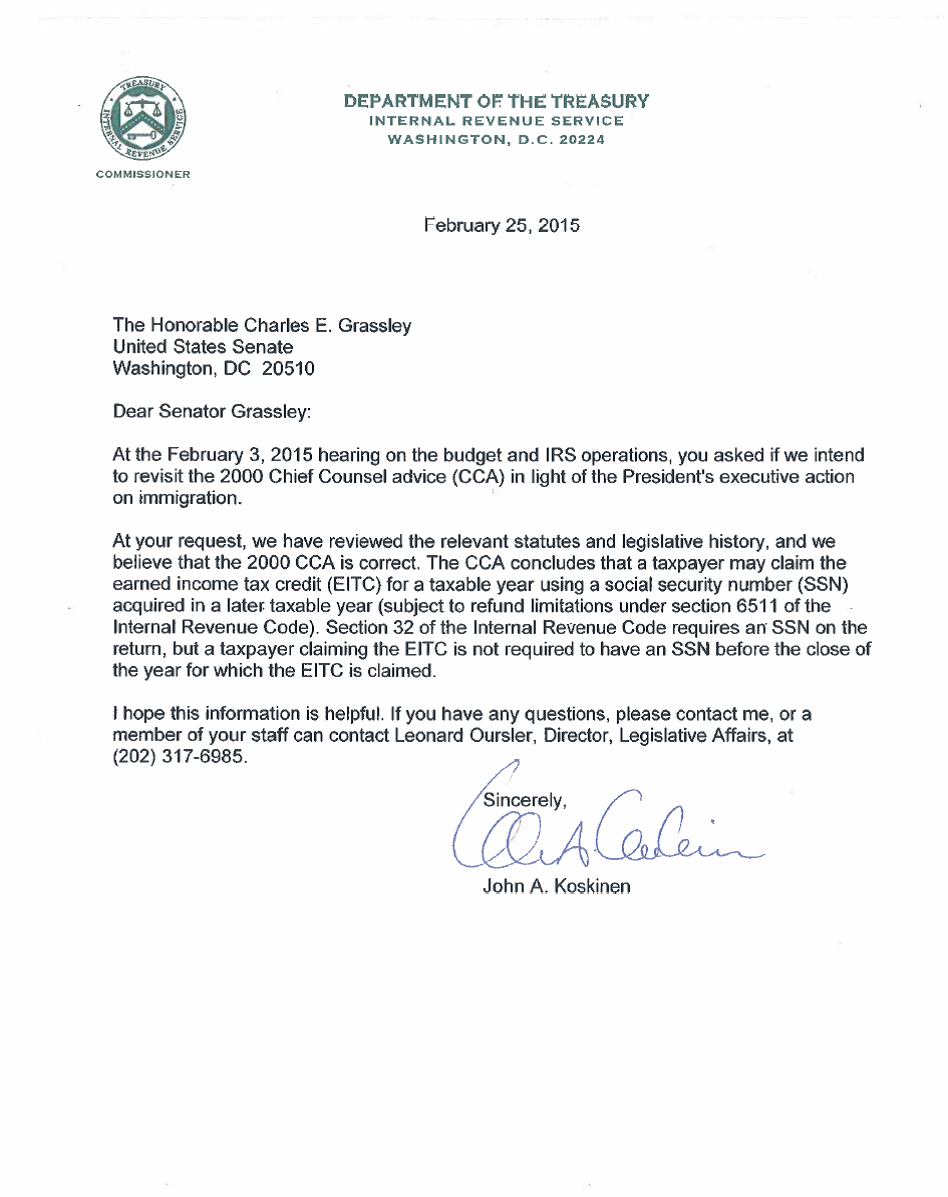

Koskinen, after consulting with his staff, sent Grassley a letter dated February 25. His answers were, respectively, yes and no.

“A taxpayer may claim the earned income tax credit (EITC) for a taxable year using a Social Security number (SSN) acquired in a later taxable year,” he wrote, citing a 2000 finding by the IRS’s legal department, known as a Chief Counsel advice (CCA). “[T]he Internal Revenue Code requires an SSN on the return, but a taxpayer claiming the EITC is not required to have an SSN before the close of the year for which the EITC is claimed.”

The upshot is that current illegal immigrants who are granted temporary legal status under the president’s plan could be eligible to apply for up to three years of retroactive EITC credits, worth thousands of dollars. In theory, the payouts could total billions of dollars.

Related: Obama’s Immigration Order Blocked by Federal Judge

On the question of reconsidering the agency’s interpretation of the rules, Koskinen said the IRS would not. “At your request, we have reviewed the relevant statutes and legislative history, and we believe the 2000 CCA is correct.”

Clearly displeased by the IRS finding, Grassley said in a statement released Monday that he planned to take action, despite the fact that the issue is moot for the time being because a federal judge has temporarily blocked the administration from implementing the president’s plan.

“An estimated five million people in the country illegally will remain here under the President’s executive action,” Grassley said. “Given the IRS’ interpretation of tax rules intended to prohibit undocumented workers from qualifying for the EITC, these individuals will be eligible to claim billions of dollars in tax benefits based on earnings from unauthorized work in the United States. With the stroke of a pen, the President rewarded those working illegally in the United States with a tax benefit that is designed to encourage low-income individuals to enter the workforce.”

Grassley continued, “Given that the IRS is intent on standing by its present interpretation of the eligibility requirements, I’m working on legislation to uphold an important principle that many of us in Congress support. The tax code shouldn’t reward those who broke our immigration laws.”

Top Reads from The Fiscal Times: